Orphan drug commercialization is maturing

Existing incentives continue to draw in new drug developers; payers begin to look at competitive markets to drive down drug costs

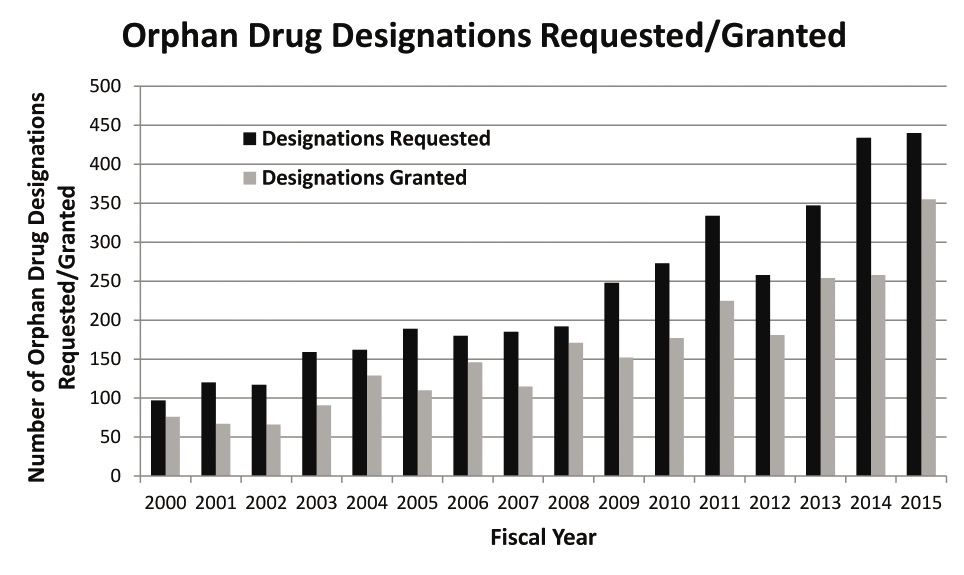

FDA data on orphan drug requests, and designations granted. Source: FDA

Despite their moniker, rare diseases are anything but rare when taken in the aggregate. By definition, a rare disease, often genetic in nature, is chronic, life-threatening and impacts fewer than 200,000 people in the US, or five per 10,000 in the European Union. Today, more than 7,000 rare diseases have been identified, and collectively, they impact 30 million Americans (about 1 in 10 in the US population). Half of those affected worldwide are children.

More than 500 orphan drugs have been approved for the treatment of rare diseases since the passage of the Orphan Drug Act (ODA) in 1983, and the pace is quickening. Over the past decade, more than 230 new orphan drugs have received FDA approval. In 2015, FDA approved 21 novel drugs with a rare-disease designation, out of 45 new drugs overall.

Also in 2015, FDA’s Office of Orphan Products Development (OOPD) received a record number of requests (440) seeking orphan drug designation, and granted 355 of them—a 22% increase over 2014. Per the ODA, this designation provides for multiple incentives, including R&D tax credits, waiver of the Prescription Drug User Fee Act (PDUFA) filing fee ($2.3 million per filing in FY 2016), seven years of marketing exclusivity, and more. The ODA provisions were designed to spur innovation by helping drug sponsors recover development costs and to provide a pathway to profitability for products that are usually limited to a small patient population.

The evidence seems clear that ODA incentives have helped drive venture funding in rare diseases. A 2015 report by the Biotechnology Innovation Organization, which studied trends in $38-billion in venture capital funding to 1,200 drug companies, compared the 2004–2008 (pre-Great Recession) and 2009–2013 periods. Funding for new drugs in major disease states (diabetes, psychiatry, cardiovascular and others) had dropped by large double-digit factors (as much as 81% in diabetes); for rare diseases, new highs have been seen for every year since 2012. Venture cap isn’t the only source of drug-discovery funding, of course, and other factors come into play with research-funding decisions; but the doors for new rare-disease drug development are more open now than ever.

“The ODA has been an unqualified success, and not just in terms of addressing unmet patient need,” says Tim Coté, MD, MPH, CEO of consultancy Coté Orphan, LLC, and former director of FDA’s Office of Orphan Products Development. “Many of the groundbreaking discoveries in rare diseases have helped the entire biotech industry to flourish.”

The pipeline is robust

According to PhRMA, 566 therapies are currently in development for patients with rare diseases. These include:

- 151 for rare cancers and 82 for rare blood cancers (40% of all orphan drugs in development target oncology indications)

- 148 for genetic disorders, including cystic fibrosis and spinal muscular atrophy

- 38 for neurological disorders, including amyotrophic lateral sclerosis (ALS)and seizures

- 31 for infectious diseases, including rare bacterial infections and hepatitis

- 25 for autoimmune diseases, including systemic sclerosis and juvenile arthritis.

“It’s hard to say what would have happened without the ODA, but it’s safe to say the program’s provisions have definitely been successful in terms of spurring drug development in these areas of unmet medical need,” says Ed Pezalla, MD, MPH, VP and national medical director for pharmacy policy and strategy for Aetna. “We really don’t know which incentives have had the biggest impact—each one addresses a different issue that may be experienced by, or important to, companies of different sizes or resources or expertise.”

While some critics complain that the seven years of market exclusivity is partly to blame, allowing the sky-high prices of orphan drugs to go unchallenged, Coté feels that this incentive has been particularly critical in ODA’s success, because it gives drug developers a fighting chance to recoup their development costs over a relatively short time frame. “The high drug prices that come with market exclusivity are time-limited, yet the knowledge that comes from the discovery is eternal, so eventually competition will arise, once the exclusivity period has expired, and this will help to bring drug prices down over time.”

Coté notes that, to the surprise of some, the tax credits provided by the ODA have not been an important incentive, largely because many of the companies pursuing orphan drugs have been smaller companies that have no real revenue (and thus no major tax liabilities) yet.

Balancing cost and patient access

While many applaud the success of the ODA, some say it is unfair (or even unethical) when developers of orphan drugs are able to first take advantage of the financial subsidies and market exclusivity provisions to bring an orphan drug to market for a targeted rare disease indication, but then use that approval as a springboard to seek additional, broader-market indications for the same drug. Others see this strategy as a win-win for all.

“Why should we penalize subsequent drug-development successes when sponsors are able to show that a new therapy’s reach can be extended to help other patients in other indications?” says John Doyle, DrPH, MPH, SVP, Advisory Services, for Quintiles. “The ODA was put in place to help focus drug developers’ attention on the 7,000 rare diseases and we’re only just beginning to scratch the surface.”

“I think there’s this ‘pharma karma’ thing at work here,” adds Coté. “If you’ve been fortunate to unlock some key breakthrough for an underlying biomedical condition, you should try to discover how many other patients may benefit from the discovery, and you should be allowed to benefit financially when you take risks to pursue those other commercial opportunities.”

“There have been some cases where follow-ons were delayed or denied when the more stringent efficacy requirements for larger study populations were applied,” adds Mary Dorholt, PharmD, senior director and clinical practice leader, specialty, for Express Scripts.

Part of the criticism is that orphan drugs typically enter the market at very high retail prices—sometimes on the order of $100,000 to $400,000 per year—and these prices end up getting locked in for the later indications, too, even if the later indication has potential blockbuster market opportunities.

Rituxin (rituximab) from Genentech is considered by many to be the poster child for this phenomenon. “Originally granted its ODA designation and approval to treat non-Hodgkin’s lymphoma, it has had a steady drumbeat of approvals for use in other diseases since then, so yes, the sponsor has benefitted but so have the patients,” says Doyle of Quintiles.

The practice of “indication-based pricing”—pricing a drug with multiple indications differently to match, for instance, the disease state and potential market size—is not currently used in the US, but many argue that such an approach could help to blunt some of the frustration about premium-priced orphan drugs being able to benefit from larger patient populations in later-approved indications. “Indication-based pricing is happening now in the EU and there’s a lot of speculation as to whether we can do something about it in the US, but it’s not that simple; it remains an open question and it’s something the industry as a whole is studying right now,” says Pezalla of Aetna.

A more practical approach to help stakeholders to either justify or challenge the high price of today’s orphan drugs is for drug sponsors to develop real-world evidence (RWE) after the drug has entered the marketplace. “Therapies for rare diseases are often approved more quickly, based on less clinical trial data, and there needs to be an acknowledgement that benefit/risk profile must be validated over time with real-world evidence,” says Doyle. “FDA has issued some recent guidance on this, and there is discussion in PDUFA VI, but the orphan drug regulations need to connect the dots between orphan drugs and real-world evidence.”

And stronger RWE can help drug makers make the case to justify the high prices of their orphan drugs. “While the products may be more costly per dose, they may also be more effective for the individual patient,” says Matt Sarnes, SVP of the Commercial Consulting practice at Xcenda.

Historically, there has been relatively little pushback from insurers on these high-cost therapies. The traditional thinking has been that the total number of impacted patients on any given plan is so small that the cost to address their severe unmet need and the lack of alternative treatment options helps to justify the prevailing “treat at any cost” mentality. Similarly, industry observers point out that many rare disease patient populations have, by necessity, formed vocal advocacy groups which can bring significant swift unwanted publicity to insurers who might otherwise restrict or deny coverage.

Nonetheless, the times are changing. “In terms of the per-member, per-month dynamics, the increased volume of orphan drugs in use today, especially across oncology, means that payers are managing access for orphan drugs in ways they did not before, and, in some cases, excluding certain therapies from their formulary altogether,” says Sarnes. For example, patients with certain cancers will face access issues for Gleevec (imatinib mesylate; Novartis), which is approved for the treatment of several diseases, in 2017, as some payers and healthcare companies have removed it from their formulary lists.

Nonetheless “insurers are responding to high-cost orphan products by increasing Prior Authorization (PA) requirements to disease states and drugs that did not historically require PA, and by imposing quantity and days-supply limits,” says Dorholt of Express Scripts. Accredo Specialty Pharmacy (a division of Express Scripts) works with plans, physicians and patients to ensure that orphan medications remain accessible and affordable in the face of increasing restrictions. This can be done not only by helping to expedite PA requirements, but “by providing clinical insight and expertise to plans to help guide and refine authorization requirements,” says Dorholt.

When managed-care companies use utilization-management tools and controls for orphan drugs, “the goal is not to be punitive, but rather to steer patients toward more cost-effective drugs if available, to make sure that the patient has been properly diagnosed and the disease has the particular form or stage of the disease needed to justify treatment with that medication, and to work with the patient and physician to maximize adherence to the prescribed medication and so on,” says Pezalla of Aetna.

However, Pezalla is quick to point out that when it comes to payers imposing restrictions on coverage and reimbursement of costly orphan drugs, “it very much depends on the drug—we continue to look at each one individually. Many orphan drugs are the only disease-modifying treatment available for those patients, so we are committed to making sure patients have access to the drugs they need.”

“Payers are also looking more closely at how the drugs may contribute to the plan’s ability to meet certain quality metrics,” adds Sarnes of Xcenda. “Consideration of quality metrics, strong clinical trial and real-world data, and pharmacoeconomic evidence is increasingly important for payers when making coverage decisions in orphan indications.”

Borrowing best practices? Not quite yet

In some drug categories (for instance the newest class of PCSK9 cholesterol-lowering agents within the cardiovascular market), a base of knowledge is growing around the use of so-called “value-based contracting”—whereby the negotiated price of an agent is tied directly to patient outcomes over time, with the manufacturer eating more of the cost (through ongoing discounts and rebates to payers) if patient outcome objectives are not met. Doyle of Quintiles says that this innovative model may, eventually, serve as a useful paradigm to help manage the cost of orphan drugs. “However, my feeling is that, over the short term, with limited bandwidth and expertise, payers will first begin piloting such pay-for-performance programs in more prevalent, chronic high-cost conditions (such as rheumatoid arthritis, diabetes and cardiovascular diseases), and only later expend the effort on doing it with orphan drugs.”

Meanwhile, with the orphan drug sector now firmly in its third decade, some rare disease indications have begun to see the arrival of next-in-class therapies. Technically, this should, eventually, open the door for more widespread use of more price negotiation and payer-contracting strategies. However, this trend has not really taken hold yet. “For many ultra-rare diseases, there are still often only one or two options available, which doesn’t allow for much formulary negotiation,” says Dorholt of Express Scripts. “And in some cases, even when there are increasing options, many of the second-in-class drugs are extended-release formulations or bring some other clinical benefits (such as better side effects profile), so this usually means they come to market at a relatively high price point. And in many orphan drug scenarios, we see in-class innovation with the new approvals being targeted for specific or previously untreated subsets of the condition.”

Nonetheless, Dorholt adds, “For some orphan conditions, where we do see the number of therapy options expanding, we are beginning to see more plans explore step therapy. We may begin to see more strategies like this in immune disorders and other categories.”

“We are seeing more cost sharing in orphan drugs and it seems to correlate with the cost of these expensive agents, and not just in traditional private-pay insurers but in some of the health exchanges, too (with 30–40% co-insurance required for some orphan drugs),” says Doyle of Quintiles. However, since affordability has a direct impact on adherence, he adds: “This short-term control mechanism is something we need to address, because it is not a long-term, sustainable solution.”

Meanwhile, Pezalla of Aetna says “while there are no specific examples yet, we are also looking forward to eventually seeing generic small-molecule and biosimilars competitors come to market in some orphan categories. This will certainly create competition and help to bring down some orphan drug prices.”

Model-informed drug development

In recent years, the use of modeling and simulation (often referred to as biosimulation) has gained traction within the realm of drug development, and has a particularly valuable role to play in the development of orphan drugs. In a 2015 survey conducted by the International Consortium for Innovation and Quality in Pharmaceutical Development (IQ Consortium), more than 95% of the leading pharma companies participating used modeling and simulation in key therapeutic areas.

“One key technology—Physiologically based pharmacokinetic (PBPK) modeling—is increasingly used to facilitate decisions about specific clinical studies, to identify better inclusion/exclusion criteria, to inform study design and to guide appropriate labeling language,” says Edmundo Muniz, MD, PhD, CEO of Certara, a provider of biosimulation technology and consulting services.

Such efforts are now increasingly being used to shorten the developmental timelines (thereby reducing costs) and improve the probability of commercial success (by informing ‘go/no-go’ decisions); help regulators to review such findings; and enabling users to design safer, more-targeted and efficient clinical trials (and in some cases, helping to eliminate the need for some trials). Modeling and simulation has begun to earn its place at the table as an essential enabling technology that is not only accepted but encouraged by regulators worldwide.

Nowhere are these capabilities more important than within the realm of orphan drug development, which faces particularly intense clinical, regulatory and commercial challenges. With such small patient populations, it is often hard to identify and recruit patients for clinical trials, and rare disease patients often have complex phenotypes that react very differently to proposed treatment protocols.

PBPK modeling lets drug companies test assumptions using virtual populations, based on in vitro data, to predict the absorption, distribution, metabolism and excretion of a drug. Substituting certain actual clinical studies with informative virtual trials allows sponsors and regulators to answer many “what-if” questions that are designed to test the limits of safety and efficacy.

“Within the realm of orphan drugs, we often don’t have the ability to scale our knowledge from small clinical trials to real numbers,” says Muniz. “Modeling and simulation—to create and study the impact of candidate therapies in so-called ‘in silico’ patients—thrives when you cannot find enough patients, or when they are too frail to participate, or when it may be unethical to test developmental drugs on them in a clinical trial setting.

“Clinical trial designs are often underpowered or overpowered due to lack of adequate information or understanding,” adds Rick Sax, MD, SVP of Advisory Services for Quintiles. “At the extreme, a Phase III trial with a marginal outcome could mean that the drug is actually working, but the design chosen was insufficient to enable registration. A failure of this type is painful for companies of any size, and could be especially perilous for smaller companies with more at stake on a single molecule.”

According to Certara research, among FDA’s 2015 drug approvals alone:

- More than 90% of all 2015 drug approvals leveraged one or more modeling and simulation technologies

- Of the 21 approved drugs for orphan drugs designated for rare diseases, 19used one or more modeling and simulation technologies

- 5 of the 21 drugs leveraged the use of PBPK models used to describe and predict the handling of drugs by the body, based on demography, physiology, biochemistry and genetics, in virtual patient populations.

Modeling and trial simulation can also be particularly effective to leverage information developed for the approval of a drug for one indication and help the sponsor to gain approval for its use in another, different indication. A Certara case history describes the techniques that were essential in helping to secure a second approval for Soliris (eculizumab), a humanized monoclonal antibody (mAb). Initially approved for the treatment of PNH (paroxysmal nocturnal hemoglobinuria), a rare, progressive and life-threatening disease that causes destruction of red blood cells and excessive blood clotting, eculizumab was later approved for the treatment of another ultra-rare condition—aHUS (atypical hemolytic-uremic syndrome), an ultrarare genetic disease that causes abnormal blood clots to form in small blood vessels throughout the body, and can lead to organ failure and premature death.

“This would not have been achieved using real-life clinical trials alone—the total number of patients (57) who participated would not have been enough without the use of simulation to assess the efficacy of treatment using two biomarkers and to recommend dosing regimens for adult and pediatric aHUS patients,” says Muniz of Certara. “And more importantly, the insight that modeling and simulation was able to provide without having to run dose-escalation studies gave FDA the confidence to receive the drug with open arms.”

*https://www.bio.org/biovcstudySave

Save

Newron, Myung In Pharm Form Partnership Centered Around Treating Schizophrenia in South Korea

January 14th 2025The license agreement will feature an upcoming Phase III trial and—depending on results—the development, manufacturing, and commercialization of evenamide as a potential treatment option.