Sustained growth in specialty medications continues to create ongoing hope for patients and the potential for strong return on investment (ROI) for drug developers. But launching these highly specialized therapies—which are used to help patients manage chronic, sometimes debilitating or life-threatening diseases and genetic conditions—is no easy task; it requires doing all that is necessary to remove barriers to access and points of friction that threaten drug access, affordability and adherence.

Today, specialty medications are used to treat chronic conditions, such as rheumatoid arthritis, multiple sclerosis, Crohn’s disease, many forms of cancer and more, and they share a number of defining characteristics. These premium-priced therapies—whose costs can run into the thousands or even millions of dollars per patient over a lifetime—typically have complex self-administration or titration-based dosing requirements, significant potential safety issues, and exacting logistics requirements to safeguard temperature-sensitive therapies that must be maintained at refrigerated or cryogenic temperatures from the point of manufacturing right to the point when the patient takes possession of their medications (see related story here).

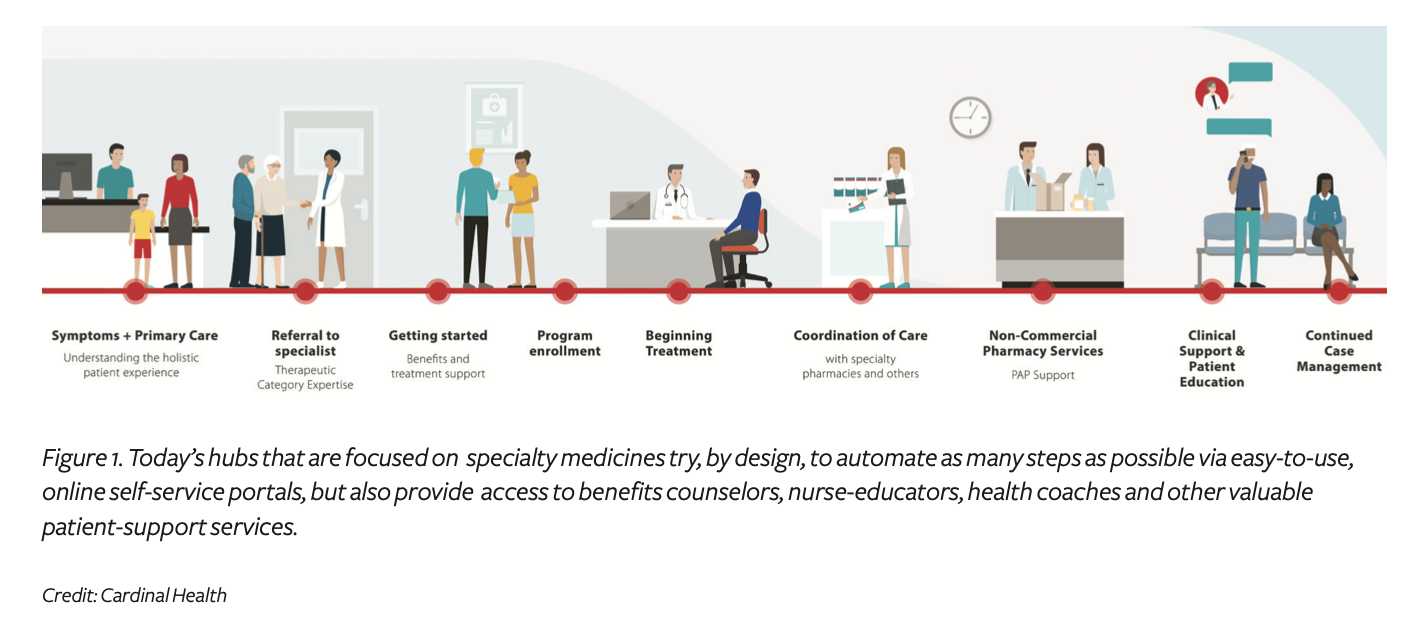

To give these lifesaving specialty medications a fighting chance in the marketplace, biopharmaceutical manufacturers routinely enlist one or more supply chain partners to develop and administer a tailored mix of wraparound services, which are collectively referred to as the product’s hub-services program. The explicit objective of any hub program is to reduce or eliminate barriers and provide easy access to all of the product and disease-specific services that will help the patient to get on—and stay on—therapy.

A well-designed hub program “provides a natural extension for pharmaceutical/life sciences manufacturers and their supply chain partners to demonstrate their value, and the most successful hub programs remain engaged throughout the patient journey and continue to evolve over time using data-driven insights,” says Tommy Bramley, PhD, president of Lash Group, a patient-support services company that is a part of AmerisourceBergen.

Failure to design an effective hub program to centralize and integrate all of the product-specific supports and interventions that can help patients and their physicians to overcome these barriers can thwart the therapy’s commercial success (at launch and over time) and undermine both clinical outcomes and brand reputation.

“Hub providers must build a quantified evidence base that can demonstrate that those services have a meaningful impact on outcomes for specific disease states and demonstrate to manufacturers that patients who engage with those services fare better consistently,” says Lili Ferguson-LaChance, an Accenture life sciences strategy executive. “Demonstration of relatively modest impact could translate to a point or two of rebate recapture for a manufacturer—a significant profitability gain, especially for common disease states with large populations on therapy.”

“Excellent hub programs can cast a halo on the entire brand and amplify a provider’s willingness to prescribe the therapy,” adds Tom Dmochowski, vice president and general manager, pharma and life sciences, Conduent, a business process services company based in New Jersey.

Bulldozing barriers for patients and physicians

Underpinning the entire hub concept is the fact that today’s specialty medications have put more and more responsibility directly into the hands of the patients—no matter where they may be on the health-literacy spectrum. Such patients must now:

- Master complex, self-administration routines (i.e., the self-administration of injectible or infused biologic therapies, or precise titration-based dosing regimens that are required for today’s growing number of oral oncology agents).

- Monitor and manage side-effects from home.

- Take ownership of potential safety or toxicity issues that could become life-threatening or undermine adherence.

- Advocate for themselves to navigate complex coverage and affordability issues that could hinder access in the first place, and undermine adherence over the long run.

That’s a tall order for most patients.

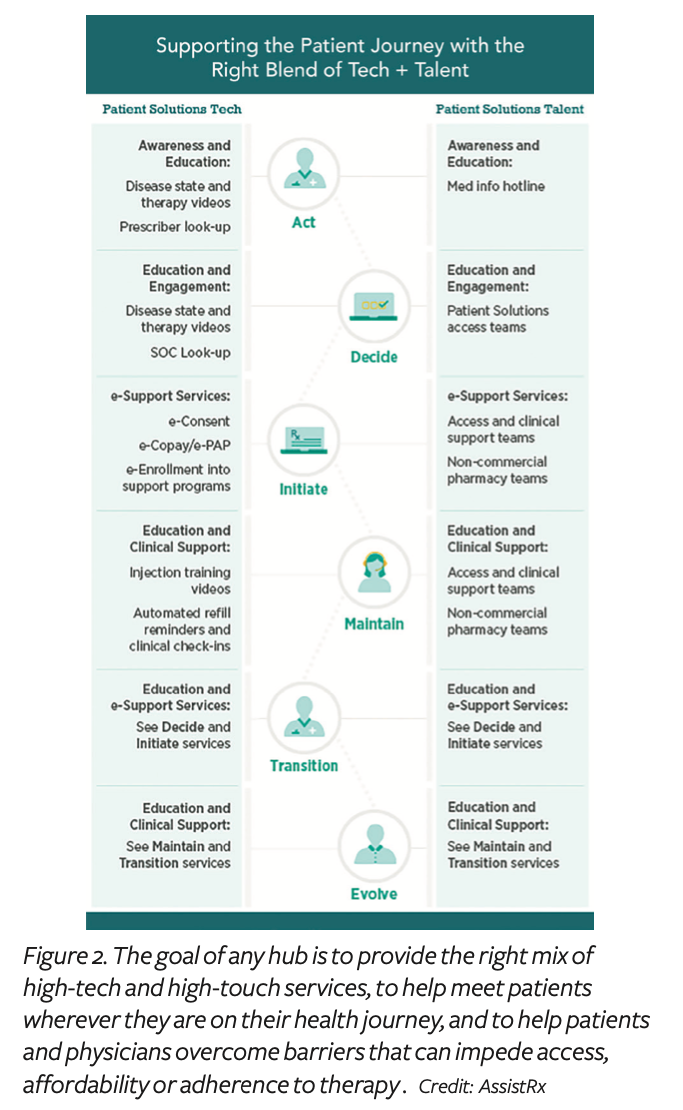

As a general rule of thumb, a hub-services program should strive to put the needs and preferences of the patient and physician first. “Drug manufacturers must integrate the right balance of technology-based and talent-enabled support services that improve patients’ treatment outcomes,” says Jan Nielsen, division president, AssistRx Patient Solutions. For example, she notes that a program may need to involve more high-touch human support at launch, but then transition to increased use of high-tech, self-service program components as the product gets onto more payers’ formularies and the program matures (see Figure 2).

To speed time to therapy and deliver a quality brand experience, “a well-designed hub must not only support the overall patient experience but connect and support prescribers, payers, pharmacies (retail and specialty) and manufacturers in a way that provides real-time visibility into insurance benefits, patient-support programs, timing of delivery/pick-up and associated costs to patients,” adds Maria Kirsch, SVP and head, patient services, Eversana.

Importantly, hub vendors must provide both nurturing soft skills and a solid technology backbone. “The best hubs are those that can provide near flawless program design and execution while thoughtfully embedding the solutions deeply and seamlessly within the workflow of the physicians and within the health-journey flow of the patient,” says Dmochowski.

Similarly, the best hub partners are those that are able to provide guidance in terms of regulatory, competitive and technology over the lifecycle of the brand. Toward that end, “a good hub provider should be monitoring federal and state sample-in-name requirements and advising on alternative models or forecasting funding in the copay assistance program escrow account to ensure adequate funding throughout the year,” notes Nielsen.

The four horsemen of a great hub

When it comes to structuring hub programs that will make sure patients can get started on therapy and stay on therapy—and eliminate barriers along the way—the various program elements are typically organized along four pillars (each is discussed ahead):

- Access

- Affordability

- Adherence

- Analytics

Access. As specialty medications are among the most expensive prescribed therapies, health plans have understandably created mechanisms to ensure that only the most appropriate patients can access them. However, delays often result when physicians are not able to successfully navigate prior authorization (PA), step therapy and other administrative requirements imposed by the patient’s health plan.

Hubs play an essential role by providing a range of tailored programs to support reimbursement, including electronic tools for rapid benefits verification and streamlined processing of PA requirements.

“Generally, hubs are acting as the agent for the pharma brand team, so we inform and educate doctors on payer-specific PA processes, and then provide easy-to-use tools that are visible through the hub and present the necessary questions to the clinical, in electronic form, right in the physician’s workflow,” says William Dupere, practice lead and VP, market access solutions, for TrialCard.

A key access challenge in this area is keeping any temperature-sensitive specialty therapy within its required temperature range (refrigerated, frozen or deep-frozen).

Today’s hub programs routinely embed highly engineered processes and tracking systems to ensure reliable temperature-controlled delivery and precise chain-of-custody of the drug—from the manufacturing site right to the patient’s door, with high-visibility tracking along the way.

Meanwhile, adding another potential access challenge, many of today’s specialty medications are part of the personalized-medicine revolution, and thus require that the patient undergoes genetic testing to verify the presence or absence of one or more targeted biomarkers or genetic mutations (as required by the original label indication) prior to prescribing. “Today, a growing number of specialty medication hubs are including program elements that help physicians and patients to manage genetic-testing requirements associated with the targeted therapy and speed time to therapy,” says Heather Morel, SVP/GM, access and adherence, RxCrossroads by McKesson.

Affordability. For many patients, affordability gaps are literally where the rubber meets the road in terms of getting on and staying on therapy. As such, a core function of any hub program is “to help insured patients to understand what is required to gain access to costly specialty therapies via their insurance plan, and to help uninsured or underinsured patients gain access to the therapy in other ways, to reduce out-of-pocket expenses by accessing other sources of funding via manufacture-sponsored copay-assistance programs, or free medications via patient assistance program (PAP) or charitable foundations,” explains Morel.

Self-service capabilities provided through the hub help patients to screen for and enroll in a manufacturer-sponsored copay-assistance programs in real time. This also gives prescribers confidence that their patients will be able to access the therapy they are prescribing.

“Improved price transparency at the point of prescribing—and providing immediate screening and enrollment into available patient-support programs—can not only speed time to therapy but help to differentiate brands in a crowded market,” says Nielsen.

Working to familiarize physicians with any product hub is critical to removing access and affordability barriers for patients.

“Today we have an engaged an active network of over 700,000 healthcare workers working with our CoverMyMeds offering—through efficient processes that are right in their workflow,” says Morel. “This is important because most patients won’t even have an opportunity to be part of a financial-support program unless they hear about it from their doctor.”

The impact of financial and health disparities has been a long-running challenge for all stakeholders across the US and elsewhere, and it has come into sharper focus once the Covid-19 pandemic descended.

“Last year, we saw people with chronic conditions like diabetes and obesity—especially within communities of color—hit hard by the Covid-19 pandemic,” says Doug Langa, executive vice president, North America operations, and president of Novo Nordisk Inc. “It’s vital that we continually identify and reduce the barriers that may contribute to people not getting the care they need.”

“In early 2020—after the pandemic hit—we implemented a PAP that was specifically designed to help people who had lost their health insurance or had their insurance changed because of Covid-19. The program has helped these individuals to get free insulin for 90 days,” he continues.

Novo Nordisk’s product hub sends out not only reminder texts, but motivational messaging and educational materials for patients and healthcare providers to support diabetes management and drug adherence. It also offers complimentary access to live Certified Diabetes Educators, either via phone or virtual chat for anyone taking a Novo Nordisk diabetes medicine.

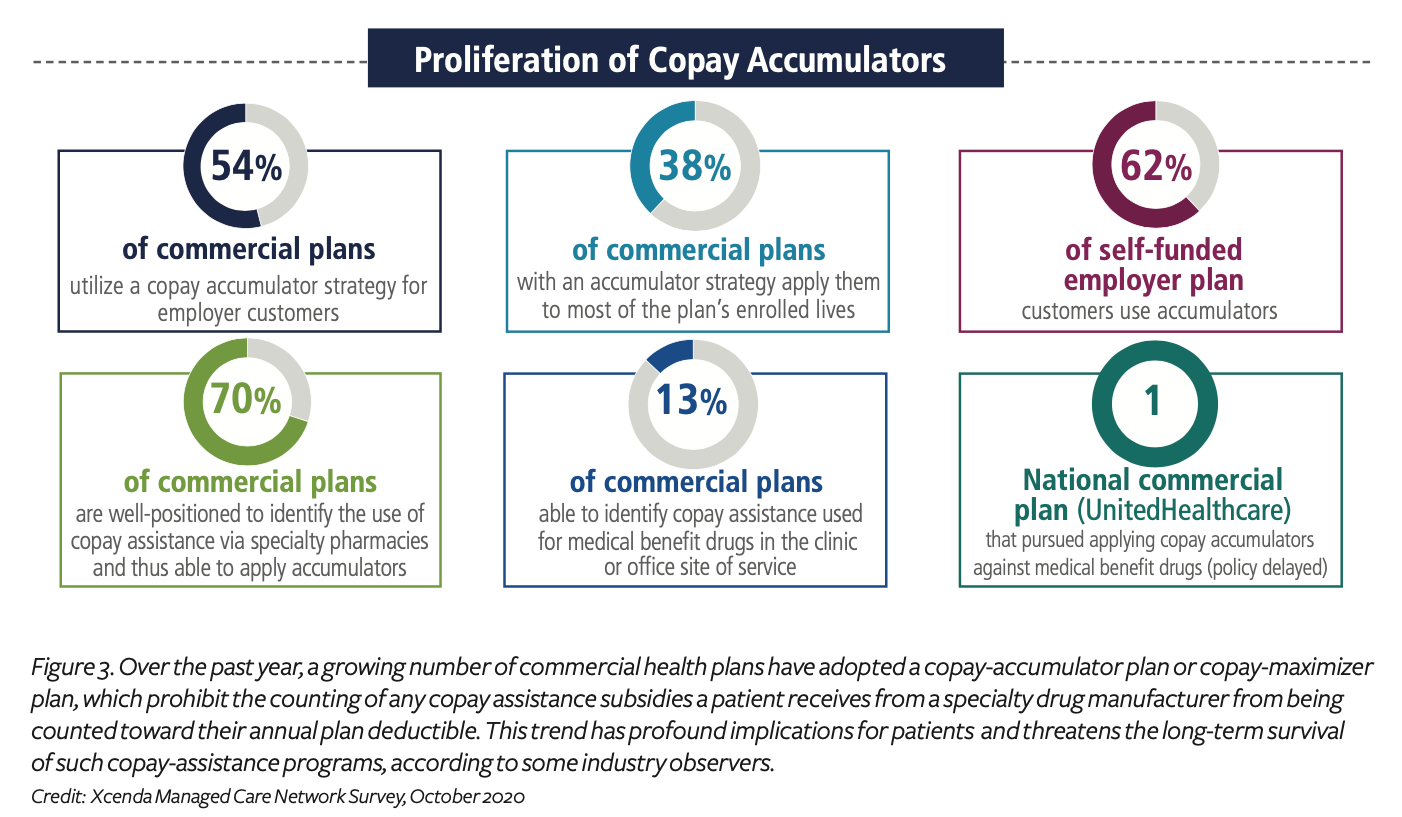

Meanwhile, under the affordability umbrella, the subject of copay-assistance and copay-maximizer programs (described ahead) has been causing considerable storm clouds to gather. Over the past few years, such programs have been increasingly put in place by commercial health plans and pharmacy benefit managers (see Figure 3), and the trend is creating concern among all stakeholders, as such programs produce a critical affordability barrier for a growing number of patients.

By design, such cost-shifting programs prohibit the counting of any financial subsidies a patient receives from a manufacturer-sponsored, copay-assistance program from being counted toward the patient’s annual out-of-pocket (OOP) health plan deductible. This creates direct impact for both patients and drugmakers:

- Patients are more likely to end up shouldering their entire plan deductible with OOP expenses, rather than satisfying their deductible earlier in the year and having the plan pay for their medications after that.

- Drug manufacturers may end up having to provide the copay-assistance subsidy to a given patient for an entire year—whereas, in the absence of a copay-accumulator or copay-maximizer program, the copay assistance would typically be paid for just a portion of the year, until the patient’s deductible has been met, and then the cost burden would shift back to the insurance plan.

“A year ago, the existence of copay-accumulator and copay-maximizer programs was just a patchwork; a year later, this is definitely a trend that’s picking up steam,” says TrialCard’s Dupere. “These programs effectively rob qualified and eligible patients of benefits, creating affordability gaps that greatly undermine the patient’s access to therapy and their ability to remain adherent over time.”

“This ongoing tug-of-war around cost-shifting is creating big implications in healthcare,” adds Jason Zemcik, senior director of product management for TrialCard, who notes that “in 2020, among the drug franchises we support, nearly 12% of patients were already impacted by copay-accumulator or copay-maximizer programs (up from 8% in 2019).”

Such cost-shifting is also greatly undermining the future of copay-assistance programs, as any given specialty medication brand ultimately, in most cases, has a finite budget for patient assistance. “Because accumulator-impacted patients will continue to require assistance throughout the entire year—as opposed to simply receiving copay assistance to satisfy their deductible early in the year—many pharmaceutical manufacturers’ costs to operate these programs have increased significantly,” adds Zemcik. “This is causing many to evaluate the long-term viability of such programs, which puts patients who rely on them to afford costly therapies at risk.”

In a recent study conducted by Xcenda, a strategic global consultancy and part of AmerisourceBergen, of the commercial payers in its managed care network, the company found that the percentage of plans that were already using copay accumulator or copay maximizer plans (or both) had grown from 39% in 2018 to 60% in 2020 are currently restricting the use of manufacturer copay-offset plans, according to Corey Ford, director, reimbursement and policy insights for Xcenda.

A customized pharmacy option

Most people in the healthcare industry are familiar with the standard models of pharmacy services. They include retail, mail order, specialty and specialty lite, to name a few. Each of these models serves an important purpose in providing much needed therapy to patients. But each of them follows a relatively standard set of processes specific to their intended service.

Most retail pharmacies focus largely on more common, less costly drugs that treat routine day to day afflictions. With a mix of Rx and OTC therapies, they are designed to serve a very broad audience and require a very high volume of overall sales to achieve their desired ROI. Typical mail-order pharmacies are similar in nature having the same volume-based strategy and relatively low touch attributes. Both models depend on high-volume, quick-turn dispensing.

Specialty pharmacies are the antithesis of retail or mail order. They specialize in dispensing therapies with a much higher wholesale acquisition cost (WAC) and, typically, a smaller patient population. These therapies require a very high-touch, often intensive, clinical care model. Specialty pharmacies also expend considerable effort helping their patients overcome financial access barriers due to the much higher cost of the drugs they manage. All these factors contribute to a higher operating cost suitable only for higher-cost therapies.

The specialty lite model is a relative newcomer to the pharmacy space having become more popular during the last decade as technology evolved that could automate some of the more common tasks within specialty pharmacy, largely around patient access and adherence. In general, the result was a specialty-like model that could accommodate products with a lower WAC. But at its core, the basic process is still very much the same as specialty.

Today, in a growing number of cases, a brand needs a solution that addresses challenges across multiple traditional pharmacy models. In some cases, these new challenges were never even considered in the traditional models and require new, more innovative solutions to address them. This is where a new breed of specialized pharmacy service comes into play called “custom pharmacy solutions.” This model leverages robust infrastructure, broad talent and technology prowess to combine features and functions of many pharmacy models with new process and technology that is outside the box of traditional pharmacy.

Recognizing this shifting landscape, independent specialty pharmacies such as KnippeRx are seeking to combine existing high-touch, high-tech, patient-centric pharmacy services with high capacity infrastructures, expanded talent pools and enhanced technology tool kits. Scalability is key. The goal is to provide brands the ability to leverage the infrastructure of a nationwide distributor with multiple locations, automation and talent and technology assets, to develop solutions that are tailor made to address each brand’s unique needs.

Customized-oriented pharmacy support can potentially serve the commercial and non-commercial efforts of small, medium and large pharma. Those can include single-brand launch initiatives, support for multi-brand solutions for mature products, and even direct-to-patient cash approaches for brands that have lost exclusivity or those that are better served outside the retail model.

Helping to drive this trend at the policy level, in 2020, the Centers for Medicare & Medicaid Services (CMS) finalized a new rule in 2020 that allows commercial plans to employ copay accumulators within the commercial market—even for brands that do not have a medically appropriate generic alternative. “Several states have tried to fight back, by enacting legislation that outright prohibits copay-accumulator programs or limits their use in commercial plans, but many large employer-based health plans are exempt from such state plans,” explains Ford. “With a growing number of large health plans pursuing accumulator models targeting medical benefit products, manufacturers offering copay assistance will need to work closely with their hub designer to incorporate accumulator-mitigation strategies into their program design.”

In light of this trend, many stakeholders worry that drug manufacturers may ultimately move away from offering direct copay assistance to patients. Without such financial scaffolding from manufacturer copay-offset subsidies, impacted patients would then be more likely to abandon their prescribed drug regimens.

Adherence. Throughout the entire healthcare arena, poor adherence is one of the biggest factors to blame for reduced clinical outcomes and diminished brand success. “Through every hub, we try to match up different touch points in way patients will best respond to them” says Myra Reinhardt, vice president of production innovation and analytics, Lash Group “You want to automate as many of the program offerings as you can, but you also need the right type of in-person support (from pharmacists, nurses, coaches and more), using empathy and problem-solving skill sets that can never be addressed with automation.”

Today, the digital capabilities are available to push training videos and tutorials related to self-injection and side effects right into the patient’s digital device, making it easier than ever for them to access the information, notes Bramley.

The more steps a patient has to take to get what they need from the drug manufacturer or their insurance plan, the less likely they will be to be adherent. “A common mistake among brand teams is to take on the time and cost to craft patient-facing applications that are not easily integrated into the patient’s day-to-day lifestyle,” says Assist Rx’s Nielsen.

Meanwhile, the national conversation continues to grow around the impact that the broader social determinants of health (SDOH) have on medication adherence and clinical outcomes. As a result, hub designers continue to work with their biopharma clients to design HIPAA-compliant interventions that can help patients to address SDOH factors—such as transportation and housing issues, health literacy, food insecurity and more.

“Our nurse navigators conduct onboarding assessments and welcome calls so they can get to know patients on a personal level and can identify what challenges they may be facing at the onset of the program,” says Jason Monteiro, director, access and patient support, Cardinal Health Sonexus Access and Patient Support. The use of natural language processing (NLP) technology also plays a key role in identifying barriers throughout the patient journey and can help nurse navigators to make sure they’re understanding a patient’s situation holistically, he adds.

Having complete data and robust analytics capabilities can also help the hub to develop more-tailored patient-support programs and interventions to address certain SDOH. “For example, if you understand that cancer patients in a rural area have longer commutes to get care and have limited access to transportation, help finding a transportation service and getting it paid for could really help this population get access to care and improve adherence to treatment and overall health outcomes,” says Jennifer Spada, an Accenture Life Sciences strategy partner.

While many biopharmaceutical brand teams may want to address all specific SDOH, “there are real limits on services that can be provided based on health laws,” cautions Morel of RxCrossroads by McKesson. However, she notes that the landscape continues to evolve. For instance, the US Office of Inspector General (OIG) recently wrote an opinion that stated that one specific company’s program can furnish travel and hotel/meal expenses to patients, and in the specifics of that program and clinical context, it is compliant and lawful. “Generally, assisting patients with these complex logistics in an effort to help improve adherence would have been out of the question,” she notes.

Analytics. Typical metrics that are tracked through a product hub include (but are not limited to) the number of calls handled, average speed to therapy, time to refill, duration on therapy, turnaround time for benefits verification and PA reconciliation, prescription-abandonment rates, patient health-literacy scores, use of manufacturer copay-assistance programs, number of preventable hospitalizations and emergency room visits and more. Gathering data on the most relevant key performance indicators (KPIs) can also help stakeholders to identify bottlenecks, inform continuous improvement and drive process efficiency.

“We have implemented platforms to enable electronic benefits verification (eBV) and electronic prior authorization (ePA), and these allow us to streamline and automate what traditionally have been time-consuming manual processes,” says Monteiro. “As a result, tracking the average time to get a patient on therapy has become an important metric for measuring the success of the overall hub program.”

Such efforts have helped Cardinal Health “to reduce approval wait times from several days down to just a few hours,” Monteiro adds, noting that this also helps to reduce the staffing costs for the company’s biopharma clients to manage this part of the process.

Meanwhile, advanced data-analytics capabilities—based on the use of NLP, artificial intelligence (AI) and machine learning (ML) techniques—are enabling patient hubs to uncover hidden trends from massive amounts of structured and unstructured data.

“The use of predictive analytics and machine learning is also helping biopharmaceutical manufacturers and their hub partners rapidly identify patient behaviors and patterns that lead to treatment drop-off, and respond with targeted corrective actions,” says Eversana’s Kirsch.

Cardinal Health currently records all of its patient calls and then analyzes them using NLP technology. “At the onset of the Covid-19 pandemic, we updated our program to account for words associated with the coronavirus and have continued to adjust as it noticed related trends in conversations around the pandemic,” explains Monteiro. “This has enabled us to identify new barriers patients were facing, such as challenges with affording their medications, so we can work with our biopharma clients to intervene with the timely resources to support the changing needs of patients.”

Similarly, by segmenting data-analytics efforts across the payer, provider and business operations, Conduent’s Dmochowski says that “we are able to understand the general coverage landscape and identify outliers, considering such things as time, geography and outcomes.” For instance, with regard to providers, “we are able to compare and contrast outcomes with timing and normalize this along geography and payer,” he adds. This is helping Conduent to identify payers and practices that are comparatively low performers and identify root cause that inform the “next best action.”

Conduent is also actively deploying AI technology to gain greater insight into call-quality metrics—by analyzing emotional quotient and sentiment analysis—and deploys AI when monitoring calls, chat and communications to detect adverse events more effectively. The company then uses the derived insights to trigger outreach, engage third-parties or loop in agents.

Lash Group has also been applying AI to its benefits-verification efforts, and in doing so, it has been able to reduce BV time “from hours to minutes or seconds,” says Bramley.

Meanwhile, by leveraging AI and ML techniques, Eversana is “helping manufacturers rapidly identify patient behaviors and patterns using our technology solution, which provides data to develop patient personas and predict the next best action to enable more personalized engagement,” says Kirsch. “With integrated commercial services support, the ultimate result—improved patient outcomes—drives value for payers, providers and patients alike. In this way, the hub offering can ensure that products find the quickest route to patients with minimal steps and faster, two-way communication.”

Efforts based on AI and ML techniques can also be used “to predict, for instance, which patients may be at risk for non-adherence and produce model assumptions on the optimal types of support needed based on zip codes and other regional factors,” says Nielsen of AssistRx. “Such insights can help to shape decisions related to channel, content and timing to deliver the most effective adherence engagement.”

“A comprehensive program must meet the patients’ needs in a way that seems effortless, despite a tremendous amount of complexity in the background; interactions are straightforward and effective,” adds Reinhardt.“It’s about doing everything we should be doing—not everything we could be doing. When the hub is able to take what’s very complex and make it really understandable and hassle-free for the patient and the physician—that’s a winning strategy.”