The 2018 market for pharma cold chain logistics is $15 billion

Pharmaceutical Commerce’s annual market forecast projects 12.7% YOY growth

Pharmaceutical Commerce’s annual Biopharma Cold Chain Sourcebook, now in its 9th edition, projects a continuation of the double-digit growth in global logistics services for temperature-controlled products. In terms of the value of biopharma products themselves, the publication estimates that the 2018 sector is worth $318 billion, out of a total sales volume of $1.19 trillion, or 27% (Fig. 1).

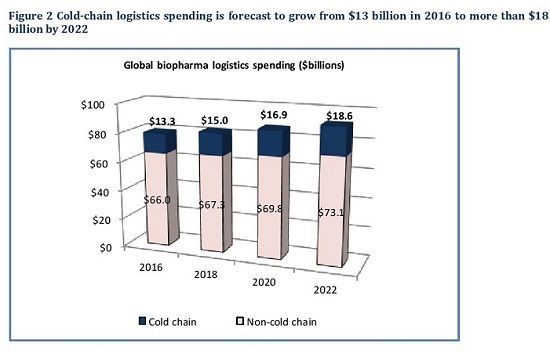

“The rule of thumb for many years now has been that the sales volume of temperature-controlled products grows at twice the rate of pharma overall, and that is continuing for the near term,” says Nick Basta, editor of Pharmaceutical Commerce. “Growth rates for the logistics services to deliver these products also grow at a much faster rate than overall pharma logistics, but at a slightly lower rate than the increased sales volume of products.” For the 2016-2022 period covered in the Sourcebook, the year-over-year growth rate is around 8% for cold-chain logistics, and barely 2% for non-cold-chain (Fig. 2).

The Sourcebook further breaks down the biopharma cold-chain logistics market into transportation services, and packaging and instrumentation. The transportation portion is estimated at $10.6 billion for 2018, and packaging/instrumentation at $4.4 billion. “Global transportation costs, especially air freight, has risen substantially in the past couple years, and shippers are complaining of capacity shortages in major markets,” says Basta. “Short of a dramatic change in global economic activity, this isn’t going to moderate in the near term. Pharma supply chain managers—both domestic and global—are addressing this by getting better at projecting future capacity needs and working with logistics providers.” There is a shift going on between air freight and ocean transportation (and ocean transportation is a major mode for raw materials and semi-finished goods), but high-value finished products are still handled mostly by air.

Clinical research trend

In terms of headline news, 2017 saw new FDA approvals of cellular and genetic therapies, notably the oncology products from Novartis (Kymriah) and Gilead (Yescarta). These are the first of what is expected to be a wave of new products that involve complex transfers of human cells (in some cases, the patients’ own cells), which are genetically manipulated and then returned to the patient. Volumes involved are minuscule relative to conventional biologics, but the logistics complexities are a significant component of these drugs’ eventual commercialization.

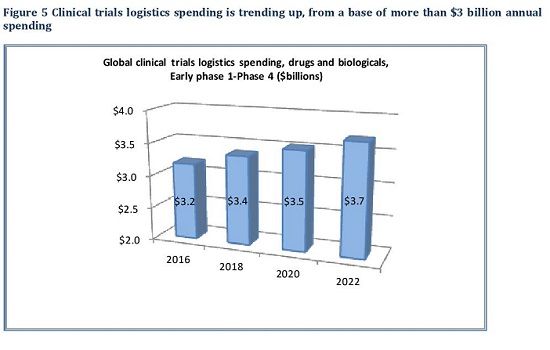

The main driver for clinical trial logistics is the number of trials being initiated, and how rapidly trials move from initial Phase I and II to larger Phase III programs. The Sourcebook projects clinical trial logistics to be worth $3.4 billion in 2018, rising to $3.7 billion in 2022 (Fig. 3).

Methodology

To perform its analysis, Pharmaceutical Commerce starts with the current lists of approved drugs, and what their labels say for storage and shipping conditions. Drugs in the pipeline are also evaluated to the extent possible. That fraction of approved drugs is then compared to measures of overall pharma sales (from organizations like IQVIA and Evaluate Pharma), and overall pharma logistics spend and volumes. Data are broken down according to shipping mode (air, ground, sea) and the spending proportions between transportation, packaging and instrumentation. Regional breakouts are also calculated. Comprehensive information on global regulatory policies are reviewed, and a directory of global logistics, packaging and instrumentation services are provided.

The Biopharma Cold Chain Sourcebook, now in its ninth year of publication, is available for purchase from Pharmaceutical Commerce. Email [email protected], or call (+1) 718 282 6112, for more information.