Thermal blankets find a growing cold chain role

Management of controlled room-temperature shipments generates rising demand

click to enlarge

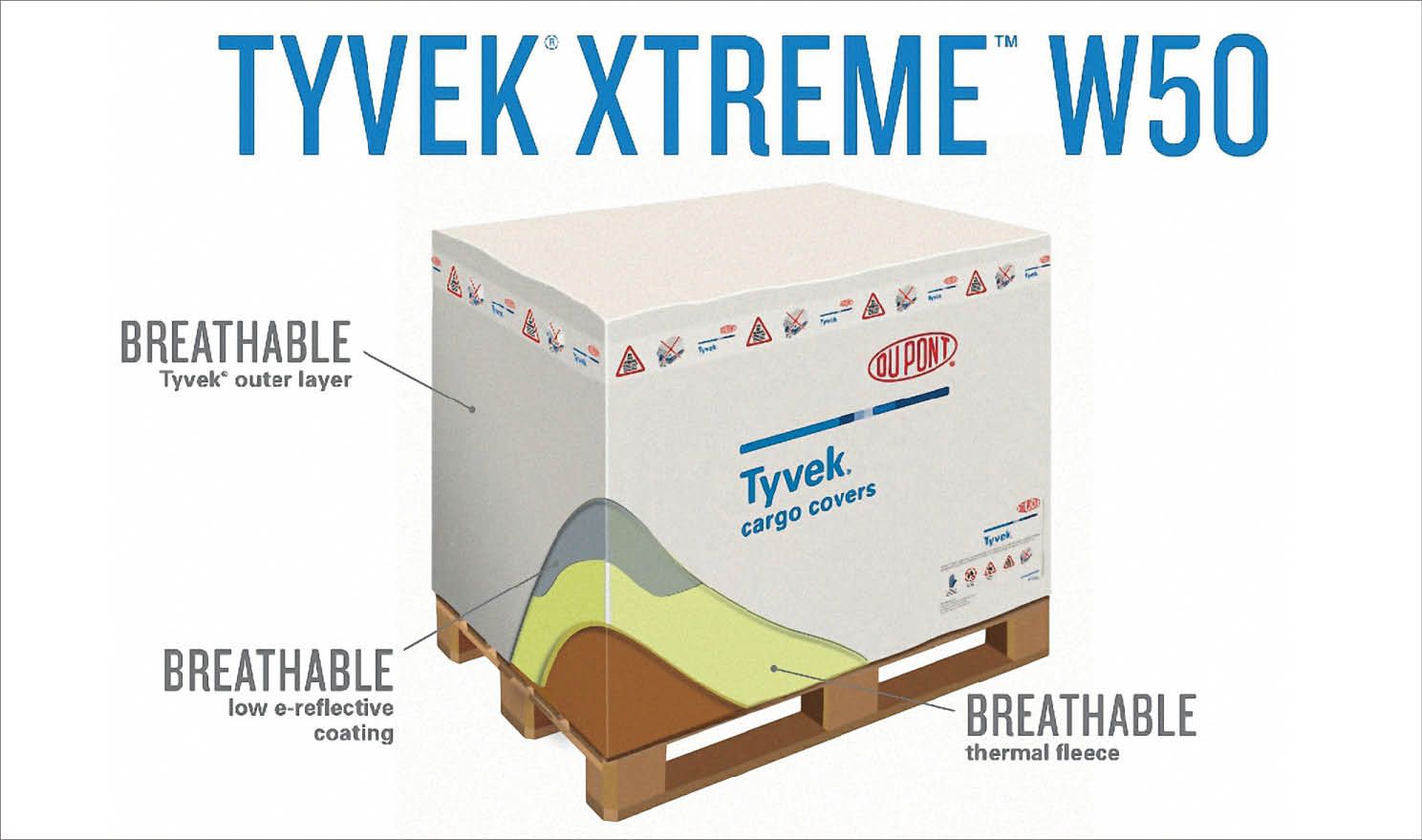

Fig. 1. DuPont Protective Solutions is controlling humidity as well as heat transfer with its new blanketing material. Credit: DuPont[/caption]

The pharma cold chain is dominated by refrigerated products—those that need to be kept between 2–8°C in storage and transportation. A broad-based network of insulation technologies, technical practices at freight forwarding companies; and devices and systems for air, ground and ocean transportation have evolved to manage these requirements, all driven by the grim reality that an exposure to elevated (or freezing) temperatures can spoil a pharma shipment, putting thousands, if not millions, of dollars of product inventory at risk.

In recent years, however, added attention has been paid to temperature requirements outside the 2–8° range. Frozen (and “deep frozen”) shipments are important for a small number of commercial shipments, but also for many clinical research shipments. A much bigger universe is “controlled room temperature” (CRT). The simple reality is that many CRT shipments have historically been delivered by general freight—putting the carton or pallet on a truck and hoping for the best. Now, with the growing emphasis of the EU GDP standards, pharma companies and their logistics providers are compelled to pay closer attention to CRT shipments, including monitoring temperature in transit and documenting excursions. To ensure compliant delivery of CRT products, some shippers are making use of the same cold-chain packaging technologies as refrigerated: insulated boxes packed with gel refrigerants, and managed more or less the same way the 2–8° products are.

Since only about 7–10% of pharma products require refrigeration, the implication is that 90–93% are CRT—a market 10 times the size of the refrigerated cold chain, and representing an enormous added expense for pharma logistics. The industry is eager for alternatives. One approach is to be more rigorous about the “stability budget” of a CRT shipment—determining, through lab testing, how much time can be spent at an elevated (or depressed) temperature before the product undergoes degradation. Armed with these data (and the environmental characteristics of a shipping lane), a pharma shipper can defend the operational performance of a logistics process to regulators. The challenge, then, is to limit, rather than absolutely eliminate, temperature excursions. Enter thermal blanketing as a performance option.

Fig. 2. Wrapping a pallet at UPS’ Healthcare Logistics facility in Louisville, KY. Credit: UPS

Covers, blankets and more

In practice, thermal blanketing involves at least three approaches: a thermal “cover” that provides protection against sunlight while providing a slight degree of insulation; a thermal blanket, which mates a cover material with an insulating layer; and thermal quilts or other advanced technologies, which provide a thick, durable material for a higher degree of physical and thermal protection.

Thermal covers have been around for many years for pharma shipments, even of refrigerated containers, because of the reality that the containers can spend hours sitting on airport runways or exposed to high temperatures on a loading dock. A cold-chain container with a set amount of refrigerant can lose significant refrigerating capacity under direct sunlight; the cover cuts that substantially. Thermal covers have been offered with nonwoven plastic construction (DuPont’s Tyvek material is a widely used option). An enhancement of the thermal cover is to coat it with a reflective material, such as aluminum-containing polymer composite, for even better light reflectiveness.

In recent years, providers of thermal blanketing materials have significantly expanded the insulation properties of their offerings:

- Q Products: offers Qfoil, a thermal blanket with a metallized outer layer and varying thicknesses of inner liners, and a variety of quilted products for encasing drums, pallets or the internal walls of entire containers or truck trailers.

- TP3 Global: based in the UK, provides a variety of configurations under the SilverSkin brand name, ranging from multiple foil layers and insulation of bubble-wrap structures; the products can be delivered fitted for pallets or other typical dimensions.

- Protek Cargo, out of Napa, CA, offers SureTemp blankets with either a bubble-wrap inner layer, or one made of synthetic hollow fibers; the latter provides higher insulating properties.

- Insulated Products Corp., Rancho Dominguez, CA, provides foil-and-bubble-wrap blankets; in addition, it touts the use of fitted carton liners to enhance the insulative performance of expanded polystyrene, a typical material for refrigerated pharma shipping containers.

- DuPont Protective Solutions (Richmond, VA), developers of Tyvek, offer a variety of compositions; the most recent design, Xtreme W50, addresses a recently recognized problem of thermal blankets: the accumulation of condensation, caused by hotter, humid air interacting with a cooler payload under or within the confines of the blanket. Such condensation can damage the appearance of packaging, as well as create potential mildew problems. Xtreme W50 addresses this with a breathable form of the Tyvek material (a nonwoven polymer); insulation is provided with a fleece inner lining. The products are marketed by another firm, Material Concepts (Philadelphia, PA).

TP3 Global and Q Products struck a cross-licensing agreement last year; each company sells the other’s products in their respective geographies.

Tech service

Specifying the appropriate blanketing material can be as complex as a conventional refrigerated container—at least for the pharma industry. A key guidance document is Technical Report No. 72: Passive Thermal Protection Systems for Global Distribution, Qualification and Operational Guidance, a document published by the Parenteral Drug Assn. in 2015. The report covers most conventional configurations of boxes that contain insulation and refrigerant materials, but also includes several sections on thermal blanketing.

Susan Li, manager of Temp True Packaging at UPS Healthcare Logistics, notes that engagements with UPS clients usually require an analysis of the shipping lanes, seasonal temperature variations, and the stability characteristics of the product being shipped—and the degree of risk the client is comfortable with. “Different shipping lanes around the world will have differing requirements; in addition, while some CRT products are specified for a 15–25° range, others are for 2–30 °C or other ranges,” she notes.

Thermal blankets, while conceptually simple, have already attracted considerable engineering know-how. Q Products’ sales manager Paul Yadron notes that the company has a tech services department to run performance testing of the materials in environmental chambers, and it is customary to work with pharma clients on their shipping lane requirements. Besides developing customized configurations of the blanket, clients can factor in the reusability of the material. Q Products is aiming for something of a home run in thermal blankets: outright replacement of conventional insulated containers. “This could work, with some products that are delivered in a routine ‘milk run,’” he says.

Various industry sources note that the US’ regulation of CRT shipments lags behind that of other countries—Europe in particular, as well as Canada. A significant fraction of US shipments still go by general freight (which might be perfectly acceptable, as long as stability budgets are respected); but the direction overall is for a tightening regulatory environment. Expect to see more blanketing in the years ahead.

Save