Value frameworks are here: What to do about them?

A host of evaluation methodologies are defining ‘value’ in drug prices

Click to enlarge

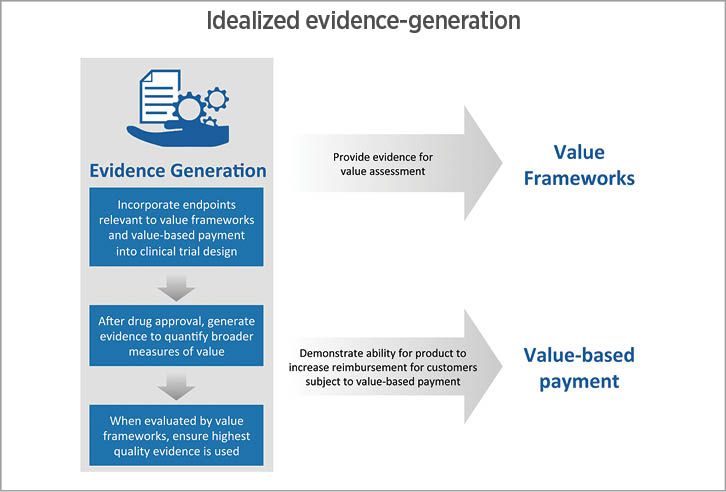

Fig 1. The interplay between frameworks to evaluate drug-therapy value,

and then to justify its cost. Source: Precision[/caption]

Over the last 20 years, new health care innovations have had a dramatic effect on patient longevity and quality of life. A near cure for the hepatitis C virus has been developed. Disease modifying therapies have dramatically changed the prognosis for patients with multiple sclerosis. Patients with cancer can expect to live longer, healthier lives in the future due to a variety of innovations, including recently approved immuno-oncology agents.

At the same time, the cost of many of these innovations has been high. The cost per treatment for some hepatitis C products was near $100,000 per year at one point, and novel oncology treatments can be even more expensive. Not surprisingly, the cost of drugs has become one of the top issues in the 2016 election.

In response to rising health care prices, there have been two dramatic changes in the way new treatments are evaluated and reimbursed. First, value frameworks are increasingly being used to assess treatment value. Second, provider and health plan reimbursement are being increasingly tied to measures of value. In this article, I briefly discuss each of these developments in turn and provide some recommendations on how innovators can generate evidence in this increasingly value-based world.

Assessing treatment value

In response to rising drug costs, there have been no less than six value frameworks developed. These include frameworks developed by the American College of Cardiology and the American Heart Association (ACC/AHA), the American Society of Clinical Oncology (ASCO), the European Society for Medical Oncology (ESMO), the Institute for Clinical and Economic Review (ICER), Memorial Sloan Kettering Cancer Center (MSKCC), and the National Comprehensive Cancer Network (NCCN).

All value frameworks rely on four broad steps to compare treatment value to cost. [1] These steps include:

(i) Selecting health outcomes of interest (e.g., efficacy or safety)

(ii) Identifying a relevant evidence base to identify the impact of treatment on each outcome of interest

(iii) Aggregating the outcomes into a single measure of health benefit; and

(iv) Calculating the cost of care and comparing it to health benefit.

Nevertheless, the audience and exact methodology do differ across value frameworks. For instance, ICER says its framework can be used by insurers to “guide their assessment of the value of medical services, including drugs, medical devices, and procedures” [2] whereas ASCO states that its value framework should be used to facilitate the patient-physician decision-making process. The value calculation also varies across frameworks. For instance, ASCO uses a transparent, formulaic points system tied largely to efficacy and safety measures, by assigning an efficacy score that is proportional to the hazard ratio measured in the treatment’s clinical trial. NCCN, on the other hand, relies on expert opinion to rate treatments on a 1 to 5 scale in its efficacy domain.

In addition to differences in methodology, the output of the value frameworks are used in different ways. ASCO and NCCN calculate a value measure to help patients and physicians compare the value of different treatments, while ICER and MSKCC use their value framework to recommend explicit prices that firms should be charging for their products.

Tying reimbursement to value

Not only are new treatments being measured in terms of value, the reimbursement received by providers and payers is increasingly being tied to value. Hospitals that treat Medicare patients are already subject to a number of value-based reimbursement programs, including the Hospital Value-Based Purchasing Program (HVBP), the Hospital Readmissions Reduction Program (HRRP), and the Hospital-Acquired Conditions (HAC) Reduction Program. Hospitals are not the only providers subject to value-based reimbursement. Medicare began the Home Health Value-Based Purchasing Model (HHVBP) in January 2016, is in the process of implementing the Merit-Based Incentive Payment System (MIPS) for physicians, and will implement a value-based purchasing program for skilled nursing facilities by fiscal year 2019. [3] In fact, within two years, CMS aims to have 90% of Medicare fee-for-service payments be tied to value in some form. [4]

In addition to provider value-based purchasing programs for Medicare beneficiaries, providers also receive value-based payments for patients enrolled in commercial and Medicaid health plans. UnitedHealthcare, for instance, paid out more than $148 million in quality of care bonuses in 2015. [5]

Further, health plans themselves are also subject measures of value. The CMS Star rating system ties Medicare Advantage plan premium support and other incentives to the quality of care their patients receive.

Forward-thinking strategies

In light of the increasing importance of value measurement and value-based reimbursement, innovators should adopt a forward-thinking evidence generation strategy. This strategy should both demonstrate the value of their products under value frameworks, and also demonstrate the treatment’s value to providers and health plans whose own reimbursement is tied to quality of care. I describe a three-step approach for demonstrating treatment value below (Fig. 1.).

Value measurement should begin at the stage of clinical trial development. Clinical trials often use biologic endpoints (e.g., HbA1c levels for type 2 diabetes treatments) or some validated measure of functional status (e.g., the Health Assessment Questionnaire (HAQ) for rheumatoid arthritis treatments). In some cases—such as A1c levels—these metrics will already be included as quality measures in existing value-based purchasing programs. In other examples—such as the HAQ score for RA—that is not the case. Including secondary endpoints such as avoided hospitalizations, or reduced readmissions can help demonstrate the value of your product to potential customers. These endpoints should be tailored to the specific disease area of interest; there is no one-size-fits-all approach.

Once a drug is approved by FDA, innovators should already have a plan in place to quantify the full value of their treatment. When a drug is approved, the cost of treatment is well known, but treatment benefits are uncertain. Consider the case of a new disease modifying therapy for multiple sclerosis. Payers will know the cost and the results of the clinical trial, but at launch other components of value—such as its effect on caregiver burden and worker productivity—are typically not known. And, although treatment efficacy is well measured in clinical trials, treatment effectiveness is not. Even where two treatments have identical efficacy, effectiveness in the real world may differ if patient adherence is much higher to one treatment than another. In general, a treatment’s estimated value will change over time as more evidence comes to light; it is incumbent on innovators to help fund the research to estimate that value in a scientifically rigorous manner.

Finally, when a treatment is in the process of being evaluated by a value framework, innovators should ensure that the organization conducting the evaluation uses the highest quality evidence available. Ideally, value frameworks should release full methodological details to better enable manufacturers to identify and test all assumptions made; some of these seemingly minute details can have large effects on the value a framework assigns to a treatment. In the case of ICER’s review of multiple myeloma, for instance, changing a single parameter regarding dose intensity altered the estimated incremental cost effectiveness ratio from $255,000 in its draft report to $428,000 in its revised report. Because the estimated value of a product may hinge on a few critical parameters, manufacturers should be prepared to critique these value frameworks when appropriate. Oftentimes, creating one’s own cost-effectiveness model for the US market is useful for providing these critiques and identifying the model assumptions that have the largest influence on estimated treatment value.

Looking to the future

Value frameworks and value-based reimbursement are likely to remain, but will evolve over time. The merits of these two value initiatives, however, depend on the quality of evidence available in the public sphere. Innovators dedicated to providing value to patients, providers, health plans and broader society should actively participate in efforts to generate evidence to better measure treatment value. These evidence generation initiatives will not only be good for manufacturers’ bottom line, but more importantly, they will be used to ensure that patients receive the highest value care available.

References

- http://jama.jamanetwork.com/article.aspx?articleid=2521978

- https://icer-review.org/methodology/icers-methods/icer-value-assessment-framework/

- https://www.cms.gov/Medicare/Quality-Initiatives-Patient-Assessment-Instruments/Value-Based-Programs/Other-VBPs/SNF-VBP.html

- https://www.cms.gov/Newsroom/MediaReleaseDatabase/Fact-sheets/2015-Fact-sheets-items/2015-01-26-3.html

- https://www.uhc.com/news-room/2016-news-release-archive/quality-of-care-bonus-payments

ABOUT THE AUTHOR

Jason Shafrin, PhD is a senior research economist at Precision Health Economics and the Director of Research at the Innovation and Value Initiative. He is an expert in value-based purchasing, Medicare reimbursement systems, advanced econometric analyses using claims data, and the evolving field of value networks. His doctorate in economics is from the University of California – San Diego.

Save

Save

Save