Pharma ups the ante on DTC advertising

Despite the buzz around digital media channels, pharma continues to pour marketing dollars into television

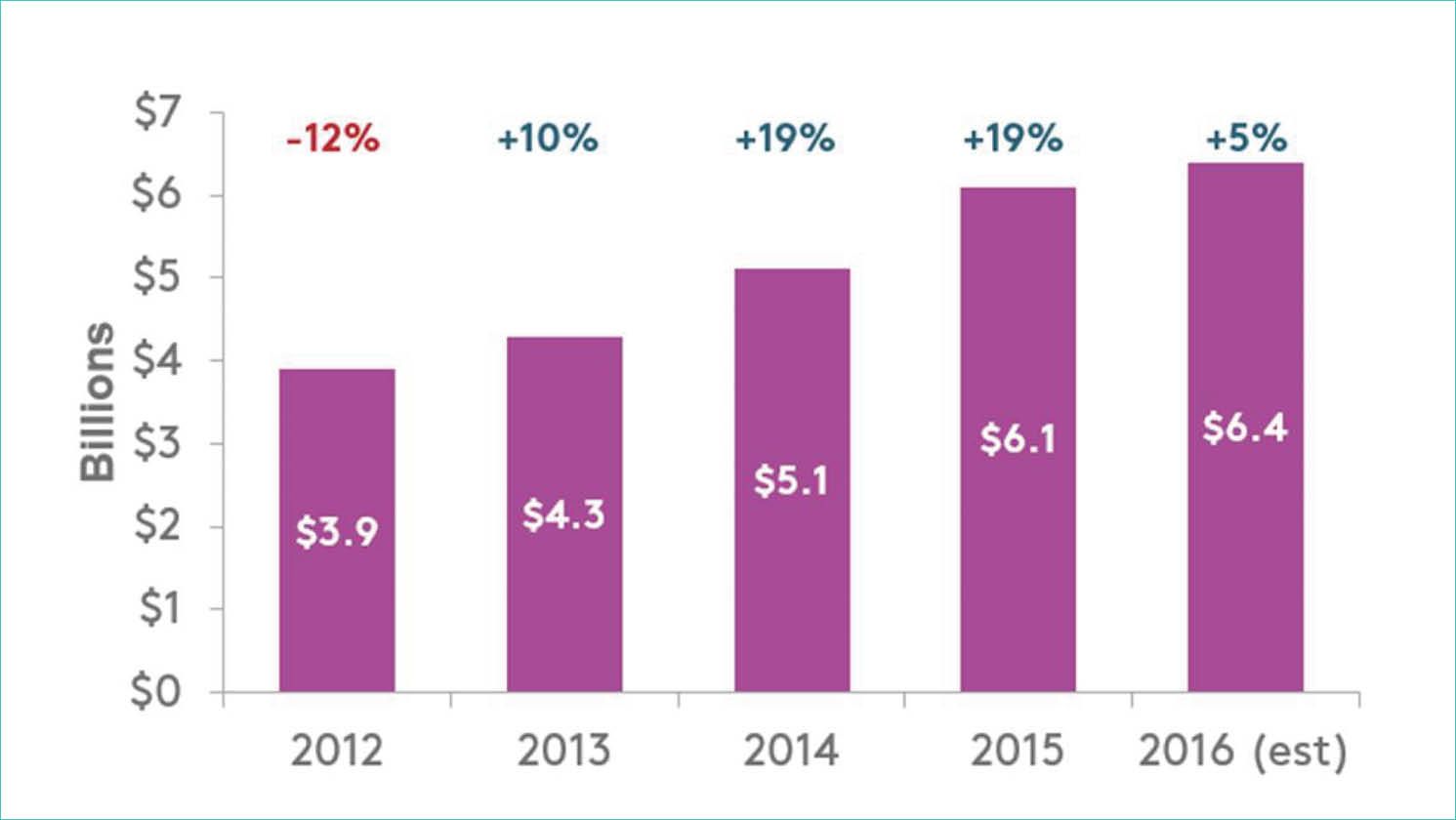

Fig. 1. DTC ad spending by pharmaceutical companies has increased 62% since 2012. Credit: Kantar Media

For the fourth year in a row, direct-to-consumer (DTC) advertising funded by the healthcare and pharmaceutical industries continued to grow, most likely surpassing 2015’s record-breaking media spend. Although the figures were not completely tallied at presstime, in 2016, consumer-marketing efforts probably cost about $6.4 billion, a 5% jump over the $6.1 billion spent in 2015, according to the market research firm Kantar Media.

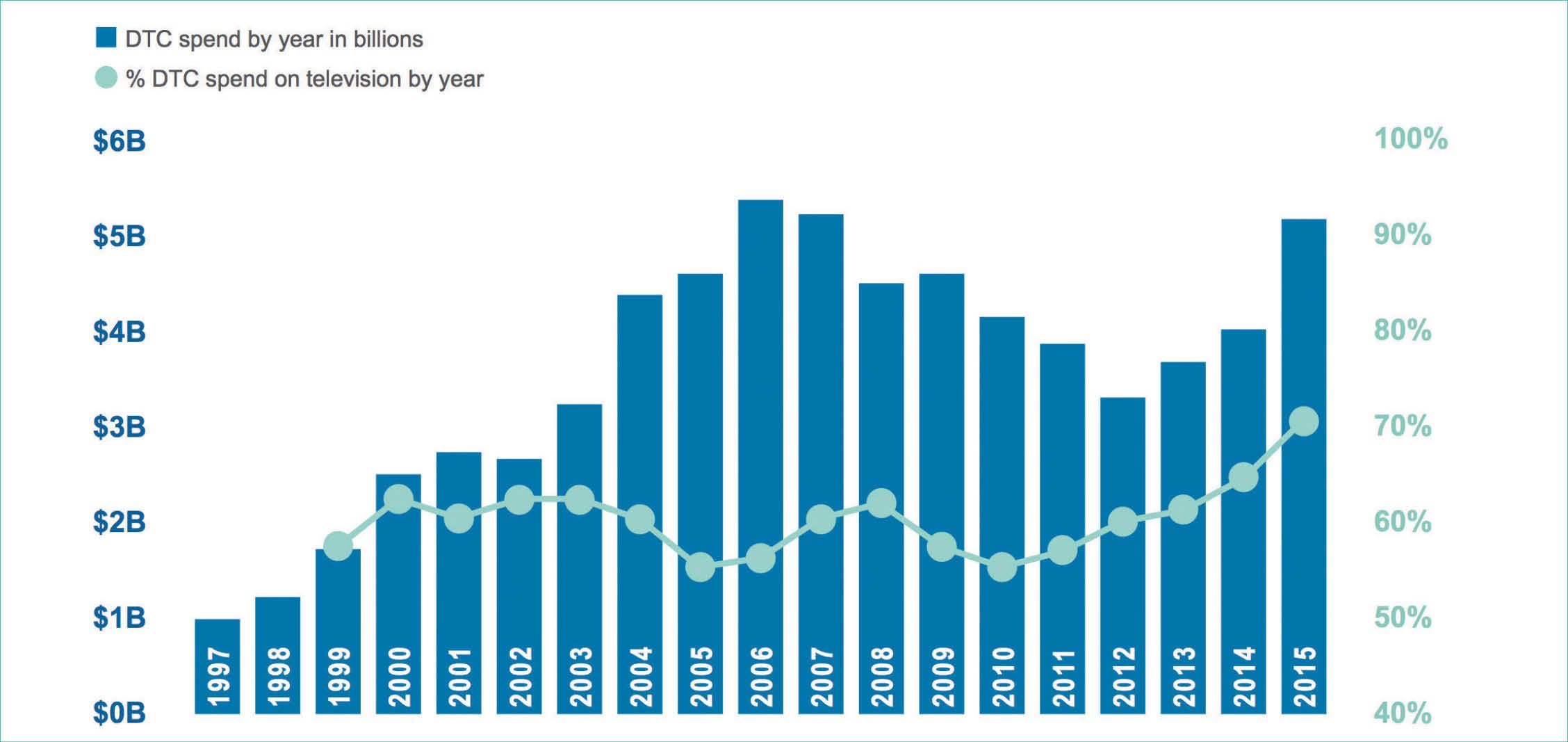

Since 2012, DTC spending by pharmaceutical companies has increased 62%, with back-to-back 19% increases in 2014 and 2015, according to Kantar data. The previous high mark for consumer advertising, $5.4 billion, was set in 2006 (Fig. 1). As usual, television benefited the most from higher spending, capturing 83% of the increased cash flow since 2012. Television’s share of the DTC ad pie has grown 12% since that time, while magazine and other print media’s share has shrunk by 6%, says Kantar.

Expenditures for digital marketing also grew in 2016, but at a slower pace than experts would have predicted a few years ago. Advertisers spent $2.02 billion on healthcare and pharma digital promotions last year, a 20% gain over 2015, but still only accounting for 2.8% of the total digital ad spend among all US industries. [1]

There is a widespread agreement among marketing experts that drugmakers should be making more inroads into digital. “We’re urging clients to shift more resources to digital media, because their customers are there, and even after a TV ad or a detail generates that initial awareness, they are making medical decisions based on the information they find online,” says Matthew Arnold, a principal analyst at the consulting firm Decision Resources Group. “But digital spending remains a pittance at most pharmaceutical companies.”

click to enlarge

Fig. 2. DTC spending overall has been on the rise since 2010, driven primarily by television spending. Credit: ZS Associates[/caption]

Prime time works

Part of the reason for the increased consumer marketing is a flood of new diabetes products, according to a report by market research company eMarketer. New diabetes entrants from Boehringer Ingelheim, Sanofi and Eli Lilly debuted in 2016, which in turn prompted defensive ad spending to protect established brands from AstraZeneca and Johnson & Johnson. Multiple sclerosis was another crowded marketplace that attracted copious ad dollars, according to the company.

“Pharma growth continues to be driven by well-funded marketing launches for new or recent drug approvals, plus existing therapies that have been approved for new indications and have increased their spending rates as a result,” explains Kantar Media CRO Jon Swallen.

“Some of the new product approvals are for conditions with relatively small patient populations but extremely high list prices for the drug—in some cases tens of thousands of dollars for a full course of treatment,” he continues. “Thus the sales revenue potential of the drug justifies spending $50 million plus on advertising.”

Indeed, the number of drug brands with marketing budgets of $50 million or more in yearly spending nearly doubled between 2012 and 2015, according to Kantar; and the number of budgets with $75 million or more rose from 13 to 30 during that time period.

Many of these dollars are going toward prime-time television media buys. According to Kantar data, total healthcare spending on prime-time TV in 2015 amounted to $963 million. In the first three quarters of 2015, that figured totaled $587 million. At presstime, Kantar only has figures for the first three quarters of 2016, but at $747 million, the prime-time television spend is well on its way to surpassing 2015.

Television remains popular because it has a track record. “Pharmas do rely heavily on this tried and true formula of sales reps and TV ads because it works,” says Arnold. “There is a real culture of ‘if it ain’t it broke, don’t fix it,’ among pharmaceutical marketers. They feel their jobs are already complicated enough. And to be fair, it is an incredibly complicated job.”

Furthermore, the average pharmaceutical drug patient, who tends to be older, still watches a great deal of prime-time television. “Overall, adults who suffer from chronic ailments are more likely to be heavier users of TV and print media,” says Swallen, adding, “Consumers who value TV and print as sources of healthcare information are highly valuable. They are more likely to be proactive about their health, trust pharmaceutical marketers more, pay more for branded medications and take action after seeing healthcare advertising.”

Walled gardens

Among healthcare and drug manufacturers, spending on digital video and social media advertising, with a focus on mobile technologies, will continue to grow in the coming years, according to eMarketer. The company forecasts a 15% compound annual growth rate through 2020. “This is higher than the overall US industry average of 13.6%,” a company report states. But that level of growth does not amount to much if the pie itself is relatively small, the report notes: “Digital ad spending in the healthcare and pharma industry has historically been the lowest among the industries measured by eMarketer. That will remain the case throughout 2020.”

Digital media ranges from the ubiquitous banners that appear on popular websites, to mobile presentations, to advertisers’ own websites for both consumers and for physicians. In a perfect world, readers would gravitate to the latter; but that is only occasionally the case. FDA’s oversight of pharmaceutical promotion is something that most online advertisers don’t have to contend with.

One of the reasons often put forth for pharma’s tepid approach to digital and social media is the daunting challenge posed by regulatory compliance. And that is certainly true, especially on the consumer side. It is pretty much impossible to squeeze all the potential adverse side effects of a drug into a 140-character entry on a Twitter feed, for example.

But there are other factors at work as well. Healthcare exists in a different realm than most other industries. It is both more serious and more private. “There are sensitivity issues,” says Arnold. “Maybe consumers don’t want an ad popping up on their computer telling everyone they have X condition. People are understandably a little squeamish about that.”

Another factor is the inherent challenges associated with what is known as advanced programmatic advertising. This is essentially automated, real-time ad bidding, a robotic trading system that can get ad messages closer to a desired customer demographic than the hit-or-miss approach of traditional TV or print media, or even the more targeted strategies of display or search digital ads. This is the kind of personalized targeting advertisers dream about.

However, the tech giants that offer programmatic advertising—Facebook, Google, Apple, Twitter, etc.—tend to be less than forthcoming when it comes to revealing performance metrics and the behavior of their customers. They prefer to self-report such data rather than offer transparency to their advertisers. The reason most often given for keeping these ecosystems closed is to protect the privacy of their users, but large advertisers claim the tech giants are more interested in maintaining the financial value of this data by keeping it under lock and key. [2]

In some cases, big name advertisers are starting to push back. In 2015, Kellogg’s, after publicly tussling with Google over a lack of transparency with its data, ultimately pulled its business with the search engine giant. Kraft Foods soon did the same thing, in addition to halting business with other digital formats that refused to allow independent third-party assessment.

During a panel discussion at Ad:Tech London that same year, media power players from GlaxoSmithKline (GSK) and Nestlé voiced concerns that potential programmatic digital strategies lacked crucial data.

Global Head of Digital Media at GSK, Khurram Hamid, reportedly said: “The problem that we have in this industry at the moment is that large publishers—Facebook, Google, Apple, Alibaba and Amazon—all have data that’s much better than cookie data but behind walled gardens.”

He added: “If we don’t change as an industry in pushing publishers and agencies to start reducing these walled gardens down, then large advertisers will never move all their money into programmatic.” [3]

To some extent, drugmakers can target individual patient demographics using a few highly trusted online platforms such as WebMD, Medscape, Epocrates Online and Everyday Health, according to Arnold—but for the most part, programmatic ads are not yet a significant factor in the healthcare industry.

For the time being, pharma may find greater success targeting physicians directly through digital channels, he says: “There is increasing difficulty reaching physicians through sales reps. Partly, this is a result of the massive movement of doctors into large practices and hospitals over the last decade or so, particularly since the Affordable Care Act. And those doctors are increasingly tied to the EHR (electronic healthcare records), but they’re also spending a lot of time seeking digital information on websites aimed at healthcare practitioners, such as Medscape.”

Customer experience

An area where digital display and search ads seem to be making headway is in “customer experience,” which has been an industry catchphrase for several years. Providing an online experience aimed at educating or supporting patients is becoming a common strategy. For example, last year Boehringer Ingelheim announced plans to use gamification to provide support to patients taking its new diabetes drug Jardiance (empagliflozin), according to eMarketer.

The company used a similar campaign to educate patients about its asthma medication, Spiriva Respimat (tiotropium bromide). In addition to providing education, the gamification program awarded patients points for taking the medication, which could then be exchanged for rewards such as gift cards.

In an increasingly patient-centric world, digital channels can be an important tool in providing engagement and customer satisfaction. “Traditional media will remain the largest benefactor of pharma companies’ marketing budgets for some time to come,” according to the eMarketer report, “but brands are beginning to see the benefits of the shift to digital, especially when trying to reach and educate consumers about disease specific remedies.”

References

- The US Healthcare and Pharma Industry H2 2016 Update: Digital Ad Spending Forecast and Trends. By Patricia Orsini. Published December 2016 by eMarketer.

- Can Advertisers Make the Walled Gardens Hand Over Their Keys? By Merrily McGugan, June 20, 2016. ClickZ magazine. Accessed Feb. 17, 2017: https://www.clickz.com/can-advertisers-make-the-walled-gardens-hand-over-their-keys/101762/

- GSK and Nestle Want the Walled Gardens of the Tech Giants to Fall Before They Go Full Programmatic. By Seb Joseph, Oct. 15, 2015. The Drum magazine. Accessed Feb. 17, 2017: http://www.thedrum.com/news/2015/10/15/gsk-and-nestle-want-walled-gardens-tech-giants-fall-they-go-full-programmatic

What is driving DTC spending?

By Hensley Evans, ZS Associates

Why are marketers spending more than ever before on DTC overall? The power of the consumer as a key decisionmaker is increasing, even in categories where the healthcare provider has traditionally been the key (or even the sole) influencer. With increased access to a multitude of information sources, consumers simply want to be a part of the discussion and are coming to their doctors equipped to participate.

Also, it makes economic sense for pharmaceutical companies to invest in DTC television advertising. Given the channels available, few allow for the frequency needed to significantly impact net sales or are large enough to scale with the population. For example, there are only so many times that a physician is going to attend a speaker program. This leaves personal promotion through the sales force and TV as the primary tactics for scaling promotion.

Even within DTC, non-TV channels are quickly saturated. Profitable digital opportunities become exhausted long before marketing budgets are fully spent, leaving TV as a logical place to continue to invest. Moreover, due to the high margins on pharmaceutical products, especially in the specialty space, there is greater flexibility to advertise broadly on television and to withstand a lower conversion rate. Given the potential to penetrate a market and continue to scale, marketers continue to allocate the majority of their DTC spend to television.

While some hypothesize that manufacturers’ declining ability to access HCPs is driving investment in consumer promotion, they’re actually acting very independently from each other. Our analysis reveals that the categories where we see the largest restrictions on access don’t necessarily correlate with the categories where we see increased DTC investment.

Marketers are leveraging analytics to help them evaluate marketing mix trade-offs. It’s important to note that what matters for these decisions isn’t ROI overall, but marginal ROI (mROI), which specifically measures the impact of an additional dollar spent against a specific activity. For most tactics, you see that mROI will eventually decrease as spending increases, in which case marketing mix decisions may change. For some, mROI can actually become negative: For example, with sampling, increasing spending begins to actively cannibalize product sales at some point.

Comparing the value of an incremental dollar spent on DTC versus additional sales reps versus non-personal promotion to HCPs can be done in a number of ways. Here are three:

- Single-channel impact measurement: One of the most straightforward ways to evaluate the impact of investments in a specific channel is to conduct a test/control analysis. In the simplest terms, this approach looks at individuals (consumers or HCPs) exposed to a specific message or channel and compares this group to a “matched” group (based on segment, decile and other key characteristics). However, it may be difficult to get apples-to-apples comparisons of two or more channels across different test/control analyses, so while this is helpful for understanding the level of impact that a specific channel had, it’s less effective as a means of determining where to invest incremental spending.

- Marketing mix modeling: This is the most commonly used approach to determine which channels are contributing to overall sales and how they compare to each other. Also sometimes called attribution models, the output of these models tells us how much of the sales (or other dependent variable) is attributable to which channels. Most of these models are “direct” attribution models, in which all impact is distributed to individual channels and the sum of the impact adds up to 100% of the dependent variable. What this fails to capture is the relationship between channels.

- Pathway modeling: Pathway modeling is built around (or on top of) a marketing mix model, but instead of looking only at direct attribution, it looks at the interaction between channels, particularly consumer channels. The outputs of these models are “bundles” of tactics that drive specific impact. The advantage of this approach is that you can see which channels are dependent on others and realize that when increasing spending on one channel, you also may need to increase spending on others in order to see the full potential impact. Negative marginal ROIs can become positive if investment in other channels is optimized.

Real-World ROI

The answer to whether mROI is higher for DTC than for other channels obviously differs by brand and specific strategic circumstances, but we can take a look at some publicly observable data as well as some high-level benchmarks to give us some directional answers.

Even if you take a very “back of the envelope” approach to ROI, you can see why some of the specialty products may be investing in DTC even for very targeted patient populations. Let’s look first at a “blockbuster” DTC example: Lipitor in 1999. At that time, there were almost 90 million cases of high cholesterol in the US. That year, Lipitor spent approximately $100 million on DTC, or just more than $1.10 per potential patient. If we estimate the annual patient value for a Lipitor script at that time at about $1,000, that means you’d need to convert 100,000 new patients—or 1/10th of 1% of the total patient population—to break even on the investment.

Compare this to Opdivo, a therapy for patients with advanced non-small cell lung cancer (NSCLC). The total NSCLC patient population is about 342,000 in the US (and the subset of this group where Opdivo is indicated is even smaller), and the estimated DTC spending for the brand in 2015 was $50 million. That works out to more than $150 per potential patient. But with the treatment costing roughly $12,500 per month per patient, Opdivo would only need to convert a few hundred (instead of 100,000) incremental patients to break even on the DTC investment. We don’t know the specific ROI for the Opdivo campaign, but the continued support for DTC from Bristol-Myers Squibb’s senior leadership would suggest that it has been considered successful to date.

Within DTC channels, mROIs can also vary. Online promotion is generally considered profitable, however, there’s a limit to growth via search and digital ads. Consequently, DTC efforts on television are more likely for generating a positive mROI as the patient population scales.

Our own pathways analysis suggests that investing in DTC isn’t a zero sum game, either. For example, increasing DTC investment in TV and radio typically has a market-expanding effect and also increases the volume of other high-ROI channels like branded search. Similarly, we see that in many cases, consumer promotion complements, rather than offsets, HCP promotion.

Overall, there’s evidence that TV and other broadcast DTC channels continue to drive strong consumer response and sales impact. While there’s little doubt that some brands are making poor investment choices and spending more on DTC than they should, our work suggests that there is a strong return on many DTC investments, and that pharmaceutical marketers are increasingly scrutinizing their DTC investments to ensure a wise distribution of their limited marketing spend.

ABOUT THE AUTHOR

As a 15-year industry veteran, ZS Principal Hensley Evans leads the global sales and marketing firm’s consumer and patient marketing practice, and works with many of the world’s top healthcare, biopharmaceutical and consumer packaged goods brands. Hensley can be reached at [email protected].

Save

Save

Newron, Myung In Pharm Form Partnership Centered Around Treating Schizophrenia in South Korea

January 14th 2025The license agreement will feature an upcoming Phase III trial and—depending on results—the development, manufacturing, and commercialization of evenamide as a potential treatment option.