2017 Hub Services report

Rising tide of specialties lifts most providers’ businesses

click to enlarge

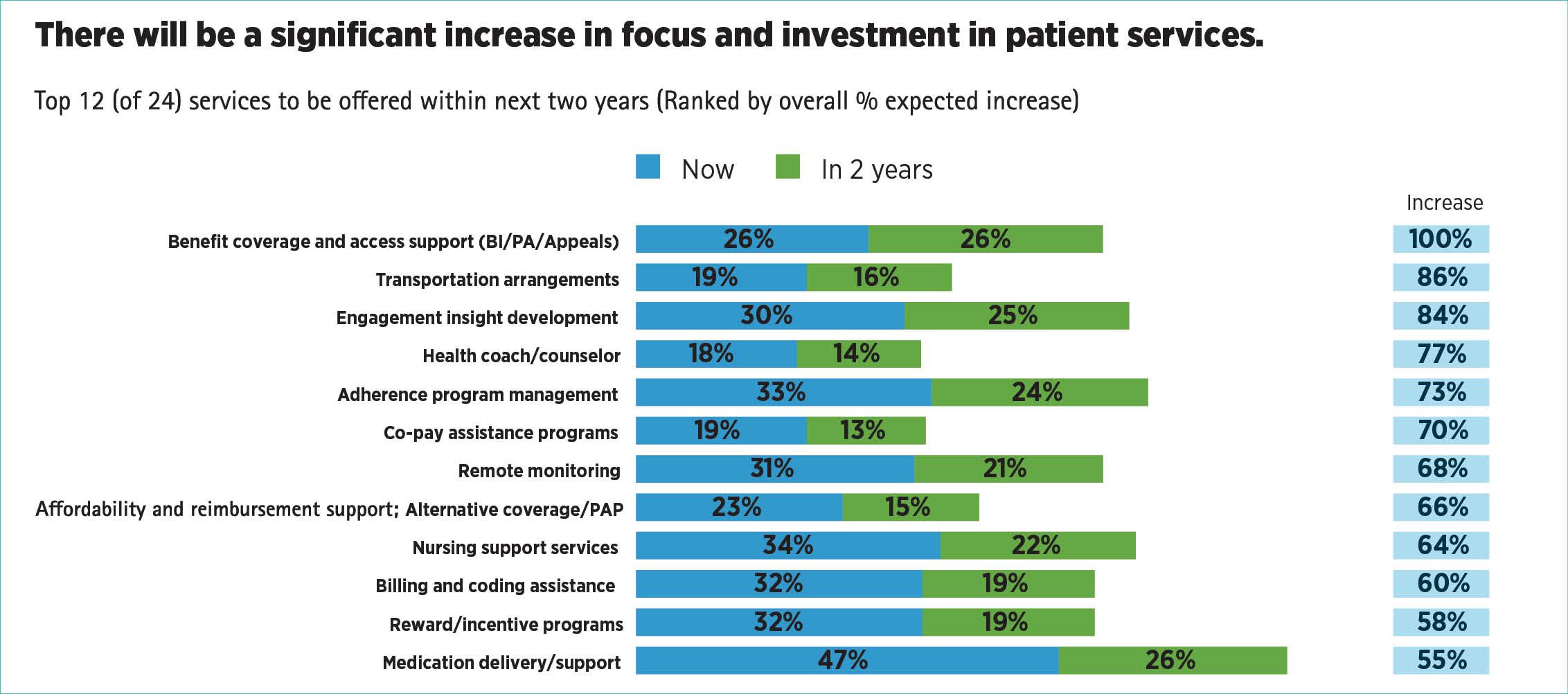

Fig. 1. 2016 survey shows rising spending in a variety of patient support services. Credit: Accenture[/caption]

Nature, as we’re told, abhors a vacuum. In the past, as new specialty pharmaceutical products came onto the market, a vacuum of sorts developed as healthcare providers (HCPs), pharmacists and the drugmakers themselves realized that the new drugs needed additional support to be successful therapies. The drugs have more complex routes of administration (infusion, auto-injection); more complex handling (cold chain storage); and, more than anything else, a more complicated pathway to reimbursement.

Pharmaceutical Commerce has been tracking the evolution of hub services for specialty pharmaceuticals for three years now, and the field shows no sign either of slowing down, or of settling into a predictable and agreed-on set of business activities. Leading organizations in the field have been doubling in size, year-over-year, for several years now. And there is still fundamental disagreement over what to call the activity, if Hub Services (the term Pharmaceutical Commerce prefers) is not the accepted one.

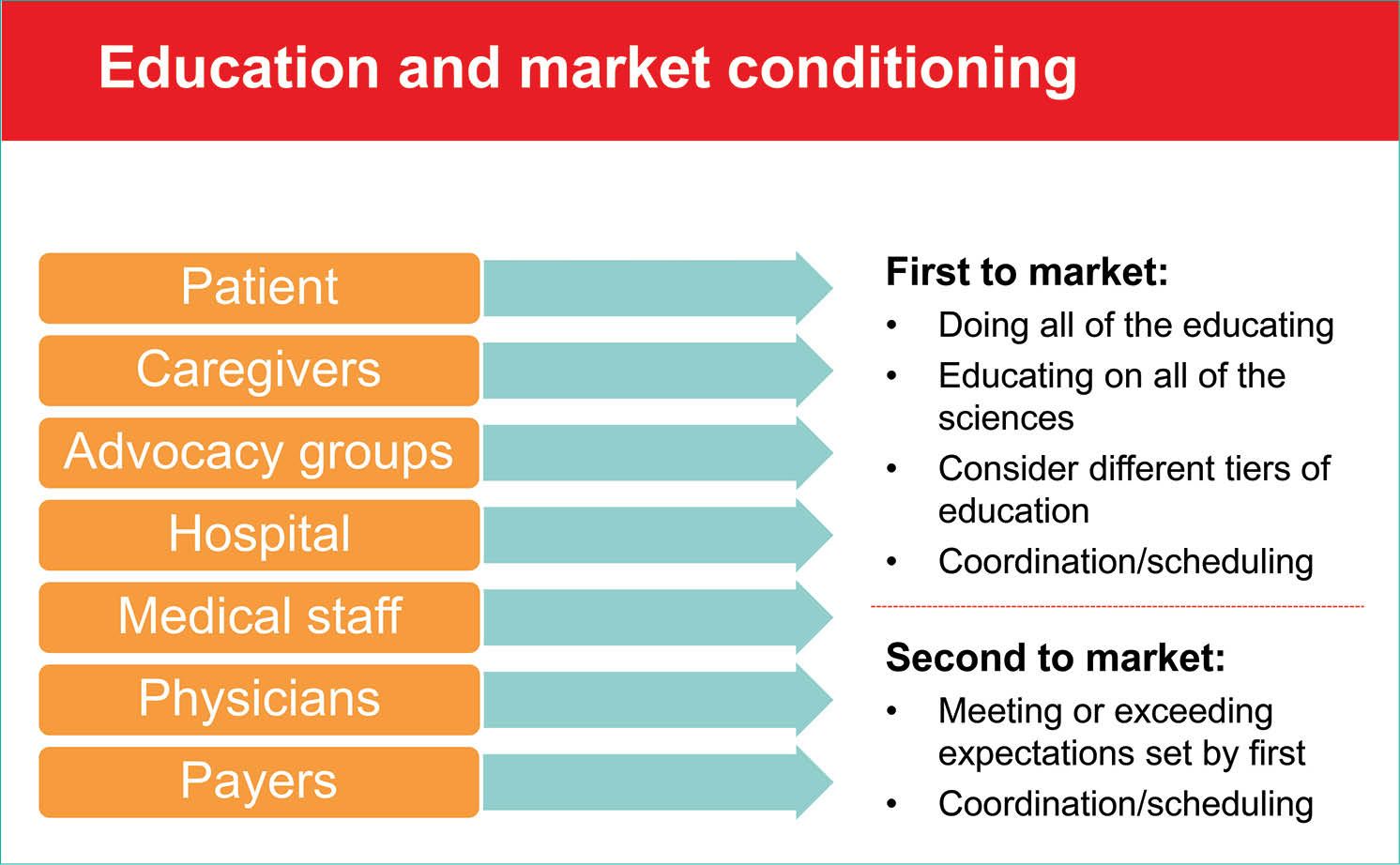

Fig. 2. Hub services are directed to more than patients. Credit: Cardinal Health

The concept of hubs for patient services arose among West Coast biotech firms more than a decade ago, as companies recognized that the new biologics entering the market had substantial service needs besides getting dosages into distribution channels. Besides such issues as cold chain handling in distribution or the complexity of auto-injection, the drugs were seeing growing numbers of restrictions from payers, usually in the form of a Prior Authorization (PA) document, which had to be filled out by the prescriber.

The earliest hubs were patient-support or -advocacy centers within biopharma companies, and these still exist at many firms. Service providers to the pharma industry, especially those involved in distribution, recognized that these services could be offered by them, and a trickle of initiatives in the area soon turned into a mini-flood. Each of the leading wholesalers has a specialty division, and each has been building out patient-support services as part of their offerings.

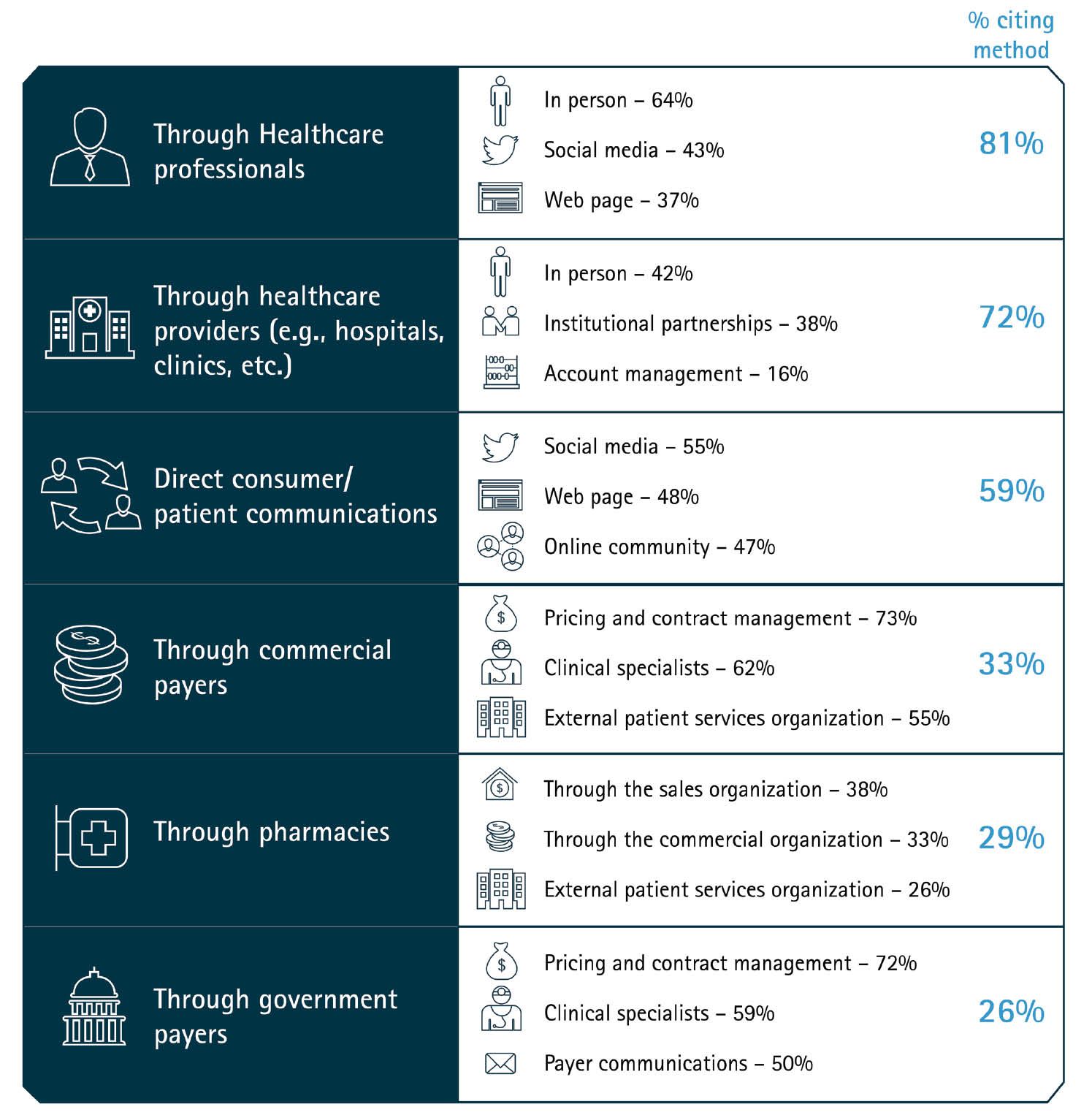

The IT services consultancy Accenture has been tracking the evolution of patient support services across the board in the pharma industry for several years now; a 2016 survey, “The Patient Is IN: Pharma’s Growing Opportunity in Patient Services,” finds that while companies in both the US and Europe are investing more in this function, “the vast majority of patients do not know about the services that are already available to them.” [1] Accenture predicts that digital channels will “dominate when it comes to making patients aware of services whether a company is going through healthcare professionals, healthcare providers (such as hospitals or clinics), or directly to the patient.” To this end, the company is creating an online platform for third-party software firms to coordinate their offerings to life sciences companies (see Fig. 1 or Accenture’s findings).

Along the way in this patient-centric environment, the pharmacy profession recognized that its early efforts to provide specialized pharmacy services were the basis for an entirely new channel—specialty pharmacies—and this type of drug dispensing has grown dramatically in the past five years. The National Assn. of Specialty Pharmacy is now a force in the field; and the number of national and regional chains, as well as networks of independent pharmacies, that have sought out accreditation as an SP from organizations like URAC now number in the hundreds.

“Even though hubs and patient services have been a part of specialty pharmaceutical commercialization for years now, we still find ourselves educating manufacturers and making them aware of how specialty commercialization works,” notes Jan Nielsen, a co-founder of Sonexus Health (now a part of Cardinal Health Specialty Solutions) and longtime executive in the field. “A typical situation at a large manufacturer would be a brand manager with a successful launch into retail pharmacy, and now moved over to specialty with the responsibility for commercializing an orphan drug for a rare disease. There’s a lot of education around that.”

Four trends dominate the hub services field today: a greater emphasis on assisting prescribers in helping their patients, especially regarding prior authorization (PA) paperwork; the rush to develop comprehensive data platforms; the drive to be one-stop shops offering a growing number of services; and, for some service providers, the effort to broaden hub services to lower-cost or even retail-pharmacy drugs, a so-called “specialty lite” effort (H. D. Smith, the nation’s No. 4 wholesaler, has trademarked the term “hub-lite” for its service.)

And for most firms in the field, the trend has been relentless growth:

- Sonexus Health has doubled in size since Cardinal acquired it, and has opened a new distribution center in Houston, TX, with a scale similar to its original site in Plano, TX.

- RxCrossroads, now a subsidiary of CVS Health (it was acquired along with its parent, Omnicare, in 2014), will be doubling its staff and office/warehouse capacity with a new facility in the Louisville, KY area in Q3 this year.

- TrialCard, a leading player in copay coupon and related forms of patient assistance, expanded with a new TC Market Access division last fall, including patient education, nursing support and other hub services.

- Lash Group, a unit of AmerisourceBergen Specialty Group, has opened a new, consolidated facility in Fort Mill, SC, bringing together a variety of local offices, and is about to break ground on an expansion of the new facility.

- PharmaCord, a new hub-services venture, has been started up by Nitin Sahney, former CEO of Omnicare and one of the founders of RxCrossroads. Sahney touts the company’s “independence,” in that it is not affiliated with a PBM nor with a wholesaler.

- H. D. Smith Specialty Solutions, a unit of the H. D. Smith wholesaling company, has brought together several business units to coordinate patient services, including Smith Medical Partners, the distribution component of the specialty hub services, recently expanded to a 340,000-sq. ft. facility in Carol Stream, IL; the unit works with Triplefin for patient support services, and CompleteCare Pharmacy, a closed-door specialty pharmacy that can fulfill direct-to-patient prescriptions. Triplefin, in turn, has recently partnered with GoodRx, a consumer-oriented aggregator of drug pricing information, to make Triplefin’s coupon programs more widely available.

click to enlarge

Accenture’s 2016 survey found that awareness of patient services is low overall, and that communication methods (right column) vary based on the audience (left column) to whom the message is directed.[/caption]

These primarily physical expansions are matched by the growth of services, especially those involving data services: Lash Group says that it will be implementing a top-to-bottom rewrite of its internal data-management system, being called Fusion, by Q3 this year. Lash, one of the largest providers of patient support services in the US, runs hubs that start with prior authorization clearance processes and include a full range of follow-up services; Fusion is meant to be the system that can tie all these services together.

“Combining both industry-leading integration systems and proprietary technology and processes, the new, cloud-based platform will significantly enhance the patient support services that are critical to bringing the latest therapies to the patients who need them most,” according to a company statement.

A similar undertaking has occurred at Smith Medical Partners, where a system called Rx365 has been implemented. The system includes tying delivery of prescriptions from the company’s closed-door pharmacy to patients receiving other hub services.

Accenture’s multi-year analysis of patient-support trends appears to have culminated in the development, a year ago, of its Intelligent Patient Platform, a customized version of the SalesForce Health Cloud (SalesForce, which has been building up cloud-based IT services for a while now, offers this platform to a variety of health organizations, and Accenture has been a leading implementer of such solutions). A key near-term goal of the Intelligent Patient Platform is the ability to integrate data feeds from health-system EMRs (electronic medical records) so that health information originating in, say, a hospital stay can be combined with ongoing chronic care.

More recently, Accenture added to this Platform with the Intelligent Patient Service Exchange, a neutral platform where other third-party vendors can host their software and perform the configuration steps necessary for that software to interoperate with each other and with Accenture’s tools. One of the vendors who has signed on is AssistRx, an Orlando, FL IT firm whose product, iAssist, enables PA and patient-eligibility checks to be conducted prior to a prescription being written. Other resources on the Accenture Exchange include SpringCM, a customer relationship-management solution, and DocuSign, an electronic-signature verification provider.

Automating the PA process is an essential task of hub service providers; the faster the paperwork can be submitted for a successful application, the sooner a patient can be on therapy. Sonexus’ Jan Nielsen notes that her company, in addition to having its own PA management software, is willing to work with other third parties’ software; the company has recently added access to consumer credit-reporting databases so that the financial-qualification part of a PA (necessary for some types of patient financial assistance) can be completed quickly.

These third parties include a PA service from Asembia, a group purchasing organization for specialty pharmacies, NeedyMeds and PARx Solutions, among others. The value of an efficient PA management process was highlighted with the acquisition of CoverMyMeds, another PA service, by McKesson for $1.1 billion in late 2016. (McKesson Specialty Health manages a variety of programs for specialty pharmaceuticals, but the company does not offer an integrated hub service. Another McKesson unit, McKesson Patient Relationship Solutions, has been a longtime provider of patient support services for most types of pharmaceuticals including specialties; however, the announcement of the acquisition was tied most closely to yet another McKesson business unit, Relay Health, which adjudicates prescription reimbursements for a major portion of the prescribing universe.)

Dan Rubin, president of PARx, cites 2009 data that 75% of PA aren’t filled out correctly, and that of those, 40% lead to prescription abandonment. “Doctor’s offices spend hours going through a painstaking process of trying to manage the PA process; their level of frustration has never been greater,” he says. PARx has signed on 40,000 physicians’ offices, and Rubin asserts that PAs submitted through PARx have a higher approval rate than competitors. PARx contracts with pharma manufacturers to prepare the necessary data for a submission involving their drug; the company’s software is available to freestanding hub providers. Most recently, the company signed a partnership agreement with ZappRx, a relatively new service provider that provides an automated platform for specialty product prescribing and patient follow-up. For pharma companies, ZappRx offers a mechanism for collecting outcomes data and managing adherence programs.

Chronic care

Besides managing the PA process, hub providers coordinate patient assistance programs to support patients financially, offer training or education to ensure patients are taking medications correctly (which can be a complicated process for some specialty products), coordinate needed ancillary services such as locating nurses to provide home-based infusions, manage adherence programs, and more. Most or all of these services are funded by the pharma clients themselves—although precautions need to be taken to ensure that, for example, a copay coupon is not offered to a Medicare patient (who are not permitted, under federal rules, to accept this type of financial assistance).

Central to coordinating these “wrap-around” services is the availability of a call center with trained case managers who work directly with patients and with healthcare providers. Hub providers differentiate themselves on the training and certifications of their case managers; some use credentialed nurses or pharmacists. An extension of this is the availability of nurses or other professionals to visit the patient at home.

Just as speed is critical to managing the PA process, so is the case with getting a prescribed drug into patients’ hands quickly, once it is prescribed. To this end, some hub providers, whose business includes a closed-door pharmacy, are capable of sending the first prescription even before the PA has been resolved. Such “quick start” programs have their own complexity: Denise van Dohren, VP at RxCrossroads, notes that this quick start usually entails sending a less-than-standard number of dosages (for example, a five- or 15-day supply, rather than the conventional 30-day supply). But as a distributor, RxCrossroads is not legally permitted to break down a standard prescription to this lesser amount; that’s where the closed-door pharmacy comes in. “Quick start programs, also called ‘free drug,’ can be very important at product launch,” she notes.

The product launch process can entail a wide range of such ancillary services; eventually, the prescription is handed off to a specialty pharmacy in the manufacturer’s network, and the range of services becomes more streamlined.

Mention of specialty pharmacies brings up the complexities of that channel: the biggest SPs (Accredo, CuraScript, Coram), as arms of their PBM parent are sometimes in the position of recommending one drug over another for specific disease states; the hub providers who are separate from these PBMs make the claim that pharma manufacturers are better served by them in such cases. There are also independent SPs, such as Diplomat Pharmacy or Avella Specialty Pharmacy, who offer hub-type ancillary services.

“We’re the aggregator of SP networks,” notes Sonexus’ Nielsen. “SPs are generally set up to dispense drugs and then be reimbursed; they’re not so good at reporting data back to the manufacturer.” There has been some friction between SPs and hub service providers in the past (over issues such as who manages and gets reimbursed for handling the PA process), but “generally speaking,” she says, “we hub providers are working well with SPs today.”

A different perspective of the hub services field comes into focus with non-specialty products, but ones that still benefit from the wrap-around services hub services provide. For example, PA documentation is now being required even for products conventionally distributed to retail pharmacies. This situation has led to the growth of “specialty lite” hub services. As noted earlier, Smith Medical Partners has gone so far as to brand the term “hub-lite,” to signify its presence in this field. “The key here is to be flexible enough to provide the services that make a difference for the patient, and indirectly for the success of the brand, but at a cost that is affordable,” says Tom Doyle, EVP of H. D. Smith Specialty Solutions, the parent organization of Smith Medical Partners and Triplefin.

RxCrossroads is another player that has focused on the specialty-lite opportunity. “We’re seeing a lot of traction in this area,” says van Dohren, who notes that manufacturers of such products have a challenge in stocking the product nationally; a mail-order service with a consigned inventory can expedite delivery to patients, yet keep costs to a minimum.

The company is also targeting a yet-to-be-established market: patient support for biosimilars. “When multiple manufacturers start coming to market with these products, the quality of services attached to their offerings will make a commercial difference,” she predicts. “No one owns this space, so we see an opportunity.”

Ultra-orphan

Orphan drugs, which are generally limited to patient populations under 200,000 in the US, are usually a specialty product, and usually require additional patient support. The ultra-orphan field—where patients can number in only the hundreds or a few thousand—are a subset of that. For years, Dohmen Life Science Services (DLSS) has addressed this market with a specialized service that attempts to provide all services around patient support—PA, financial assistance, 3PL services ongoing care, adherence programs and even offers services in cases where clinical research is part of the equation.

“Specialty pharmaceutical delivery is characterized by many handoffs, from distributor to pharmacy to healthcare provider; we aim to eliminate the handoffs,” says Marie Lamont, president of DLSS Patient Services. Her company stresses attention on the patient journey from initial diagnosis through treatment; of any of the hub provides interviewed for this article, DLSS was the only one that mentioned grief counseling for caregivers as part of the service. The company is banking on the continuing growth in orphan drug approvals (which were 40% of the drugs approved by FDA in 2016).

DLSS literature notes that part of the company’s rationale is that by taking over the entirety of the distribution and dispensing of a drug, the company can cut out many of the markups that are added to a drug’s cost en route from the manufacturer to the patient (it notes, for example, that for the $114 billion spent on orphan drugs in 2016, an estimated $19.4 billion, or 17%, was consumed by intermediaries). However, in an about-to-be-published white paper, it also notes that manufacturers who choose to use the all-in approach of DLSS run the risk of dissatisfying traditional commercial partners like PBMs and wholesalers. “So while a manufacturer might determine that DLSS offers the best service for its rare disease product, if that same manufacturer makes a future product that doesn’t require a high-touch patient services model and opts to use the traditional model, it may not get the best terms from payers.”

The dynamics of relationships between manufacturers, wholesalers, PBMs and specialty pharmacies are still evolving; but in the meantime, there are thousands of patients, every day, doing relatively better or relatively worse based on the quality of service they’re obtaining from all these channel partners. Hub providers, acting as agents of the manufacturers, want to ensure that the manufacturers’ interests are at least as well aligned with patients as the rest of the channel partners.

Save

Save

Save

Save