Advancing the biopharma cold chain

Vendors and service providers scramble to serve a growing market

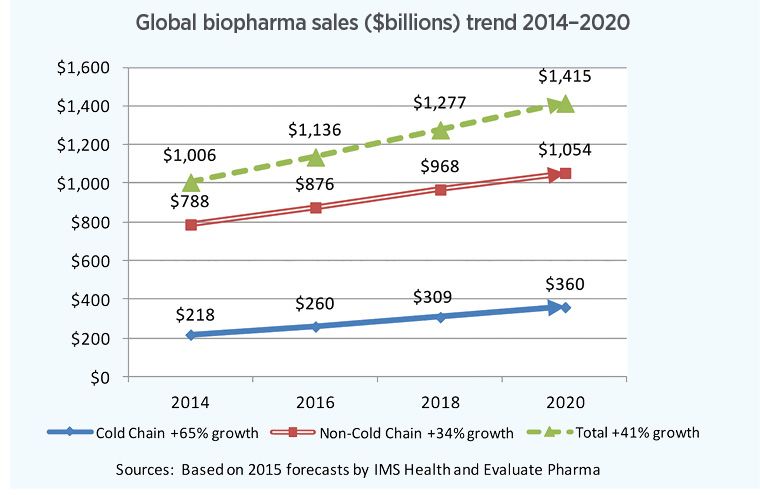

Fig. 1. Sales of cold-chain drugs and biologics will outpace overall industry growth through 2020.

With apologies to Rodgers and Hammerstein of Broadway musical fame, we can say that “biopharma cold chain is bustin’ out all over” in 2016. The steady stream of openings of dedicated, temperature-controlled warehouses and intermediate storage areas for biopharma products ticked up noticeably in the past year. More and more freight forwarders, air carriers, trucking firms and 3PLs (third-party logistics providers) now have branded life sciences services. Technologies for packaging life sciences products and clinical trial materials (CTMs) are advancing, as are digitally based networks and devices for tracking shipments through supply chains.

According to estimates by the Economist Intelligence Unit, WHO, IMS Health and others, global healthcare spending is ripping along at a 3–4% annual rate currently, and is approaching $10 trillion globally. That’s 2–3 times the rate of population growth. Within that, global pharmaceutical spending is projected to rise by 4–5% through 2020. And within that, according to Pharmaceutical Commerce’s 2016 Biopharma Cold Chain Sourcebook, spending on refrigerated (2–8°C) drugs is growing about 7% annually, or 41% during the 2014–2020 period (Fig. 1).

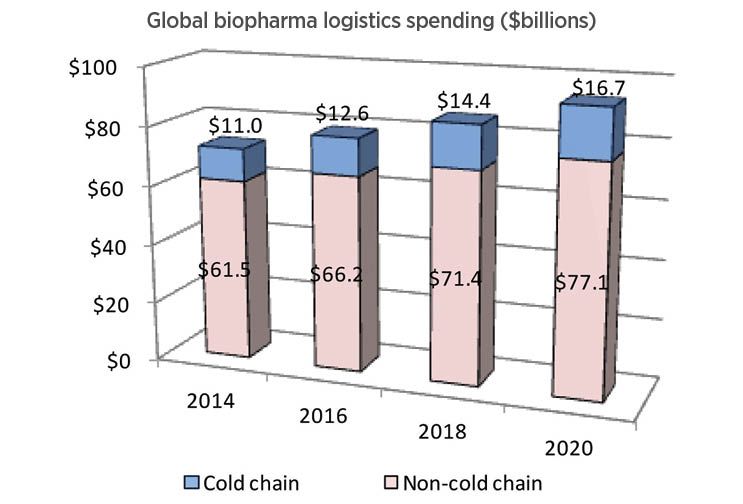

Looking at the entirety of pharmaceutical logistics, the Sourcebook projects that cold chain currently represents 19% ($12.6 billion) of a $78.8-billion industry, rising to 22% ($16.7 billion) of a $93.8-billion industry by 2020 (Fig. 3).

Fig. 3. Cold-chain logistics spending is forecast to grow to more than $16 billion by 2020

A second, related driver to this growth is that more and more of the pharma industry is biotechnology-based. While there are refrigerated small-molecule pharmaceuticals, and while not all biotech products require refrigeration, the great majority of biotech products do, and they command the highest value in the healthcare market. Of necessity, biotechnology manufacturers (as well as vaccines, insulin and blood products, and others) need to spend liberally on technologies and services that ensure the quality and efficacy of the products they ship around the world. Spurring this on is the latest R&D on cellular therapies, including stem cells, regenerative medicine and varieties of genetic therapies. On a commercial basis, these are still relatively small markets, but the logistics of managing their distribution will add complexity and cost to healthcare.

A third driver is, to some degree, self-imposed. Through collaboration between leading industry organizations, and national and international government regulators, the restrictions on how pharmaceuticals, medical devices and other healthcare products are transported are becoming significantly tighter. A key factor here is the imposition of Good Distribution Practices (GDPs), which are beginning to address not just refrigerated products, but also so-called controlled room-temperature (CRT) ones. The days of tossing any pharma product into a cardboard box and dropping it off at the local parcel delivery company are fading. While the industry globally has not, as yet, adopted insulation and cooling systems for CRT products across the board, the use of techniques like thermal blanketing and regulated warehouse room temperatures is become widespread.

DHL, one of the world’s largest mover of healthcare products globally, organizes an annual life sciences customer event each spring, and surveys the attendees to get their views on current industry trends. According to Angelos Orfanos, president of the Global Life Sciences Sector at DHL, there was a shift this year in attendee priorities. “For many years, cost and quality traded back and forth as the No. 1 and No. 2 priorities for our attendees,” he says. “This year, the No. 1 priority was vendor capabilities to meet evolving industry needs.” That translates, he says, into a greater emphasis on performance in delivering products safely and on time.

Orfanos goes on to note that mergers and acquisitions activity has been intense in the industry for the past couple years; when these combinations are announced, Wall Street and other investors expect to hear about synergies that result in better cost effectiveness for the invested capital. That, in turn, usually calls for rationalizing supply chain activities like warehousing and distribution. Logistics providers’ capabilities to manage client supply chains as these complex corporate mergers take place is one important performance factor; but another is to raise the level of performance of both the logistics provider like DHL and also its service partners, such as air carriers, trucking companies and warehousing facilities. Orfanos notes that his company has taken a leadership role in the CEIV for Pharma (Center of Excellence for Independent Validators in Pharma) program of the International Air Transport Assn. (IATA). Under this program, IATA validators certify the capabilities of air carriers, freight forwarders, ground handlers and trucking companies to ensure a common level of quality. Just over 20 organizations have been certified so far.

(For its part, IATA notes that it is in a competitive position vis a vis other forms of transportation, such as ocean carriers, for pharma trade; CEIV for Pharma is looked on as “supporting the air transport industry to comply with pharmaceutical manufacturers’ requirements.”)

2016 Forecasts

The Sourcebook, as in the previous editions, is premised primarily on two things: a methodical review of the labels of most common pharmaceutical and biotech products to calculate how much of the overall pharma supply chain is dedicated to cold chain practices; and an analysis of as much data as can be collected on the costs of pharmaceutical logistics in the US and globally. A third element is an evaluation of the pharmaceutical “pipeline”—the pace at which drugs under development will come on the market, and how the market will grow for those and for existing commercial products. The forecast timeframe is five years (2016–2020).

Since the 1980s, when the commercial biotechnology industry introduced its first products, the global market for such products has expanded enormously. As of 2016, it exceeds $250 billion in value, and the special logistics for maintaining the quality of temperature-sensitive products as they are shipped from manufacturers to hospitals, clinics, pharmacies and patients around the world account for more than 15% of all biopharma logistics spending.

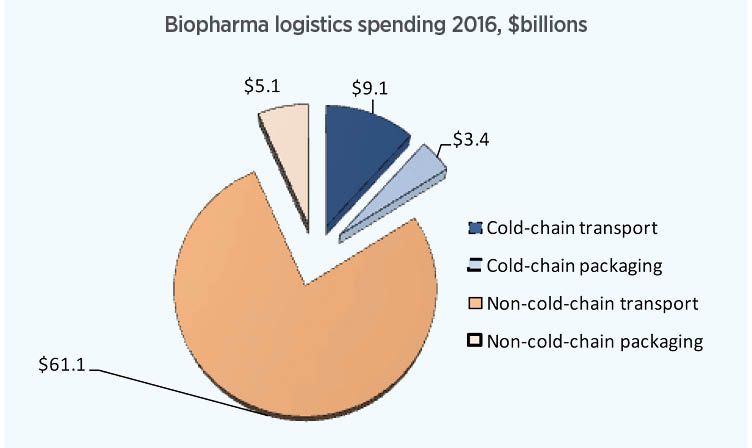

Fig. 4. More than $12 billion will be spent on cold-chain logistics in 2016, mostly on transportation services.

Our updated forecast for cold-chain logistics spending in 2016 is that it will be more than $12 billion worldwide, in a $79 billion overall pharma logistics market, of which $9 billion will be transportation and $3 billion will be specialized tertiary packaging and instrumentation, such as insulated boxes, blankets, phase-change materials, active-temperature-control shipping containers, and various temperature sensors and recorders (Fig. 4). By 2020, cold-chain biopharma logistics spending will expand to more than $16 billion.

The bulk of this spending is on refrigerated (2–8°C) products; the amount of frozen products or clinical trial materials is trivial by comparison. There is a trend toward more spending on devices and system for controlled room-temperature (CRT) shipping, but to date, most of this involves more careful monitoring of shipping conditions and not necessarily extensive use of insulation or other environmental controls.

"

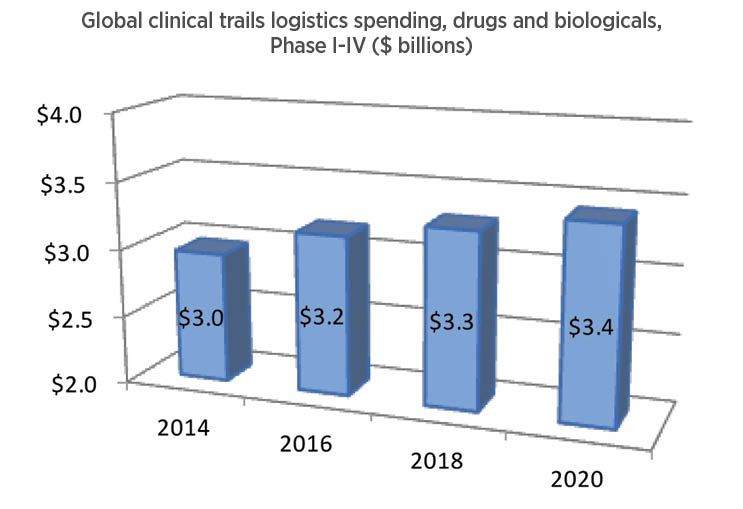

$3 billion annual spending" alignment="left"/>

The Sourcebook also evaluates the clinical trials market, but with somewhat less granular detail. There are both pallet and parcel shipments of clinical trial materials, but no good way to characterize their respective volumes. A factor that is somewhat outside the scope of the Sourcebook is return logistics that occurs during clinical trials—the delivery of, for example, blood or tissue samples from a trial. Our analysis is based primarily on the trend in trial startups, along with estimates based on how much of a trial’s budget is dedicated to logistics issues (Fig. 5).

Clinical trial logistics is an adjacent and very substantial market for temperature-assured transportation and packaging. It involves shipment of products to be used in trials to study sites that may be dispersed around the globe, and return of unused medicines, as well as shipment of medical samples to centralized analytical laboratories.

This year we are updating our estimate for the market size to about $3.2 billion in 2016, due to growth in number and enrollment of trials even as pharma R&D spending was little changed. Based on estimates of trial volume, location, and industry R&D spending overall, our forecast now is for a continued expansion of clinical trials logistics at a rate of about 2% per year, to about $3.4 billion by 2020.

Capacity bust-out

Arguably, the most prominent new cold-chain capacity announcement this year came from FedEx, which opened a long-planned facility in Memphis, TN, the company HQ and site of one of its global hubs. But it was by no means the only one.

The Memphis center (Fig. 2) isn’t a warehouse, per se, but a transfer point for shipments within the FedEx network that need to be consolidated, recharged with coolant, redirected in the network, or held over because of weather or other delays. At 83,000 sq. ft. of capacity, it has space for frozen (-25 to -10°C), refrigerated (2–8°C) and controlled room-temperature (15–25°C) storage.

FedEx has similar, smaller facilities in Kansai International Airport (Japan), Cologne Bonn Airport (Germany) and Charles de Gaulle Airport (France). Both in Memphis, those airports and select facilities globally, FedEx offers cold storage, dry ice and gel pack capabilities to refresh temperature-controlled shipments in transit. Another level of service provides for packaging and thermal blanketing (generally, for CRT shipments), and near real-time monitoring with its SenseAware technology. Another element of FedEx’s services is the Custom Critical unit, which handles ground transportation for temperature-controlled delivery, as well as connecting with FedEx’s air capabilities.

Meanwhile, United Cargo opened a facility for its transshipments at Newark International Airport (New Jersey) with capacity for up to 48 RKN units (metal-walled, powered pallet containers), with electrical connections to power the RKN batteries. Temperature is kept at a steady 15–25°C, the usual range for storing controlled room-temperature (CRT) products. Freight forwarders or pharma manufacturers can deliver product to the facility; it also serves as temporary storage for RKN units transiting from one aircraft to another.

Jan Krems, United Cargo president, used the occasion to announce the opening of a 56th TempControl facility in United’s network, in Vienna, Austria, and to note that similar TempControl storage rooms are planned for other United hubs, including Chicago, IL and San Francisco, CA. (TempControl is the overall brand for United’s dedicated service; only some of the facilities have the CRT storage rooms.)

Not to be outdone, American Airlines Cargo, which opened a dedicated pharma facility in Philadelphia, PA in 2015, has added to its temperature-controlled capacity with facility expansions in Dallas/Fort Worth, TX and San Juan, PR, this year.

Just over a year ago, Kuehne + Nagel, the Swiss logistics provider, announced a 50% expansion of its Memphis, TN contract logistics facility, part of its KN PharmaChain network. Part of the justification for that expansion was winning a six-year contract with Ortho Clinical Diagnostics; the service will include “a GxP compliant infrastructure and IT capabilities to manage its inventory and distribution,” and to manage “Ortho Clinical Diagnostics' cold chain transportation, both domestically and internationally.”

In the intervening 12 months, Kuehne + Nagel also announced multi-year contract-logistics agreements with Merck Sharp & Dohme, and a “transformational” agreement with GSK, managing both its pharma and OTC product distribution. When announced, K+N said that the GSK deal is one of Kuehne + Nagel’s “biggest customer awards” according to Detlef Trefzger, K+N CEO, “Our integrated logistics approach, comprising air, sea, overland services and Logistics Control Centres in four regional hubs will enable GSK’s global supply chains to move to the next level of performance.”

In the Southeast Asia region, Zuellig Pharma, a Hong Kong-based healthcare products distributor, is in the midst of expanding its already large network with additional capacity in Hong Kong and Vietnam, and says it is planning for a 36% expansion into the next decade, in Malaysia, Brunei, Indonesia and the Philippines.

Getting in on the act

Contract development and manufacturing companies (CDMOs) are also expanding cold chain services, especially in cases where their services also involve clinical trial materials (CTMs). On two separate occasions, Catalent announced expansions of clinical trial depot capacity in Singapore and in Japan, including a quadrupling of cold chain capacity in the former. The company is now promoting a CTM supply program called FastChain, to accelerate delivery of CTMs “for both ambient and cold chain studies on a worldwide basis.”

Almac Group, based in Northern Ireland but with facilities in the US, announced a partnership with QuickSTAT, a courier-delivery service, featuring a newly opened QuickSTAT facility near the Belfast International Airport; the ability to cut 24 hours from a fulfillment order is said to be one of the benefits of the collaboration. Almac is also promoting a specialized temperature-controlled packaging scheme, POD (Protected, Optimized and Dynamic) that includes advanced phase-change materials (PCMs) to keep shipments in their required temperature range.

“With rapid growth in the volume of our controlled temperature shipments over the past few years, the introduction of innovative solutions such as the Almac POD allows us to deliver on the growing needs of our clinical trial supply customers,” said Andrew Scott, Almac head of logistics (EU), in a statement. For its part, QuickSTAT announced additional facility expansions in Singapore and Australia this summer in conjunction with the Almac arrangement; all are designed to provide 24-hour turnaround. Separately, it expanded its brokerage and regulatory services for life sciences in Latin America.

QuickSTAT is one of a trio of leading CTM delivery companies, all of which emphasize courier-based express deliveries in addition to building out networks of depots and storage facilities around the globe. World Courier, a business unit of AmerisourceBergen, recently announced a sixfold expansion of its Moscow depot, which will incorporate a temperature-controlled pallet-racking room, equipment for secondary packaging and labeling, and related CTM management services. The facility is one of 14 that World Courier maintains globally for clinical trials management; the company is also building out the capability to handle commercial 3PL distribution of specialty products from these depots (something that aligns nicely with parent AmerisourceBergen’s wholesaling-distribution business).

Marken, another CTM leader, also recently announced an expanded supply-chain partner network in Africa and the Middle East, as well as a new operations center in Zurich, near the Zurich Airport and equipped with freezers and refrigerators to accommodate temperature-controlled CTMs. Zurich is one of 43 depots and logistics hubs the company maintains globally.

The growing CTM market is not being overlooked by the global freight-forwarding companies: both FedEx and DHL (among others) have active programs managing CTM shipments. At mid-year, UPS Healthcare Logistics announced a major upgrade of its network of healthcare logistics facilities to handle more CTM business. With the CTM business, the volumes typically experienced in commercial shipping are not seen; but the shipments themselves justify high-priority, white-glove service.

Fig. 6. CSafe lines up a bunch of unit-load devices to commemorate its 1000th unit put into service. Source: CSafe

Active vs. passive

Similar growth plans are occurring among companies that provide shipping containers and packaging to the life sciences industry. This summer, CSafe, which markets RKN powered containers for pallet-scale delivery via air, announced that the 1,000th RKN unit had been commissioned and put into service (Fig. 6). The company also sells vacuum-panel-equipped parcel containers.

Envirotainer, the market leader in RKN-type units, has also been manufacturing more containers, and in the meantime has expanded its network of “Qualified Envirotainer Providers” among air cargo companies and service providers, passing a 500 milestone in late 2015. Additionally, it is adapting an onboard telemetry system (supplied by OnAsset Intelligence) to enable condition and location tracking in near real-time as its containers circulate around the world.

A battle for market acceptance is intensifying between these vendors of active, powered solutions, and those that provide one-way passive solutions—which are similar to the passive technology used in parcel containers (i.e., an outer shell, an insulation layer, and phase-change materials to provide cold), but blown up to pallet-size scale. Va-Q-Tec, which builds metal-walled containers in the same RKN configuration as Envirotainer or CSafe units, has expanded the number of air cargo companies certified to handle its units. Sonoco ThermoSafe, Cold Chain Technologies, Sofrigam and other providers of passive systems, announced new configurations of their offerings. In the case of Sonoco ThermoSafe, the “QuarterPMC” configuration is designed to fit within a specified space on widebody aircraft. The configuration was developed in conjunction with a program with Cardinal Health, enabling that company to use the unit both in air cargo and in ground transportation, providing cost savings when Cardinal makes high-volume deliveries to customers in trucks that are carrying both refrigerated and CRT materials (without the container, Cardinal would have needed to either separate the two deliveries, or use a more-expensive refrigerated truck for both types of deliveries).

Fig. 7. An analysis of risk categories for managing a cellular therapy ‘round trip’ from patient to manufacturer and back. Red indicates high risk; orange, medium risk; and green, low risk. Credit: PCI

While pallet-sized passive shippers are in the spotlight in their competition with active (powered) unit-load devices for air cargo, the main packaging action continues to be parcel-size containers, usually built with a combination of an outer fiberboard shell, insulation and phase-change materials. Incremental innovation is a constant. In recent months, Sonoco ThermoSafe announced its Certis “platform,” a setup of these packaging components that enables year-round use (a so-called “universal packout”), and with operating life as long as 120 hours. Packagers have the benefit of a standard set of packaging components; by varying the configuration of these components a range of temperature conditions or operating life can be specified.

Meanwhile, Jarden Life Sciences has upped the ante on foam insulation with what it has branded as “Envirocooler ePUR” (engineered polyurethane). According to the company, advances in PUR technology enable it to raise the material’s R-value by 30%, while simultaneously lowering its density by 34%, as compared to conventional PUR. This allows parcel specifiers either to design a smaller box for the same payload, or to have an extended operating life with insulation at conventional thicknesses. The smaller, lighter dimensions could provide savings in shipping costs that are based on the “DIM” (dimensional) weight used by freight forwarders’ price lists. Jarden says that it is offering a series of four prequalified parcel configurations to start, and will extend that to 10 in the near future.

Another packaging provider, AeroSafe Global (formerly American Aerogel) has specialized in vacuum-panel designs that offer insulation performance that are many multiples of those provided by PUR or other plastic foams insulation. A new panel formulation, AeroCore 30, is said to provide 5–10X the insulation performance of expanded polystyrene (EPS) or PUR, but at a lower cost than its existing lines of vacuum-panel-equipped parcels.

Similar product innovations are occurring in another type of insulation for cold chain shipments: thermal blankets. Blanketing—essentially wrapping a pallet or other container to create a thermal barrier to heat transfer—has routinely been used to protect pallets when sitting on an airport tarmac or other intermediate shipping point; FedEx offers a blanketing service as part of its delivery process. Now, vendors such as TP3 Global, Q Sales and Astro-Cooler are developing multilayer blankets that combine insulation with heat and light reflection (preventing sunlight, for example, from warming the exposed pallet). This option is increasingly popular for pharma companies concerned with meeting the controlled room-temperature requirements of GDPs.

IoT cold chain

Incremental improvement is also the watchword for vendors of temperature monitors and other devices that monitor a shipment, or that verify that a shipment has been delivered without excessive temperature excursions. The combination of these devices with internet-based communications portals, creates, in fact, what is commonly regarded as an “Internet of Things” (IoT) application, although, strangely, equipment vendors have not jumped on that theme to promote their products and services.

Sensitech, one of the leaders in this field, has recently extended its popular TempTale 4 line of dataloggers with the TempTale 4 GEO, which has embedded communications electronics to enable a shipment to be tracked in real time. The company also offers a web portal, ColdStream, that enables the tracking to be communicated to clients, and to record shipment conditions.

Elpro, another datalogger vendor, has a similar program, called LiberoManager, as does Berlinger, with its Smartview offering. The service is also offered by the freight forwarders themselves, such as FedEx’s SenseAware program, DHL’s Thermonet, Kuehne + Nagel’s Cargo IQ and others.

Ocean shipping

According to industry insiders, there has been a trend toward employing ocean freight for life sciences shipments. Shipping costs for ocean are vastly less expensive than air cargo; the problem has been the uncertainty of delivery times with an ocean conveyance, and the ability to safely manage what could be a multimillion-dollar shipment held within a single ocean container (which has a much larger capacity than the unit-load devices used by air cargo).

Logistics service providers and container vendors are responding to these market needs. DHL has expanded its previously announced Thermonet service (which provides near real-time tracking of air cargo shipments) to Thermonet Ocean; other service providers offer comparable service. Container manufacturers like Klinge Corp. and ZIM now equip containers with self-contained power and refrigeration systems. The ocean carriers themselves—who are experiencing a painful contraction in shipping volumes overall, and therefore are looking to build business wherever they can—are offering more specialized, dedicated services to monitor and maintain these specialized containers during ocean transits.

Cell culturing

In pharma R&D circles, the excitement is intensifying over technologies that employ stem cells for a host of disease states, or that use a patient’s own immune system to treat a condition; following close behind is the continuing pace of development in regenerative medicine, using living tissues to create whole organs for patients. All of these therapies depend on the manipulation of living cells, which either come from biobanks (for example, those that contain cord blood drawn during the birth process) or by processes that extract cells from a patient, transport them to the pharma facility, then return the modified cells to the patient for infusion.

These technologies, along with a variety of traditional blood-processing applications, depend on frozen (rather than refrigerated) storage and delivery. Service providers and technology vendors are ramping up their offerings to address these market needs. BioLife Solutions, to cite one example, is experiencing double-digit growth with cryopreservation media that is used during clinical trials of cellular therapies. Last year, it also announced a service branded as “biologistex” to employ containers from Savsu Technologies, combined with a cloud-based portal where clients can track their shipments. Cryoport, which has been offering reusable, metal-walled containers that use liquid nitrogen (rather than dry ice) to provide frozen temperature ranges, has broadened its product line, and also is offering a cloud-based tracking system.

The logistics processes for cellular therapies and their like represent a significant challenge to the industry—it is debatable, for example, whether such therapies should be carried out at a centralized pharma manufacturing site (necessitating back-and-forth shipment of the cells), or at a biobank or even a healthcare facility managing large numbers of patients obtaining that therapy (for example, a cancer treatment center).

PCI Services, a CDMO, has looked at the process in a preliminary, overview perspective, identifying the key technical objectives that cellular therapy product management will need to observe. Fig. 7 shows this first-pass evaluation—where the risks are highest for a hypothetical therapy, where cells are extracted from a patient, processed and returned for infusion. As these therapies enter the market, a new type of “cold chain” will be created.

Click to download the 2016 Cold Chain Directory.

Save

Save

Save

Save

Save

Save

Save

Save

The Digital Transformation Reshaping Hospitals and Medication Management

January 20th 2025Despite challenges surrounding communication overload, drug shortages, and cybersecurity risks, this term is revolutionizing medication management and patient care through the use artificial intelligence and predictive forecasting.