Pharmaceutical cold chain logistics is a $13.4-billion global industry

Pharmaceutical Commerce’s annual Cold Chain Sourcebook projects moderating growth of 38% between 2015 and 2021

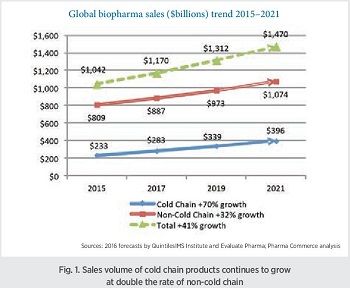

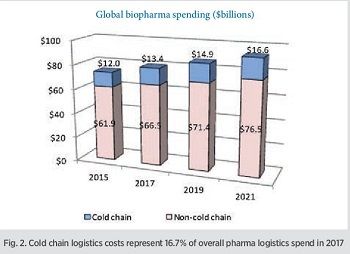

The 2017 edition of Pharmaceutical Commerce’s annual Biopharma Cold Chain Sourcebook estimates that managing the transportation of temperature-controlled products (refrigerated and frozen) will total $13.4 billion this year, growing at a 5-6% rate, and representing a moderation of the 8–9%/yr growth rate of the past several years. At the same time, the value of temperature-controlled pharmaceuticals being shipped is projected to grow 10.7% this year (Fig. 1), suggesting that the industry is learning how to manage cold chain costs more efficiently.

The growth of temperature-controlled products is continuing at more than double the rate of non-temperature-controlled products, indicating that the cold chain business in biopharma will continue to grow healthily. The Sourcebook estimates 2017 non-cold-chain pharma logistics costs at $66.5 billion rising at a 4–5% growth rate. By 2021, pharma cold-chain logistics will be worth $16.6 billion, and non-cold chain at $76.5 billion (Fig. 2).

“There has been only moderate growth, if any, in freight transportation costs across the board in recent years,” notes Nick Basta, editor of Pharmaceutical Commerce, “and since freight transportation comprises roughly 70% of cold chain logistics costs, that moderation is a factor in the slower growth rate in cold chain logistics spending by biopharma.”

The global pharma industry today is almost $1.2 trillion, and between 2015 and 2021 is projected to rise by 41% (Fig. 1). Within that, products that require refrigerated storage and transport are worth around $283 billion, and will rise 70% between over the same span, while non-refrigerated products are projected to rise by about 32%. The drivers, of course, are the continuing transition to biologically based products in new product introductions; additional drivers are the tightening requirements for life sciences shipments, combined with the growing internationalization of pharmaceutical trade. Biosimilars introductions are rising throughout the world (the first product was introduced in the US in 2015), and while this will cut into biopharma revenues, it is also expected to expand the market for biologics-based products—a potential growth factor for the cold chain logistics business. Continued strong growth in insulin products and vaccines is also propelling growth, as is the broader adoption of all these products from developed economies to underdeveloped ones, especially in Asia.

Controlled room temperature

In past years, there was a clear demarcation between biologics and other products that required refrigeration, and tablets and similar products that did not. With the introduction of Good Distribution Practices (GDPs)—and their requirement for temperature monitoring of all types of pharma products, the lines are beginning to blur. Some CRT shipments employ logistics practices identical to temperature-controlled shipments: insulated containers, refrigerants and temperature-monitoring electronics. But many CRT shipments still follow traditional practices as pharma manufacturers become adept at analyzing the environmental conditions of their shipments, and documenting the temperature stability of their products (the amount of time a product can be outside its label temperature but remain effective). “The combination of these factors enable some manufacturers to continue to employ conventional logistics practices, while convincing regulators of the safety of those shipments,” says Basta. “However, the noose is tightening around these practices, and manufacturers are shifting to use of such practices as thermal blanketing and temperature monitoring to provide better quality assurance.”

Another trend to watch closely is the evolution of a variety of precision medicine innovations, ranging from cellular therapies to biomarker testing or regenerative medicine in the form of stem cells. Some of these therapies involve extracting blood or tissue samples from patients, conveying them to a facility for genetic or other manipulation, and then returning them to the patient. Every step in this process is potentially a cold chain task, with tight constraints on the condition monitoring of the shipment. “There are a lot of new technical requirements to these therapies,” says Basta, “including freezing the biomaterials during transit, and developing new packaging methods derived from the clinical research world.” However, most of these therapies are still in the developmental phase, and the volumes involved, from a pharma logistics perspective, are relatively small.

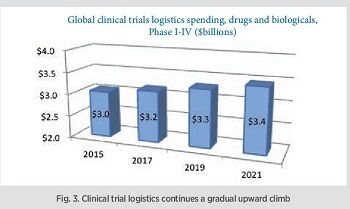

About clinical trial logistics specifically: The Sourcebook also looks at the clinical logistics field (not differentiating between cold chain and ambient, as most trials use temperature controls in some part of the process). Clinical trial logistics involves shipment of products to be used in trials to study sites which may be dispersed around the globe, as well as shipment of medical samples to centralized analytical laboratories. Trial initiations and the scale of trials will generate a logistics volume of around $3.2 billion in 2017 (Fig. 3). Based on estimates of future trial volume, location and industry R&D spending, the Sourcebook forecasts logistics spending growth at about 2% per year, to about $3.4 billion in 2021.

Methodology

To perform its analysis, Pharmaceutical Commerce starts with the current lists of approved drugs, and what their labels say for storage and shipping conditions. Drugs in the pipeline are also evaluated to the extent possible. That fraction of approved drugs is then compared to measures of overall pharma sales (from organizations like IMS Health and Evaluate Pharma), and overall pharma logistics spend and volumes. Data are broken down according to shipping mode (air, ground, sea) and the spending proportions between transportation, packaging and instrumentation.

The Biopharma Cold Chain Sourcebook, now in its eighth year of publication, is available for purchase from Pharmaceutical Commerce. Email [email protected] for more information.

Save