Biopharma dealmaking will set new records this year, says Syneos Health

New science breakthroughs, and easy access to financing, propel this year’s M&A and licensing market

At this year’s BIO Convention, Syneos Health Consulting unveiled its annual Dealmakers’ Intentions Study, a forward-looking survey of industry expectations for the full year. While 2018 set a host of new records, it appears as if 2019 will continue to be a wide-open, anything-goes environment. IPOs and deal volume are expected to decline somewhat, but deal size (venture funding, acquisition, in-licensing and debt financing) is likely to be larger than last year’s. One of the conclusions of the study authors is that “One side effect of this healthy dealmaking environment may be the degree which the teams reviewing deals are being stretched; buyers wish their teams had greater bandwidth for getting more done.”

The Syneos study does something noteworthy—it looks at last year’s expectations as compared to the actual performance. Buyer’s expectations of deal types were actually exceeded by actual results for marketed and Phase III undertakings; and both buyers’ and sellers’ expectations were exceeded in the number of deals based on NDAs.

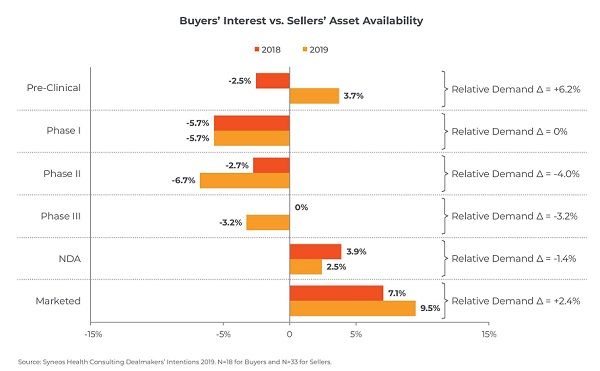

Fig. 1. In 2019, buyers' interests are highest in preclinical, and marketed products. credit: Syneos Health

Another interesting comparison of 2018 and 2019 is that buyer’s interest in marketed products is higher than the asset availability; this is also true for pre-clinical products, a reversal of the 2018 sentiment. Phase I and II and III are generally lower demand (see Fig. 1).

In terms of product type, oncology, and immune-oncology in particular, remain the highest-demand products—but the availability of such products is the highest of any therapeutic category, indicating a likely competition for deal completions. By technology type, the areas of hottest interest are immune-oncology, CRISPR/Cas9 and CAR-T; note (in Fig. 2) the low interest in biosimilars. Orphan drugs, studied for the first time in this report, are of interest to 77% of dealmakers, with 16% of buyers labeling them “an integral cornerstone” of their strategy.

The Syneos authors conclude that “The year is shaping up to be one of the strongest for dealmaking in the last decade, with buyers optimistic that there will be an acceleration in dealmaking across all deal types.”