Staring down supply chain disruption

Amid the need for enhanced visibility across the entire pharma ecosystem, strategies focused on ramping up digitalization are critical for manufacturers to boost agility and resilience in the face of predictable and unforeseen threats

For stakeholders in the biopharmaceutical and life sciences industries, potential sources of supply chain disruption bring many sleepless nights. As today’s supply chains have become more global and interconnected than ever, the likelihood of being hit by the proverbial “fast ball flying out of left field” is more the rule than the exception.

“Despite pervasive volatility, all supply chain issues can be improved with access to better data and data-driven insights,” says Scott Deakins, chief operating officer of Deacom, a manufacturer of enterprise resource planning (ERP) software. “It’s not only about having your own business data at your fingertips (related to managing inventory, manufacturing, accounting, sales, purchasing, customer relations, warehouse operations and more), it’s about investing in the tools and techniques to enable enhanced visibility into timely data from all of your suppliers (and their key suppliers), as well.”

“Historically, supply chains have been supported by large scale warehouse- and transportation-management systems and enterprise resource planning (ERP) systems that largely manage operations and transactions, but naturally, this has led to the emergence of many disjointed silos,” adds Mahesh Veerina, CEO of Cloudleaf, a cloud computing and SaaS company. In addition, the use of automation does not guarantee interconnectivity. Today, roughly a dozen different ERP systems are used by companies across the Fortune 500, according to McKinsey & Company.

“Enterprise systems were never built to use the types of contextual data that are available today from crowdsourcing efforts, insights into real-time accidents and more, so making the realization that such new sources of data could advance the objectives was a real ‘aha moment,’” notes Veerina, adding: “Today, the ability to incorporate affordable sensors and widespread mobile connectivity and cloud computing— can turn inherently ‘dumb’ products (such as packaging and shipping containers) into inherently smart products that can gather and incorporate real-time contextual data and flow it through a digital visibility platform. This enables actionable insights to reach all parties in real time.”

What’s keeping you up at night?

The list of global threats that endanger the pharma drug supply chain by creating pinch points and outright stoppages keeps growing:

- Global pandemic. The fallout from the swift, worldwide spread of the Covid-19 virus has highlighted many critical points of weakness—from unanticipated shipping delays to lockdowns to closed borders and critical labor shortages. Also the logistical and technical challenges of ramping up the cold-chain shipping infrastructure to deliver never-before-seen volumes of the temperature-sensitive Covid vaccine all over the world in a very short period of time (read more here).

- Weather catastrophes. The pace and severity of catastrophic weather events continues to rise due to climate change. When Hurricane Maria—a once-in-a-century storm—hit Puerto Rico in 2017, it damaged more than 80 manufacturing facilities producing pharma active pharmaceutical ingredients (APIs) and finished products and medical devices, and wiped out power to the island for months. This Category 4 weather event touched off a wave of shortages throughout the world. More recently, back-to-back typhoons in Asia caused local and global supply chain disruptions related to APIs and excipients, while blizzard conditions in the Northeastern US in February created delivery interruptions during an intense early phase of the Covid-19 vaccine rollout.

- Production problems and regulatory issues. Quality problems at the Baltimore, MD, manufacturing site of Emergent BioSolutions this spring severely interrupted the availability of Johnson & Johnson’s new Covid-19 vaccine, slowing down the vaccine rollout at a critical time, and impacting patients directly.

- Unplanned logistics disruptions. When the Ever Given, one of the world’s largest cargo ships (1,312 feet long) ran aground and became wedged in Egypt’s Suez Canal, it blocked that busy global waterway for more than a week. According to Lloyd’s List Intelligence1, 372 vessels were stalled, and the ripple effect was literally felt all over the globe.

- Trade wars, tariffs, localized government sanctions, economic volatility and geopolitical strife. The potential fallout of geopolitical events may be more predictable than some other factors but they can also interrupt access to key suppliers in a given region, creating a domino effect that impacts downstream supply chain partners, consumers and patients all over the world.

- Cybersecurity threats, phishing threats and ransomware attacks. The recent ransomware attack on Colonial Pipeline in March caused outages along a major US pipeline system—one that carries 2.5 million barrels per day of gasoline, diesel and jet fuel, including 45% of the East Coast supply. Industry observers agree that most companies are woefully unprepared to safeguard themselves against such risks.

- Transportation and logistics interruptions. Disruptions can arise suddenly in any of the truck, ship or air cargo channels from weather incidents, supply-and-demand imbalance or technology issues (for instance, when shipping temperature-sensitive biologics, vaccines or cell and gene therapies), creating shortages of raw materials and finished pharma products.

- Manufacturer consolidation, labor shortages and strikes. Organizations everywhere are vulnerable when their suppliers experience such labor-related issues, which can halt production of both raw materials and finished products.

“Looking back on the past year, I think we can all reflect on the lessons learned and realize there is no easy fix here,” says Chris Alverson, senior vice president, supply chain management for McKesson US pharmaceutical. “Pharmaceutical manufacturers and distributors are coming to terms with the magnitude and severity of supply disruptions and constraints. No single supply chain management strategy solves this issue—you need to be considering them all.”

Today, there is growing consensus that greater reliance on a more robust digital infrastructure—which is possible thanks to the more pervasive use of relatively inexpensive sensors for improved connectivity up and down the supply chain—is essential, as a hedge against supply chain disruptions. Increased visibility across supply chain channels can provide swift, actionable insights that can help stakeholders to both pivot proactively in the face of an impending issue, and to react more quickly when interruptions do occur.

Last year, Fortune magazine reported that 94% of the Fortune 1000 had experienced supply chain disruptions related specifically to Covid-19, and 75% reported negative or strongly negative impacts to their business.

“These numbers are certainly a testament to the scale of the pandemic, but they are also evidence that the power of technology to transform supply chain relationships and partnerships wasn’t being truly maximized,” says Anne Marie O’Halloran, managing director, global supply chain/IX.0 life sciences for Accenture.

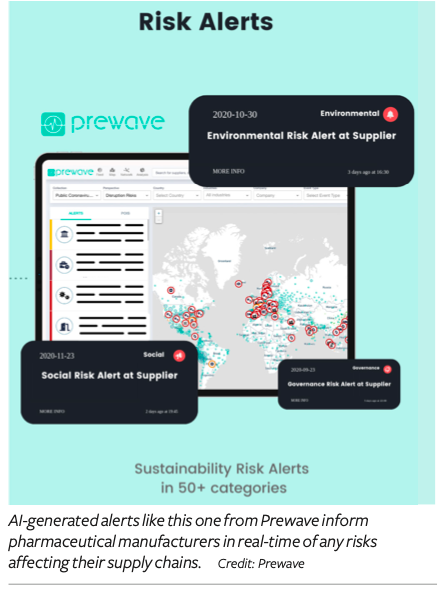

“Increased visibility along the supply chain is centered around two key questions: Who are my suppliers at each tier, and what is happening right now at each of those suppliers?” says Harald Nitschinger, co-founder of Prewave, who notes that supply chain mapping solutions can help by uncovering potential issues that are impacting each of the partners throughout the supply chain.

Creating greater visibility

Ideally, organizations need access to a unified view of demand and should use real-time mapping across the entire supply chain—looking beyond just tier 1, 2 and 3 suppliers to their partners, as well.

“The ability to automate the use of data and analytics to support smarter planning and execution and aggregating this functionality onto a digital platform built on a cloud-based infrastructure that is overlayed with analytics and artificial intelligence (AI) capabilities gives companies better ability to support real-time decision-making,” says O’Halloran of Accenture.

In general, considerable focus in healthcare and pharma has been on making sure all of the purpose-built, internal systems are working—for instance, systems used to manage purchasing, manufacturing, warehouse inventory, shipping, customer service and more. “But given the many silos that typically exist, and the variability of the data coming from internal systems, logistics providers, supply chain partners and contract research organizations (CROs)—with each supplying the data in a different format—it can be extremely challenging to combine them all in a meaningful way,” says Anshul Agarwal, partner, ZS Associates. “While such systems give organizations good visibility into specific parts of the overall operation, the ability to achieve truly seamless end-to-end visibility, from multiple upstream suppliers all the way through to end customers, has remained elusive,” he adds.

More recently, there has been growing interest in investing in an overarching digital strategy that incorporates a so-called “unified data layer.”

“By creating knowledge graphs and ontologies that are supported by natural language processing (NLP) capabilities, companies can automate and streamline the onboarding of external data and conform that external data across various suppliers into a unified data model that can then help to reduce the time-consuming and costly manual intervention that is often required to onboard new data sets from external suppliers,” says Agarwal.

This approach is also being used to help streamline the process for bringing new suppliers on board more—a strategy that can provide another hedge against supply chain disruptions, notes Agarwal. The onboarding process for a new supplier typically takes four to six months. From an administrative standpoint, some leading pharma clients are working to automate time-consuming parts of the process—for instance, by using advanced cloud computing and NLP, he says. This is helping manufacturers to shorten the time required to enable digital data exchange with external suppliers by 30%-40%, which can give them greater flexibility while reducing risk.

Manufacturing sites up and down the pharma/life sciences supply chain already collect a lot of data and notes related to bad lots or a particular process going out of specification. However, such details—which could be the bellwether of a pending supply chain disruption—are often lost in “unstructured” data sets. “Efforts to build in data-driven scenario modeling—for instance, NLP algorithms, can be used to ‘read’ unstructured data and extract relevant information, and using machine learning (ML) techniques can help to reveal important patterns and trends, allowing different issues to be assessed quickly and potentially forecast occurrences of these issues,” Agarwal continues.

The ultimate goal is to be able to the model and prioritize different scenarios, improve predictions and be able to quickly assess the potential impact on delivery timetables, product availability, pricing changes, etc. Deacom works with its customers to run so-called pricing fire drills, so they can better understand the impact of sudden price fluctuations in critical raw materials and other key components, develop “what-if” scenarios, and set up workaround solutions that could be deployed quickly to avoid a crisis and reduce the overall margin impact. “You won’t know the impact of such pricing fluctuations, or be able minimize the damage, if you are only looking at the financials 30 days later,” says Deakins.

“The persistent lack of connectivity throughout the pharma supply chain creates significant opportunities for improvement, by investing in the right analytics and the right technologies,” says Alverson of McKesson. During the initial months of the pandemic, McKesson formed a Critical Care Drug Task Force, which kept close watch on trending treatments for Covid-19 and hot spots across the US.

Prewave uses an AI-based approach to monitor publicly available information (such as published news and social media posts) associated with thousands of companies all over the world, and is able to report in real time specific risks, such as labor strikes and environmental and sustainability issues that can create pinch points or stoppages in the supply chain. “The use of AI enables us to stay on top of large quantities of suppliers and be able to infer meaning to the large amounts of data we are gathering in real time,” explains Nitschinger. Several of the major players in the automotive industry, including Audi, Porsche and Volkswagen are early adopters of the Prewave AI technology, and the approach is applicable to the pharma/life sciences industry as well. Prewave was recently able to generate a sustainability risk alert for one of the large steel furnaces nearly one year in advance, based on social media chatter and related data points. A year later, the furnace was ordered to halt operation due to sustainability issues.

“This type of information is invaluable to help automakers search for suppliers and plan ahead, giving an organization a competitive advantage by helping it to avoid a predictable supply chain disruption,” says Julian Meinke, head of marketing for Prewave. “Strategic contractual agreements form the backbone of most successful supply chain relationships, but at the end of the day, issues often arise that only real-time monitoring can uncover quickly.”

The value of enhanced digital connectivity

Increased use of best-in-class technology options, such as extensive use of internet of things (IoT) sensors and cloud computing capabilities, is a means to an end. When such sensors are used inside temperature-controlled shipping containers, for instance, they provide critical insights into not only the exact location but the condition of every single container; such real-time data lets pharma customers know a delay or problem has arisen before the impact becomes catastrophic, notes Tom Weir, chief operating officer of CSafe Global, a specialty packaging and logistics company.

Specifically, CSafe Global’s sensors are able to provide location and time stamps, but also data related to ambient temperature and humidity inside and outside the temperature-controlled shipping container, tilt and vibration experiences and the number and duration of “open-door events” that could threaten the threshold temperatures inside the cold-chain cargo container so that an effective intervention can be made.

“Enhanced visibility allows all stakeholders to know what’s going on with every single shipment and whether the extremely narrow temperature specifications that are increasingly required for many temperature-sensitive pharma products (e.g., vaccines, biologics, cell and gene therapies) may be at risk without timely human intervention,” continues Weir.

CSafe Global has been working in close partnership with Cloudleaf to enhance the overall visibility of every single high-stakes, temperature-controlled pharma shipment. With their combined capabilities, the companies create modeled scenarios that allow for idealized planning of shipping routes and more rapid response when issues arise. “By enabling better decision-making, the opportunities are enormous,” says Weir.

“Most of the risks to the supply chain are known and can be modeled using predictive analysis, which relies heavily on regression analysis and actuarial probability modeling,” adds Alex Jung, principal, EY-Parthenon, Ernst & Young LLP (EY). “We encourage organizations to contact their insurance companies for support, as the insurance underwriters frequently model these types of risks.”

Accenture and MIT recently collaborated to co-develop a supply chain resilience “stress test”2 that helps organizations to assess and prioritize operational and financial risks created by potential market disruptions, disasters or other catastrophic events and then use the data to define appropriate mitigation strategies and actions.

Accenture’s O’Halloran suggests that modeling and simulation become an integral part of standard pharma supply chain operations. Toward that end, in recent years there has been growing interest in the development of a so-called “digital twin”—which is essentially a detailed digital model of an actual production facility, along with its entire upstream and downstream supply chain network. This virtual model then receives real-time information from all of the suppliers and logistics partners, production facilities, warehouses, downstream distribution systems, hospitals and pharmacies that are interconnected within that particular pharma ecosystem.

“Once a digital twin has been set up, you can model the complex interrelationships among all supply chain partners —informed by constant real-time data—and run “what-if” scenarios that enable rapid anomaly detection gap analysis to reveal vulnerabilities, and carry out informed contingency planning to minimize unplanned downtime,” says Veerina of Cloudleaf. “While such efforts are still nascent, early work is very promising and this is likely to be a big trend in the years to come.”

Research from Accenture’s Technology Vision 2021 report3 shows that 87% of executives agree that digital twins are becoming essential to their organization’s ability to collaborate in strategic ecosystem partnerships.

Supply chains: How lean is too lean?

There has always been a natural tension between these two prevailing philosophies: Pare down your supply chain to be lean and mean, in terms of driving out surpluses and inefficiencies); versus build up redundancy, in terms of the number of suppliers and the amount of inventory, both raw materials and finished products, that is stockpiled to enable a quick response to supply chain disruptions. History has shown that the pendulum tends to swing back and forth every few years, as one approach or the other is favored.

“Without a doubt, as more companies look to build in safety and redundancy by partnering with additional suppliers in multiple regions—to spread out the risk and reduce the likelihood of a crippling incident related to any given region—the overall complexity is only growing in size and scope, says CSafe’s Weir. When it comes to the logistics associated with delivering temperature-controlled products such as vaccines, biologics and cell and gene therapies in a timely fashion, there’s no room for error. “It used to be that you could predict the exact shipping route from A to B down to the day, but that is not true at the moment, so the need additional options in order to be able to pivot quickly is essential,” contends Weir.

“Recent experience has shown that building in some redundancy to enable greater resilience to supply chain shocks is more important than trying to remain lean at any cost,” adds Veerina.

However, others disagree. “We believe that today, there are more cons than pros to stockpiling excess or redundant inventory, especially given that these are sensitive products that may be subject to expiration or contamination,” says EY’s Jung. “Effective contracting is also a huge element of this, and it does not necessarily require large cash or capital investments or even advanced AI capabilities—but rather clear communications and a well-designed model that leverages existing partner infrastructure and creates clear expectations around responsibility.”

For added risk reduction, Jung notes that supply chain partners should also explore opportunities to make nominal investments that create collaborative solutions that can be used by both sides—for example, by developing shared space, transportation or labor pools.

“Smart procurement procedures—whereby multiple manufactures in different geographical regions are awarded supply contracts—offer a clear way to build in redundancy, yet this is not always possible through economic, legal and scarcity reasons,” adds Per Troein, vice president of strategic partnerships at IQVIA. “Today, the ability to use predictive algorithms to map out and monitor upstream suppliers is becoming easier and more sophisticated, and this allows manufacturers to identify disruptions more quickly and react to them more effectively, while reducing their reliance on holding surplus inventory.”

Similarly, CSafe’s Weir advocates treating suppliers as partners, and working to develop a long-term relationship with them. “Creating just a transactional strategy, whereby you change suppliers every time there’s an opportunity to save a few pennies is a poor long-term strategy,” he believes. Instead, companies should establish clear evaluation criteria and maintain a supplier scorecard that comes from the top leadership team, Weir contends.

Ultimately for the manufacturer, effective contracts that are designed to safeguard against supply chain risks will provide a competitive advantage, executives believe. “Whether it’s new warehousing facilities or evaluating working capital on hand, manufacturers should seek out partners that are willing to give them the data and flexibility they need to make strategic decisions,” says Alverson of McKesson.

“It is important to seek greater visibility into your supplier’s subcontractors, but it is difficult to demand disclosures related to a relationship you don’t own,” adds Jung. According to recent Accenture research4, 60% of supply chain executive in the pharma/biopharma/medical device space struggle to get real-time inventory and visibility from external manufacturing partners. Spot auditing can help to identify and remediate issues early, and in addition to spelling out the requirements of every player in the contract, governance standards should be established as well, Jung says.

Cybersecurity breaches and ransomware threats

“Pharmaceutical companies rely on complex networks of interconnected partners and routinely work with critical third-party partners such as [CROs] and contract manufacturing organizations (CMOs),” says Cesar Villalta, global life sciences security lead for Accenture. “As such, the entire industry is on heightened alert for cybersecurity threats from cybercriminals and foreign adversaries looking to disrupt the health ecosystem or steal intellectual property.”

In 2019, more than 300 cybersecurity incidents impacted supply chain entities, according to a recent study by Resilience3605, a supply chain risk management firm (it recently rebraded with Riskpulse as Everstream Analytics). Companies in the pharmaceuticals, chemicals, technology and automotive sectors were targeted by ransomware and data breaches from cybersecurity attacks, phishing efforts and malware, according to Check Point Research.6

Weir adds a cautionary note: “While the broader use of sensors and cameras to provide real-time data is certainly helping to enhance supply chain visibility, stakeholders must also appreciate that some of these connected devices will also provide another entry point to infiltrate an organization, so you really must engage companies with specialized expertise to maximize the opportunities without creating additional problems.”

The efforts and investments made to detect and respond to threats across the entire supply chain must have the ability to scale appropriately, depending on the complexity of the threat, says Villalta. To evaluate their cyber resiliency across the value chain, he suggests that organizations should consider carrying out proactive cybersecurity-threat simulations to pressure test the cybersecurity controls and the existing response measures of their supply chain partners.

References

2. https://www.technologyreview.com/2020/11/24/1012450/building-resilient-supply-chains/

3. https://www.accenture.com/us-en/insights/technology/technology-trends-2021#block-mirrored-world

6. https://www.ntsc.org/assets/pdfs/cyber-security-report-2020.pdf