New science energizes the cancer market

An ‘overwhelming’ information load is affecting oncology’s ability to develop successful treatment pathways

Artist’s rendering of T cells attacking a cancer cell. Credit: iStock

Oncology drugs have

had a prominent position in the biopharma industry, as well as healthcare generally, because the stakes are so high: cancer is often fatal; in its many forms, it is a common health condition; and, in recent years, the reimbursement for successful therapies is sizable. New medical science, notably in immuno-oncology (I/O)therapies that employ the body’s own defense mechanisms, is energizing the field. The rapid pace of development, though, is stressing all parties involved: researchers, payers and oncologists. Researchers are proposing new treatment pathways—“stacking” one therapy on top of another; antibody combinations; and crucial companion diagnostics to determine treatment suitability.

Heartbreakingly, while more than a few new therapies show signs of what is a fraught word in cancer—a “cure”—those therapies have already been shown to work well for a fraction of patients—perhaps 30%—and of little or no value to the rest. Side effects can be severe in some cases. All this will put a larger burden on manufacturers and healthcare providers in developing real-world evidence (RWE) during drug development, and massive physician and patient education and follow-up during treatment.

One of the most vexing aspects of cancer cells is that they often exhibit a fiercely atavistic ability to evade recognition by the body’s own immune system, essentially preventing the immune system from recognizing them as malignancies. The leading forms of I/O therapies all manipulate cancer cells or immune cells in ways that allows the patient’s own body to attack and kill off the cancer cells lurking within.

“It is difficult to overemphasize the impact of these innovative agents in the treatment of a wide variety of cancers, and we are now experiencing a broader acceptance of immunotherapies in the first-line setting,” says Kasia Shields, PharmD, director of oncology medical communications at Xcenda (Palm Harbor, FL). “With its potential to offer more beneficial and safer cancer treatment, I/O is now viewed as the ‘fourth pillar’ of oncology treatment, alongside the pillars of surgery, radiation and chemotherapy.”

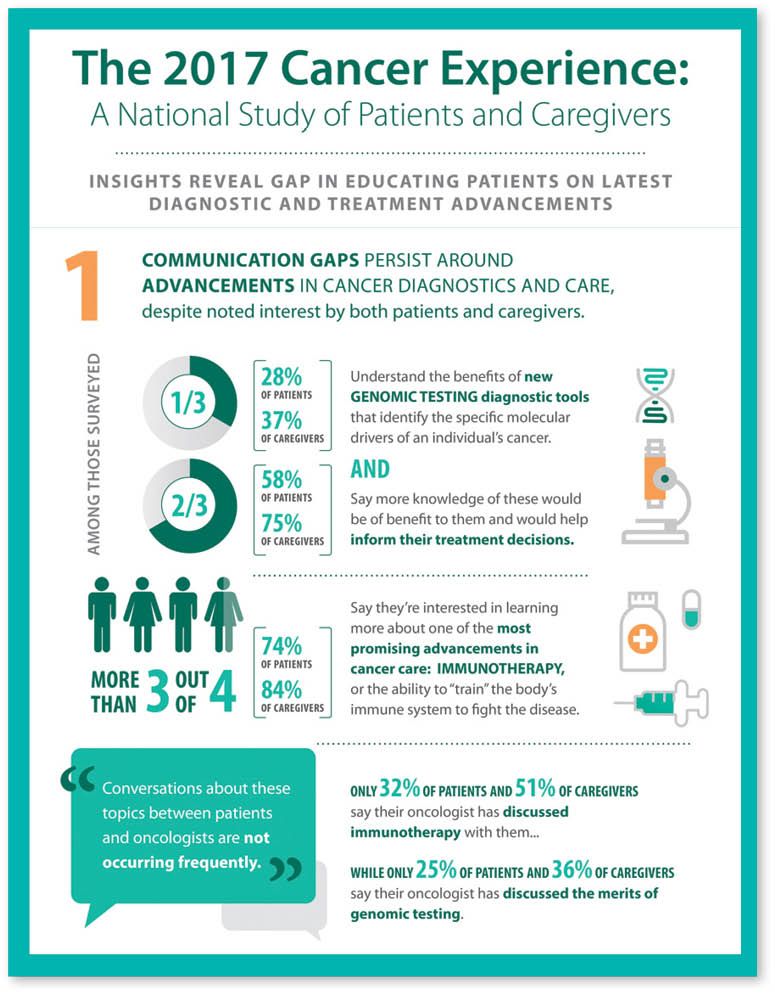

click to enlarge

Data from a national survey by Cancer Treatment Centers of America[/caption]

“Oncologists have long shared the dream of harnessing the immune system and addressing corrupted parts of the immune cycle to fight cancer. For many, the surge in I/O activities and the arrival of approved I/O therapies has felt like the dawn of a new era—and a dream come true—in the cancer-treatment paradigm,” adds Malik Kaman, associate principal, ZS Associates (Zurich, Switzerland). “Indeed, we’ve all gone a bit ‘I/O crazy’ lately, but there are some good reasons for this.”

Specifically, in recent years, I/O breakthroughs have been hotly sought in the areas of checkpoint inhibitors (such as CTLA-4, and the PD-1 and PD-L1 therapies), engineered T-cells (such as chimeric antigen receptor modified T-cells or CAR-T, therapies), bi-specific antibodies, monoclonal antibodies, and a few others. “The advantage to all of these approaches is that they train your body’s natural immune system to simply do its job better. In layman’s terms, they strip away the disguises that cancer uses to hide from the immune system,” Kaman adds.

“Immunotherapy in oncology is already providing results in several malignancies that have been difficult to treat in the past, which is exciting,” says Pamela Crilley, DO, Chair, Dept. of Medical Oncology at Cancer Treatment Centers of America (CTCA), and Chief of Medical Oncology, Eastern Regional Medical Center (Philadelphia, PA). Today, FDA-approved immunotherapies are available for a growing list of diseases, including melanoma, non-small cell lung cancer, certain lymphomas, head and neck cancer, and bladder cancer.

“I/O approaches hold tremendous promise for patients with cancer, although we are still in the early days of this field and there is still much to learn about the broad applicability of them in oncology practice,” adds Richard Gregory, PhD, EVP and chief science officer for ImmunoGen (Waltham, MA), which is working to develop and commercialize a novel therapeutic option called antibody-drug conjugates (ADCs). ADCs are not themselves an I/O therapy but work in conjunction with I/O therapies to promote therapeutic activity.

To date, ADCs have proven themselves to be particularly effective, with several ADCs approved by FDA for the treatment of different cancers, according to the National Cancer Institute (NCI). These include Kadcyla (ado-trastuzumab emtansine) from Genentech, Adcetris (brentuximab vedotin) from Seattle Genetics, and Zevalin (ibritumomab tiuxetan) from Spectrum Pharmaceuticals.

ImmunoGen’s lead ADC, mirvetuximab soravtansine, targets tumor cells expressing the folate receptor alpha (FRa). “We, along with Ventana, have developed a companion diagnostic assay which we use to select patients that are more likely to respond to therapy because their tumor cells express FRa,” says Gregory of ImmunoGen. “This targeted approach to therapy allows us to focus on patients most likely to respond to our therapy and reduces the likelihood that patients without the potential to respond will be exposed to our drug, which has both patient and cost benefit.”

“The type of I/O that is generating the most excitement are the immune checkpoint inhibitors, particularly PD-1 and PD-L1 inhibitors, which are so-called immunomodulatory monoclonal antibodies (mAbs) that work by “taking the brakes off” of immune cells allowing them to do their normal function against cancer cells,” explains Charles Lance Cowey, MD, oncologist with Texas Oncology (Dallas, TX), and member of The US Oncology Network Developmental Therapeutics Research and Genitourinary Cancer Research Committees.

Meanwhile, the data for another form of I/O therapy—using so-called CAR-T cells—has been impressive across a number of different tumor types, but most especially metastatic non-small-cell lung cancer (NSCLC) and metastatic melanoma, and more recently in bladder, and head and neck cancer.

One of the things that sets all I/O therapies apart is that it has the potential to induce long-lasting, durable responses in patients—without the need for long durations of ongoing therapy. “And while immunotherapy treatments do have toxicities, the side effect profile tends to be more tolerable compared to traditional cytotoxic chemotherapy, particularly in terms of issues that affect quality of life,” says Cowey of Texas Oncology. By contrast, many industry observers note that, for the most part, the side effects of I/O therapies are mild and tolerable, especially the existing biologics that are based on the mAbs.

The flip side of the shiny penny

Most appealing about the many I/O approaches that are available or under development is that they demonstrate impressive efficacy in difficult-to-treat cancers, which have been resistant to traditional treatment options, such as metastatic melanoma. “The I/O approach using targeted therapies or checkpoint inhibitors offers the possibility of coming close to the goal of precision medicine, in terms of marrying effectiveness with low toxicity,” notes Dana Evans, MD, Director, Medical Affairs Payer Access, Genentech (San Francisco, CA)

[Editor’s note: Evans’ remarks reflect his personal views and not those of Genentech]

. “The key upside is that patients who do respond tend to have a longer duration of response—that’s why people are excited about it.”

“However, it’s not without its own challenges, and it’s certainly not a panacea for the treatment of all cancers.” Evans continues. “There are still many non-responders, resistance still develops over time in some patients, and to date, it’s been hard to figure out the companion diagnostic piece of it.”

“It is also clear that the profound responses seen in some cancers (for example, in melanoma patients) do not necessarily extend to all other types of cancer—that is, response rates can vary significantly and probably reflect how visible a particular type of tumor is to the immune system in the first place,” notes Gregory of ImmunoGen.

“Despite the understandable excitement, stakeholders agree that I/O therapies are far from ‘miracle drugs,’ as many patients—70% by some estimates—will not respond to them at all,” adds Shields of Xcenda. “This is forcing oncology as a whole, including manufacturers in the I/O therapeutic space, to shift away from any one-size-fits-all treatment model, and to instead seek the most effective ways to distinguish those patients who would actually benefit from newer treatment modalities.”

As a result, stakeholders agree that the future success of I/O therapies in oncology will rely heavily on identification of improved biomarkers, and protocols that combine I/O therapies with traditional chemotherapies and newer biologic oncology agents. As there are dozens of new drugs in development to modulate the immune environment in a variety of ways, this leads to an exponentially high number of combinations and sequencing opportunities.

“This surge in treatment candidates calls for novel and adaptive clinical trial designs—including studies that use serial tumor biopsy sampling and selection of enriched patient populations for immune targets—to help guide the effort,” says Cowey of Texas Oncology. “The staggering cost of drug development makes appropriate trial design and drug utilization a high priority, especially in markets that are increasingly competitive and crowded.”

To wit: According to 2015 data from IMS Institute for Healthcare Informatics (Parsippany, NJ), the annual growth rate in cancer drug costs has risen from 3.8% in 2011 to 11.5% in 2015, at constant exchange rates. In the US, cancer drugs now make up 11.5% of total drug costs, up from 10.5% in 2011.

“Drug makers must think through how to position their novel I/O therapies (front-line, relapse, maintenance, or all of these),” says Chadi Nabhan, MD, VP and chief medical officer, Cardinal Health Specialty Solutions (Dublin, OH).

Similarly, perhaps unlike other oncology therapy approaches, “the key thing is to know when and how to apply I/O therapies for best effect,” adds Dr. Robert Rifkin, oncologist with Rocky Mountain Cancer Centers (Denver), a practice in The US Oncology Network. “I/O approaches will likely work best with patients with some immune system that can still be reprogrammed. Similarly, if the patient’s immune system is too damaged, they will not be as effective and the cost of the approach may not be justified.”

The two most well-known commercial I/O products—Merck’s Keytruda (pembrolizumab), approved for melanoma, NSCLC ,and some head and neck cancers, and Bristol-Myers Squibb’s Opdivo (nivolumab), approved for NSCLC—both use humanized antibodies that block PD-1 (a protective mechanism on cancer cells that help them evade detection by the immune system). In essence, these therapies rip the proverbial ‘cloak of invisibility’ off the cancer cells, allowing the body’s T cells to actively attack them. Both rely on companion diagnostic testing to identify the most receptive patients in each of the approved indications.

Meanwhile, Genentech/Roche’s Tecentriq (atezolizumab), approved last October, was the first FDA-approved checkpoint inhibitor that is focused on the anti-PD-L1 pathway instead of PD-1, and is approved for use with bladder cancer and metastatic NSCLC.

The ligand PD-L1 is a protein that is expressed on cancer cells and immune cells; anti-PD-L1 antibodies bind to the PD-L1 ligand and undermine the ability of tumor cells to use PD-L1 for protection against white blood cells, such as human T-cells from the immune system — thereby allowing the immune system to take the tumor cells out more effectively. In a nutshell, in the words of the National Cancer Institute (NCI): “Immunotherapies either stimulate the activities of specific components of the immune system, or counteract signals produced by cancer cells that suppress immune responses.”

In March, the latest human PD-L1 antibody—Bavencio (avelumab) from EMD Serono (the US biopharmaceutical business of Merck KGaA) and Pfizer—won FDA approval for the treatment of metastatic Merkel cell carcinoma (mMCC), a rare and aggressive skin cancer with fewer than half of patients surviving more than one year and fewer than 20% surviving beyond five years. The companies reported that Bavencio produces durable tumor responses in mMCC patients, with 86% of responses lasting at least six months (n=25), and 45% of responses lasting at least 12 months (n=13). Duration of response ranged from 2.8 to 23.3 months.

“With the approval of Bavencio for the treatment of mMCC, we now have seven approved oncology indications for PD-1 and PD-L1 checkpoint inhibitors, and we expect to see another five to eight different oncology indications being addressed in the next round of checkpoint inhibitor approvals,” says Herman Sanchez, partner, Trinity Consultants (Princeton, NJ).

“Both categories of checkpoint inhibitors (the anti-PD-1 and anti-PD-L1 therapies) rely on the same pathway—checkpoint inhibition—but are coming at it from a different direction,” says Evans of Genentech. “Developers are targeting the right pathway, but the companion diagnostics are just not precise enough to effectively target the right patient right now.”

“There are currently five molecules under development that appear to offer relatively similar efficacy and safety tradeoffs,” says Kaman of ZS Associates. As of this past summer, there were more than 700 ongoing trials for the main PD-1 and PD-L1 checkpoint inhibitors (nivolumab, pembrolizumab, atezolizumab, avelumab and durvalumab). Of these trials, more than 200 were for Phase I or II programs involving 100 or more patients. “This signifies a big shift in the way we think about bringing these drugs to market. It also denotes a massive arms race to be first-in-class in new indications.”

Later entrants to the space will face greater challenges to differentiate themselves to physicians and providers. “If a particular I/O will be third or later launching in a given tumor type, manufacturers must pass a higher bar and find meaningful ways to gain payer coverage,” says Kaman. “The trend is toward faster, more efficient trials, followed by RWE to prove it’s working. The key is to break the cycle of adversarial negotiations that can prevent faster and more meaningful progress on this topic.”

Hidden danger

Since the aim of immunotherapy is to “exaggerate” the immune response against cancer, it can, unfortunately, also elicit unwelcomed inflammatory and autoimmune side effects, so managing these risks will be an important issue as I/O therapies become more widely used,” notes Shields of Xcenda. For instance, among the warnings and precautions stated for EMD Serono/Pfizer I/O therapy Bavencio are such immune-mediated adverse reactions as pneumonitis, hepatitis, colitis, endocrinopathies, nephritis and renal dysfunction. Many of these are associated with other checkpoint inhibitors as well.

“Interestingly and not surprisingly, there is a growing interest among patients who want to know more about the ability to train the body’s immune system to fight the disease, but unfortunately their oncologists are not talking about it with them,” says Crilley of CTCA. In general, patients and other stakeholders may not be fully aware of how immunotherapy works, or be aware of the early- and late-term side effects. Patients, caregivers and providers need to be educated on immunotherapy treatment in order to facilitate patient-provider discussions. Manufacturers can play a leading role in this initiative.

Specifically, according to a study released by CTCA in February, the 2017 Cancer Experience,* “More than two-thirds of cancer patients and their caregivers have limited knowledge of the latest treatments to help inform their treatment decisions; 74% of cancer patients expressed interest in learning more about immunotherapy, yet only 32% say their oncologist has discussed immunotherapy with them,” says Crilley.

"Patients and caregivers frequently don't know what questions to ask, especially after an initial diagnosis, and they typically default to the Internet to obtain additional information," said Maurie Markman, MD, president of medicine and science at CTCA, at the time of the announcement. “Much of this is difficult for them to interpret, however, so an increasingly important part of our responsibility is to help them understand what they have seen or read, and its possible relevance to their treatment options.”

Another I/O modality that is different from checkpoint inhibition is the use of modified T cells (CAR-T)—which thus far has no approved therapies yet, but is eagerly anticipated as regulatory approval of the leading candidate is expected in the near future. “This modality is generating significant interest and excitement from all stakeholders as CAR-Ts have shown activity in relapsed lymphomas, acute lymphoblastic leukemias, and chronic lymphocytic leukemia,” say Nabhan of Cardinal Health. However, he notes that “the toxicity of CAR-Ts can be severe and careful attention to how these adverse events should be managed is essential to assure favorable outcomes to patients.”

Will competition moderate costs?

Worldwide spending on cancer medicines will exceed $150 billion by 2020, up from $107 billion in 2015 according to recent data from IMS. “Cost is clearly the most pressing issue associated with I/O therapies, and stakeholders agree that manufacturers need to demonstrate the value of this modality in a changing reimbursement landscape where cost containment and maximizing efficacy is a paramount concern to payers,” says Nabhan of Cardinal Health.

“The best way to position a new agent among its competitors and maximize payer coverage is to know which patients are most likely to receive response with the agent, and then gearing studies toward that population. This requires good science and thoughtful trial design, and is certainly one of the main challenges facing the I/O community over the next decade,” says Cowey of Texas Oncology. Today, cancer researchers are pursuing both traditional and non-traditional biomarkers, including “tumor neoantigen profiling,” “mutational load analysis,” and identifying certain infiltrating immune cells within tumors, to improve the deployment of checkpoint inhibitors.

“Combining checkpoint inhibitors with older or generic chemotherapy may not drive up costs as dramatically, but once you combine two immune therapies, with a biologic or a newer non-biologic specialty drug—so-called stacking—that’s going to create enormous cost issues,” adds Evans of Genentech.

Clearly the argument can be made that using a combination of therapies in search of the most advantageous synergistic effects to drastically improve outcomes represents money well spent, to get the patient into remission or even cured and back into their productive lives, where they are living longer lives, supporting their families and so on. Many believe that there will always be a tipping point where really effective treatment—or even cures—can help justify huge price tags. But it helps to back up such claims with real-world evidence.

“Consider the use of Yervoy and Opdivo in combination to treat melanoma—the cost can easily run to $200,000. While Bristol-Myers Squibb is offering a discount for patients who use both therapies simultaneously, it’s important to note that the costs aren’t necessarily hitting the patients—they are falling on the backs of the payers and the drug companies, who shoulder much of the high cost,” says Sanchez of Trinity Consultants. That’s why there’s keen interest in making sure only the right patients are getting these costly therapy options, and helping to manage the affordability. “Drug makers do not want to risk headlines of patients abandoning promising therapy options because of the cost, so RWE data (which is always messy due to poor adherence and tolerability issues) must be developed to drive the most appropriate utilization.”

Despite the hurdles, some expect growing competition in I/O to help keep costs down. “We now have a lot of different I/O products being pursued. This is already seeming to bend the cost curve for new drugs developed under the bio umbrella, where we may be seeing a 10% price premium, over traditional therapy options—not a 25% price premium,” says Sanchez. “As multiple I/O drugs are racing to the finish line, the competition should favorably impact the starting costs that were common just a few years ago.”

One promising combination is the use of ADCs (to shrink or “de-bulk” the tumor and prime the immune system) in conjunction with I/O therapies. “When the promise of this combination is realized, then the length and quality of life that patients might achieve should justify that cost,” says Gregory of ImmunoGen.

More than ever, reimbursement is contingent on showing value of a particular therapy where value is broadly defined as outcomes divided by cost. “RWE studies and patient-reported outcomes that can show how efficacy and quality of life are potentially improved for patients when I/O therapies are administered and used under real-world conditions are becoming essential in payers’ determination of favorable coverage,” adds Nabhan of Cardinal Health.

“Due to the high cost of immunotherapies, manufacturers need to proactively engage payers and other stakeholders early on in cost-effective discussions and leverage various value frameworks to communicate a comprehensive value story of these innovative therapies,” says Shields of Xcenda. “Similarly, patients may face exorbitant out-of-pocket costs, so in addition to traditional foundation programs, it will be imperative for pharma companies to establish far-reaching patient-assistance programs (PAPs) that can help to offset those costs.”

Value frameworks

“Oncologists are already overwhelmed. Many of the physicians we contact in research today have difficulty differentiating the drugs or even assigning the right molecule to its appropriate mechanism of action,” says Kaman of ZS Associates. In this context, developers will have to find alternative ways to differentiate beyond just proselytizing their data.”

“Manufacturers have an opportunity to play a strong leadership role,” Kaman adds. “Leading manufacturers must work in partnership with payers, hospitals and physicians to run pragmatic trials and generate real-world evidence that shows where these therapies work the best and where they do not.”

Meanwhile, the visible role of so many competing value frameworks within oncology—such as those developed by the Institute for Clinical and Economic Review (ICER), the National Comprehensive Cancer Network (NCCN), Memorial Sloan Kettering Cancer Center, and the American Society of Clinical Oncology (ASCO) — is also helping to shape the topography within the I/O space. John Doyle, SVP, Real-World Insights, QuintilesIMS (New York, NY) notes that many of today’s value frameworks are more amenable to meeting with drug developers earlier in the process, to have conversations about competing methodologies that may help to demonstrate value. “The conversation goes increasingly beyond just clinical attributes (safety, efficacy, administration) and cost issues—drug developers are thinking about many other aspects of the patient experience, including humanistic elements, and baking them into the clinical-development program earlier in the process,” he [Doyle] notes. “In fact, we’re seeing clinicians, epidemiologists and I/O statisticians on clinical-development programs, all worrying about the parameters that the value frameworks value, and simulating what that will look like as early at Phase II, to maximize the probability of success with FDA and EMA.This is all very new—and I’ve been in the oncology space for more than 20 years.”

When it comes to showcasing an I/O therapy’s full value proposition, Doyle of Quintiles says he finds it fascinating that some pharmacos are actually simulating what the potential “value framework” scores might be for their new I/O therapies much earlier in the process—as early in Phase II. Such efforts can help to shape future clinical development work, to better showcase safety, efficacy and administration in the I/O space, helping drug developers to study things that don’t show up in the clinical trials, such as patient costs, societal costs and non-traditional patient metrics, in parallel, so the companies have all the evidence they need to tell holistic story right from the outset.

“Similarly, there are concerns around the perception that ‘you must try I/Os on patients to see if they truly work’ which usually necessitates a 90-day trial at a substantial cost,” says John Kalada, a senior director at Xcenda. “The case for trying it is made stronger when an approved biomarker is present—then the plans are generally more confident they are getting appropriate value for their investment via a very targeted approach.”

“At present, there are 190 oncology practices and 16 payers participating in the risk-reward-bearing Oncology Care Model (OCM),” says Kalada. “The recent clarification around FDA’s FDAMA-114 statute [which was designed to allow companies to more readily disseminate healthcare economic information (HCEI) to those who need it during formulary development] will create an open environment for greater use and dissemination of this level of real-world evidence that is focused on clinical and financial outcomes.”

Save

Save

Save

Newron, Myung In Pharm Form Partnership Centered Around Treating Schizophrenia in South Korea

January 14th 2025The license agreement will feature an upcoming Phase III trial and—depending on results—the development, manufacturing, and commercialization of evenamide as a potential treatment option.