The Path for Prescription Drug Sales

A dive into this market reveals that the latest numbers yield promising results—a global value of a worldwide $1.6 trillion—but it will continue to be attributed to past, present, and future healthcare spending.

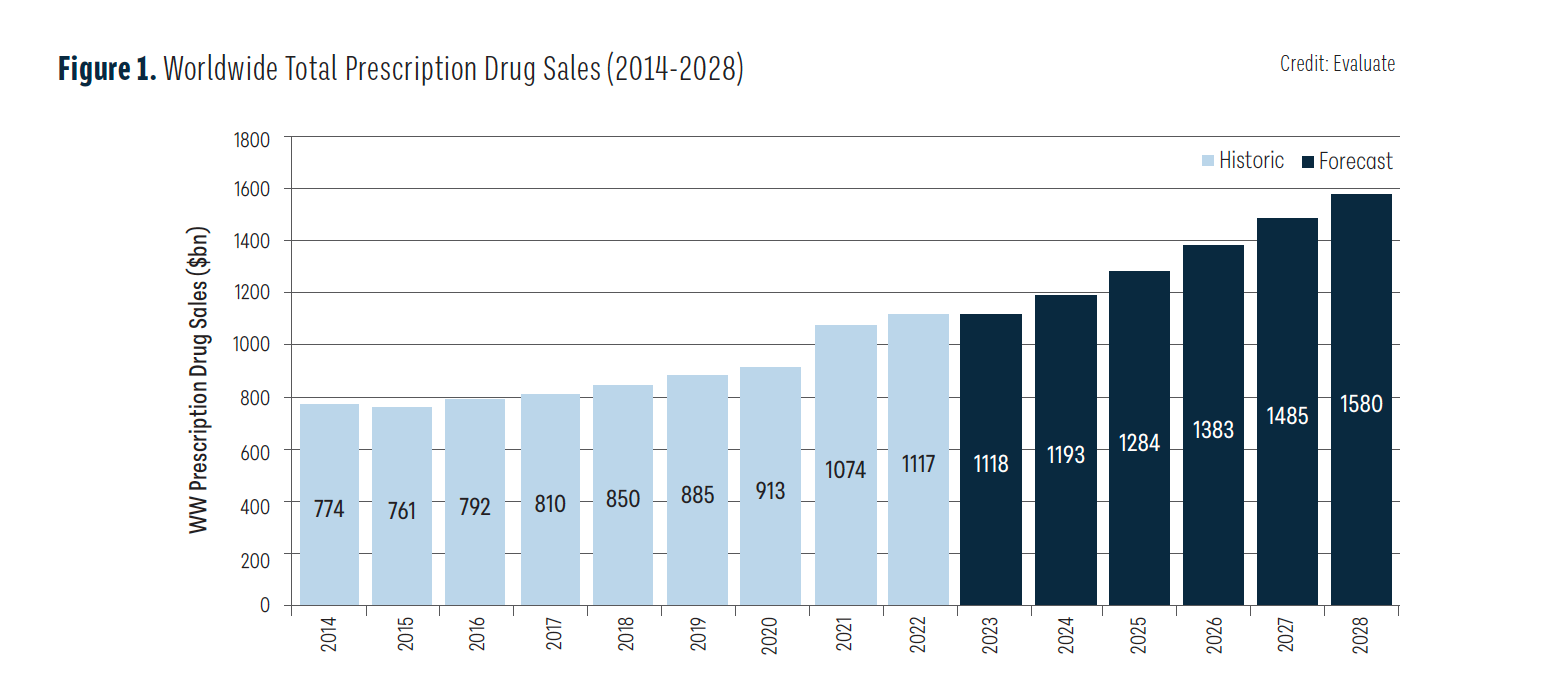

Evaluate, a consulting and data intelligence provider for the life sciences sector, releases a variety of reports through the course of a year, and 2023 was no different. In fact, in its annual “World Preview 2023: Pharma’s Age of Uncertainty” report,1 the firm cites that prescription drug sales on a global scale are anticipated to grow at a compound annual growth rate (CAGR) of 5.9% from 2022 to 2028, reaching a value of nearly $1.6 trillion (see Figure 1 below).

Interestingly, 2022’s “World Preview” predicted a CAGR of 6.1% from 2021 to 2028, and with the most recent updated figures, they are now coming in at 5.7%, suggesting a fairly consistent forecast. Evaluate notes that the slight change in these valuations—which are based on sell-side analyst estimates that feature forecasts for a combination of R&D and existing products—could be due to the passage of the Inflation Reduction Act (IRA) in the US. The legislation is powered by the Medicare Drug Price Negotiation Program and Medicare Part D prescription drug plan reforms.2

These numbers are also expected to be driven by advances in cancer, neurology, and obesity. The top 10 global Rx sales producers by 2028 will include a few newcomers, indicated by an asterisk in the list ahead. According to Evaluate, the top 10 are predicted to bring in more than $160 billion combined: Roche, Merck & Co. AbbVie, Johnson & Johnson, Pfizer, Novartis AstraZeneca, Sanofi, Novo Nordisk*, and Eli Lilly*.

COVID-19-centered shifts have been factored in as well. In 2022, according to Evaluate, sales of SARS-CoV-2-related products exceeded $100 billion, but were sliced by more than half by 2023. Revenue is projected to decline further by 2028, totaling $30 billion.

Since the start of the decade, there is no doubt that the pandemic resulted in a spike in healthcare spending, especially in the US. In fact, an analysis from Axios noted that domestic healthcare spending in 2022 reached $4.5 trillion, representing a 4.1% spike.3 This increase, however, was on par with previous years that led up to the pandemic (the 2016-2019 timeframe, which averaged 4.4% growth in spending), and 0.9% greater than that of 2021. The breakdown also attributed slower healthcare spending growth to the conclusion of the federal government’s COVID relief payments, which logically boosted health spending at the start of the pandemic in March 2020.

Subject matter experts in the space are noting that even with the data they have available, it is difficult to predict the ebbs and flows of healthcare spending, where Rx spending is a component.

In a published interview with Axios on the topic,3 Micah Hartman, a statistician in the Centers for Medicare and Medicaid Services’ Office of the Actuary noted that “[T]rends are expected to be driven more by health-specific factors such as medical-specific price inflation, the utilization and intensity of medical care, and the demographic impacts associated with the continuing enrollment of the baby boomers in Medicare.”

References

1. World Preview 2023: Pharma’s Age of Uncertainty. Evaluate Ltd. August 15, 2023.

2. Ford C. What’s Next for Biopharma Under the Inflation Reduction Act. Pharmaceutical Commerce. July 26, 2023. https://www.pharmaceuticalcommerce.com/view/what-s-next-for-biopharma-under-the-inflation-reduction-act

3. Goldman M. US health spending hit $4.5 trillion last year. Axios. News release. December 14, 2023. https://www.axios.com/2023/12/14/health-spending-united-states-2022

Newsletter

Stay ahead in the life sciences industry with Pharmaceutical Commerce, the latest news, trends, and strategies in drug distribution, commercialization, and market access.