Pharma traceability lumbers along

A 2017 postponement makes 2018 the key year for serializing US products; authentication makes a comeback, and cargo security goes digital

The modernization of the US drug supply chain is now halfway through the timeline set by the Drug Supply Chain Security Act (DSCSA): it’s been five years since the law was passed, and in five years (if all goes according to plan) it will be (mostly) fully functional in 2023.

A ten-year implementation plan for a federal program is an unusually long gestation; the Prescription Drug User Act (PDUFA), the program that organizes the payments industry makes to FDA for drug review, is a law with a roughly comparable impact on industry practices; it has a five-year span and gets Congressional reauthorization at the end of each period.

Ever since DSCSA was passed in 2013, there has been offline jawboning that the law might be delayed indefinitely into the future, or done away with as part of a Trump Administration “deregulation” action. So, there’s large reassurance in FDA Administrator Scott Gottlieb’s opening address, at an FDA public hearing in February:

FDA and stakeholders have been working collaboratively toward full implementation of the Drug Supply Chain Security Act in 2023. Reaching that milestone, on time, is a high priority for us … I know that reaching true interoperability for systems and processes that can produce full information for each transaction going back to the manufacturer – down to the individual package level, in near real time – is challenging.

… Seamless state-of-the-art security throughout the supply chain must be our shared goal.

He even looked ahead to the post-2023 scenario:

A fully digitized supply chain can also help develop predictive analytics to reduce health care fraud, waste, and abuse. It can allow regulated industry and regulators to more easily manage or avoid costly or dangerous supply disruptions. It can help support innovative manufacturing and distribution technologies at a time when the drugs being developed are becoming increasingly tailored to specific patient populations.

Gottlieb is setting a high bar; there is evidence that industry is having a difficult time achieving it. A 2016 survey of 67 suppliers (i.e., pharma manufacturers) by the Healthcare Distribution Alliance found that about 51% of them expected to be ready for providing serialized product by November 2018 (this was at a time when the official deadline was November 2017)—which implies that 49% would not.

In Europe, operating under the EU’s Falsified Medicines Directive, the picture looks worse. A February 2019 deadline for providing serialized data won’t even see most EU members having a national system in place. “Connecting to national traceability systems has proven to be more complex than originally planned,” says Mark Davison, sr. operations director for Europe at rfXcel, one of the software vendors in the field. “And the problems we see now are only part of what we’ll see next February.” Some 40 other countries around the world, including China and India, major suppliers to the rest of the world, have implementation schedules falling in the next few years.

Under FMD, an “EU hub” has been set up, and companies distributing into EU member countries are supposed to file their product serial data with that hub, which in turn directs it to national hubs. Local pharmacies in each country are then supposed to verify product against this national hub. According to sources, six or seven EU countries have their national system in place as of late spring; and among manufacturers, repackagers, and some distributors (who have partial responsibilities to reporting data), readiness is spotty.

Barcodes and serial numbersFor the past three years, the bulk of spending on pharma traceability has been by manufacturers and contract packagers, installing machine vision systems, barcode printers and varying degrees of automation for case packing and palletizing. Packaging equipment vendors have responded with a growing variety of flexible machines, especially to handle both automated, semi-automated and manual case-packing. The argument over aggregation—the need for a shipper to provide 100% accurate linking of the serial codes within a case, to the serial code of the case itself—seems to be settling down, since most companies agree that it is more economical to include aggregation as part of a packaging line serialization project. (Aggregation is not a requirement of DSCSA; however, the leading US wholesalers make delivering aggregated cases a requirement, since otherwise they would have to open each case and visually inspect the contents, which could slow down product movement considerably.)

No machine-vision or barcode-printing vendor will admit to problems with barcode print quality (which could affect product acceptance by trading partners); however, industry surveys by HDA and others point to nagging inconsistencies in this area, including printing the wrong information or in the wrong location. These problems are expected to clear up quickly.

Contract packagers have an added burden in traceability: dealing with the variety of technology and business-practice policies of multiple clients. Robert Madden, Global Serialisation Operational Manager at Almac Group (which has operations in both the US and Europe), says that “Some clients have a defined serialization strategy, some want to send Almac serial numbers and then others want Almac to guide them on the best approach.” The company goes through a seven-step process (including carton artwork and labels) to arrive at a project plan, and then executes. Almac chose Optel Vision packaging line equipment and its Level 3 SiteMaster software, with the intention that SiteMaster would then report data back to the client’s Level 4 system.

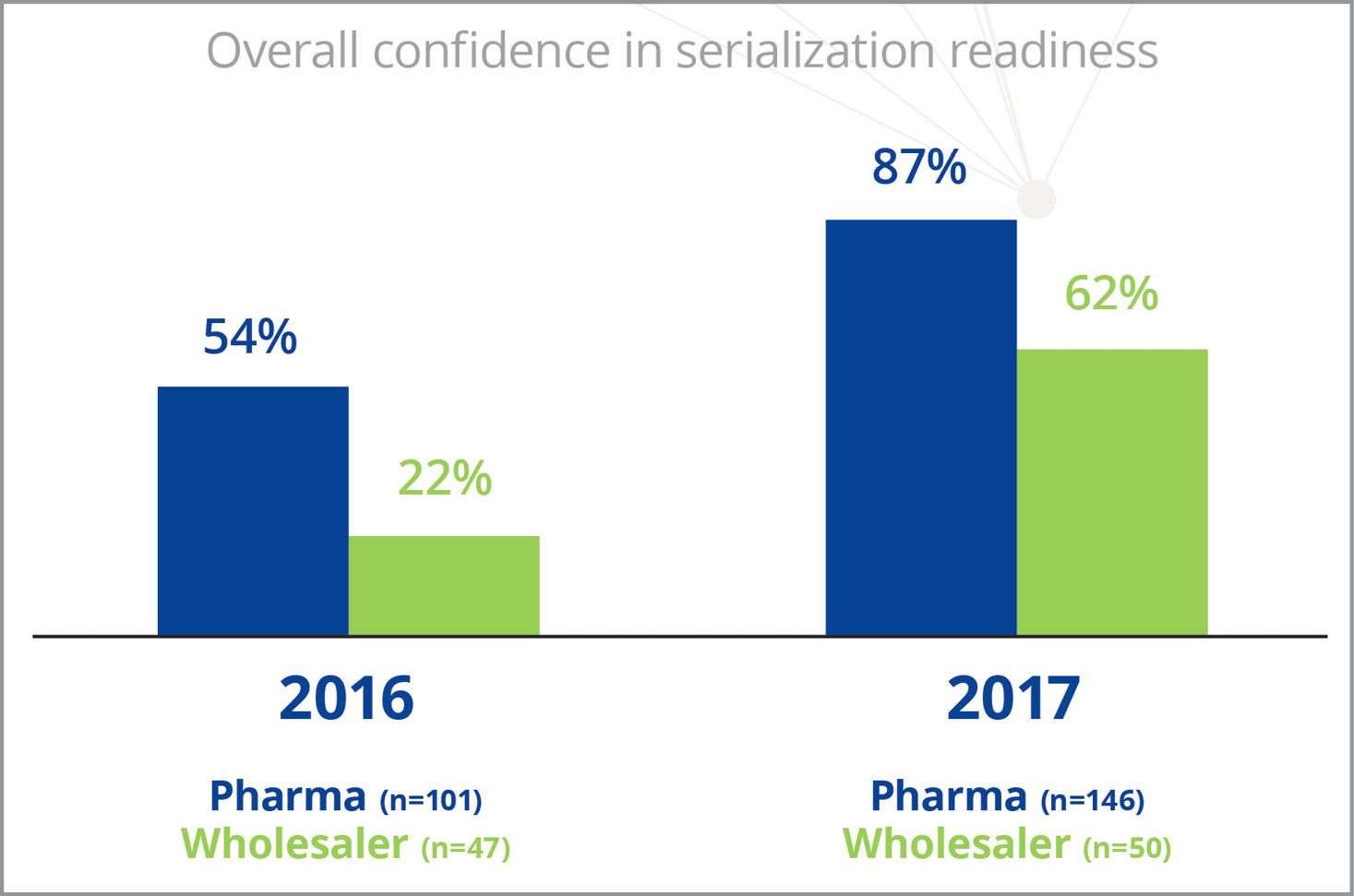

Fig. 1. A late-2017 survey by TraceLink shows significant improvement in feelings of industry readiness.

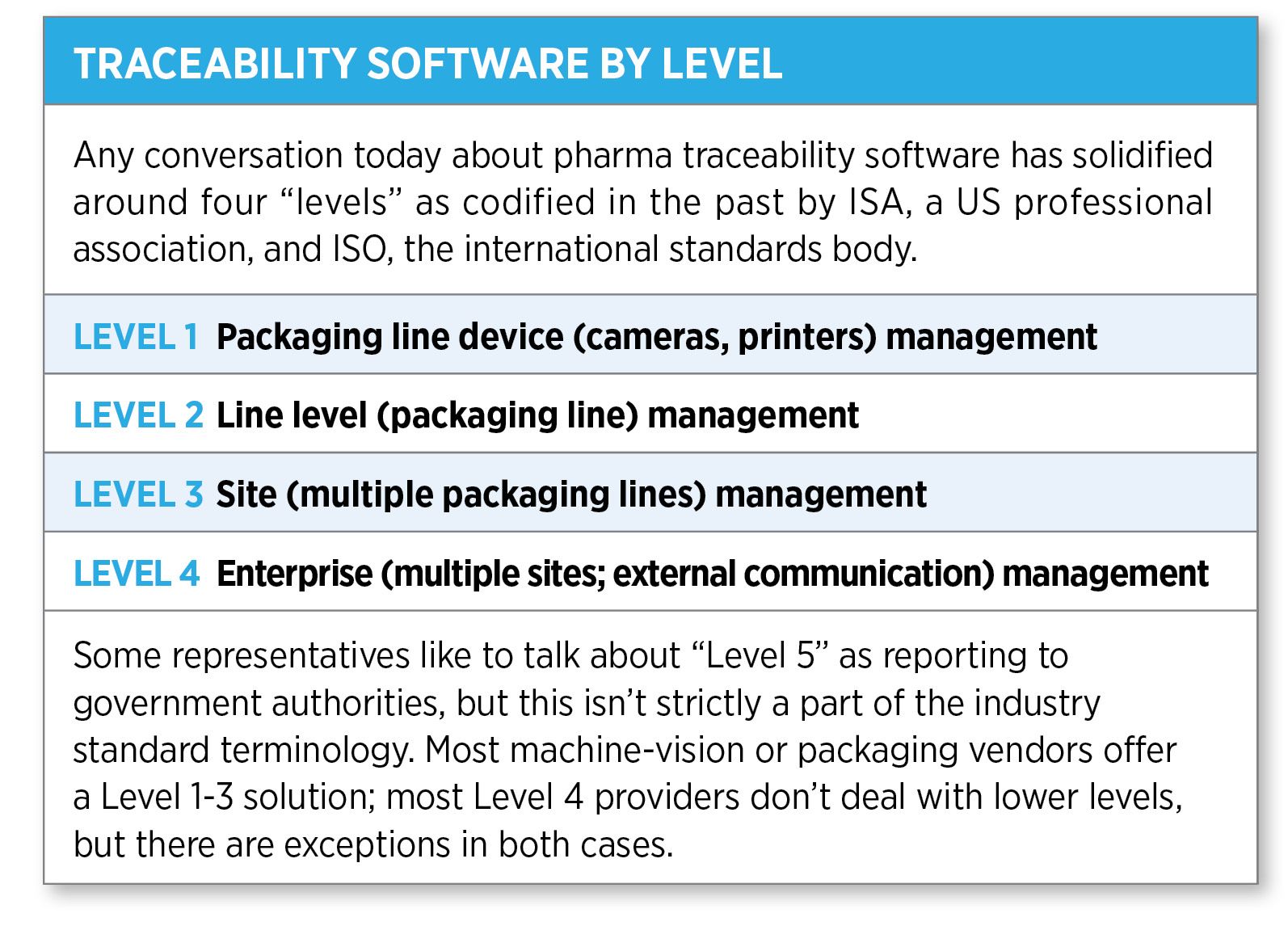

Traceability software options

A crucial component of a comprehensive traceability solution is the Level 4 software—the point at which serial data from multiple packaging lines within an organization is brought together, to report out to trading partners (in the US) or governments (in the EU and elsewhere). Here, there have been notable developments over the past 12 months:

- Frequentz, a company whose software goes back to a major effort by IBM in the mid-2000s, was acquired by rfXcel; Mark Davison says that the company will continue to support the software among its users for the near term, while gradually migrating them over to rfXcel’s flagship platform, rfXcel Traceability. This spring, the company was honored by HDA in its annual Distribution Management Award. The company was also a merit finalist for an Environmental Monitoring module which, as part of a traceability system, tracked temperature and other conditions during drug shipments.

- Optel Vision (now Optel Group), a leading vendor of machine vision systems for pharma traceability, acquired two software companies—Verify Brand, a Level 1-4 vendor, and Geotraceability, a “geomatics” vendor that tracks products in agriculture or natural resources from the field to the factory. The acquisitions are part of Optel’s vision for a true end-to-end traceability solution (i.e., from raw materials through to the consumer). (See Louis Roy profile, p. 10.) Verify Brand, which has a handful of existing customers in life sciences, is notable for handling a consumer-awards program for a major beverage and food retailer, thus demonstrating this consumer touchpoint.

- Adents, a French firm with long experience in product serialization, has stepped up as the first (and so far, only) Level 4 vendor to have a certified data-exchange interface with Origin, the master-data repository created by HDA, for product data. The intent of Origin is to provide a common repository that will direct wholesalers and other trading partners to where pharma products entered the supply chain, which HDA member wholesalers are eager to establish in order to manage product returns come November 2019, when these returns need to be verified. Adents solution users will thus have a streamlined link to Origin. The action is all the more notable for its contrast to TraceLink, which sued HDA for assumed antitrust violations late last year, then promptly dropped the lawsuit in February. Also, while TraceLink is closely aligned with Amazon Web Services (and cloud computing tools available there), Adents is aligned with the Microsoft Azure cloud platform.

- Antares Vision, another leading machine-vision vendor, has launched its own Level 4 solution, ATSFour, which Adriano Fusco, business development director, says was entirely home-grown, and is closely coupled to the software Antares has been providing for its machine-vision and packaging equipment. The software is available as an on-premises or single-tenant cloud application (more on this later), and the cloud-based version makes use of the latest “graph database” technology, an advance over traditional relational databases.

- How about a free traceability solution? Vantage Consulting (New York), an IT systems-integration house, used its booth at this year’s Interphex meeting (New York; April 17-19) to announce collaboration with an open-source, volunteer effort to build a traceability system called Qu4rtet. The intent is to provide a modularized system, so that some components (such as random-number generation) can be attached in other traceability implementations. The developers share their work at a site called Serial-Lab.com, and the software itself is available at a related developers’ site, gitlab.com. Vantage—which does implementations and does not sell software, is collaborating in the effort, and has hopes of being hired to implement the software for clients, according to John Jordon, president.

TraceLink, generally regarded as the largest Level 4 software developer, is emphatically not giving its software away; the company says that revenue in 2017 was up 85% over 2016, with 775 customers globally (including more than 180 who themselves serialize product; the others are presumably trading partners managing serial number data), and some 265,000 other companies have signed on to have accounts within the TraceLink Cloud.

TraceLink pioneered the use of multi-tenant architecture in pharma traceability, and may be the only company still to use that form of cloud computing (many other vendors have single-tenant systems; the difference is that single-tenant systems require each client to have its own “instance” of the software, while TraceLink essentially runs one instance for the world). Surprisingly, although much of the corporate world (including IT systems for pharma R&D, managing sales and marketing activities and other functions) is using multi-tenant cloud systems, there is still resistance among manufacturing IT managers, and on-premises implementations are still being performed.

The advantage of a multi-tenant architecture is that the provider can do one upgrade that is propagated throughout the user base—which should translate into lower maintenance cost and less of an IT burden across the board. There was considerable buzz earlier this year when a scheduled TraceLink update caused systems to be temporarily knocked offline. “This year, we’ve gone to a very programmatic update schedule, with defined release dates that are very predictable,” says Brian Daleiden, VP at the firm. There were “unexpected things” in the problem update, which were corrected as quickly as possible. And while no customer data was lost, he says, “we took some heat from customers, as we should.” Going forward, the company recognizes its “mission critical” role in pharma production and distribution, and while TraceLink competitors heaped scorn on the company, no one is tracking production hitches at single-tenant or on-prem implementations.

To some degree, with the proliferation of Level 4 vendors (see the Supplier Directory on pp. 32-33), and the maturation of the technology, traceability software is becoming harder to differentiate. This also shows up in the fact that vendors are now openly competing on price. Gurpreet Singh, head of sales at Arvato Systems North America, notes that many traceability vendors have a usage charge, based on how many serial numbers are being managed, in addition to whatever subscription or site-license charge there might be—and then put another charge, based on transactions, on top of the first two. “Arvato only charges for serial number usage once,” he says. Arvato is the provider of the Corporate Serialization Database (CSDB); the system is a part of the SecurPharm hub, Germany’s national hub under FMD, and has multiple manufacturing or distribution clients as well.

Fig. 3. Mettler Toledo PCE’s newly redesigned T2620 system can run at up to 400 cartons/min. Credit: MT.

Traceability at the edge

As packaging lines are being geared up for DSCSA compliance, some industry attention is shifting to what happens in their own warehouses and at third-party logistics providers (3PLs), who might be the next physical step in the supply chain for product movement. It is now recognized by some manufacturers that aggregation can be better carried out in the warehouse, as orders are put together for shipment, than at the end of a packaging line, says Matt Deep, VP of technology at DMLogic, an “edge computing” vendor for traceability. Such edge systems manage serial data being collected (for example) by handheld scanners at the receiving dock, then track where in the warehouse those packages or cases have been positioned, and finally which serial numbers are going out with customer orders.

TraceLink, presumably recognizing this next step in traceability, acquired Roc-IT Solutions, another edge computing vendor, in the past year. Other players in the field, including TrackTraceRx, Antares Vision and Systech also provide this functionality.

“Most large pharma companies have full-fledged warehouse management systems, but those systems typically haven’t been tailored to the needs of pharma traceability,” says Deep, “and that’s where we come in.”

3PL connectivity is an issue in Europe where, nominally, logistics providers are not part of the overall FMD reporting framework—but there are exceptions, and now some European 3PLs are scrambling to get ready. In the US, DSCSA brought 3PLs under FDA oversight for the first time, and the complication here is that FDA requests details on the state-level licensure of the 3PL—but only a few states have set up a licensing program for them. “Another complication is that a 3PL operating in one state without a licensing program might be required to obtain a license for shipping to another state that does have such a program,” notes Bob Glasgow, a principal at D2 Consulting, which provides services on pharma commercialization and licensing programs for manufacturers, pharmacies and others in the supply chain. This was recognized by FDA Administrator Gottlieb in his February presentation: “We plan to release new regulations that, when final, will apply to all state and federal licenses issued to wholesale distributors and 3PLs. We’re working to publish these regulations later this year.”

Wholesalers, at least in the US, have a nearer-term worry than pharmacies and other downstream supply-chain participants: in November 2019, DSCSA requires them to be able to verify product returns at their warehouses before re-entering them into commercial distribution.

Product returns

HDA surveys have found that 94% of returns can be re-introduced; that returns are a multi-billion-dollar value to healthcare, and that processing them is a multi-million-dollar burden for each of the major wholesalers. The November 2019 deadline is part of what spurred HDA to take the lead in developing the Origin master-data repository, and this year, to push ahead with the so-called Verification Router Service (VRS), which is intended to be a many-to-one source of which manufacturers are responsible for which product identities (since, much of the time, wholesalers get returns from products that they themselves did not deliver to a pharmacy, and need to locate the product’s origin).

HDA hired ValueCentric to build and operate Origin; the company has long experience in managing supply chain data. Bill Henderson, EVP, says that signups for Origin by manufacturers had slowed down after the FDA regulatory delay last year, but are picking up now. ValueCentric currently has business with some manufacturers to track specialty drugs going to specialty pharmacies (which usually involves a distribution step known as “drop shipments,” where the physical destination of the drug is different from the location of the drug’s owner) – and this experience could benefit industry in the overall transition to DSCSA-compliant tracking.

Perry Fri, HDA’s EVP, industry relations, says that about 20 pharma and distribution companies have signed on for a series of VRS pilots to run this summer. Results will be discussed at the organization’s Traceability Seminar in October.

Securing the shipment

Much of the intent of traceability regulations is to prevent counterfeits entering regular supply chains, or to address diversion. But all along, cargo theft or diversion represents a comparable risk. HDA has addressed this in the past year in part by taking on management of the Pharmaceutical Cargo Security Coalition, which had been an all-volunteer effort since 2010 led by Chuck Forsaith, who is now a senior director at HDA. At its spring 2018 meeting (the first under HDA management), attendees heard data from, among others, Sensiguard (a service of Sensitech), that full-truckload pharmaceutical thefts dominate among the range of possible categories (including pilferage, facility theft and others); and from BSI, that the five top countries for pharma cargo hijackings were 1) Brazil, 2) Mexico, 3) the US, 4) Italy and 5) Argentina. (Ironically, just before the PCSC meeting got underway, a full-truckload theft was reported in Cornersville, TN, and valued at nearly $1 million, according to Forsaith.)

PCSC attendees also heard from Barry Conlon, former CEO of FreightWatch, and now founder of a new company, OverHaul, which he says represents the next generation in cargo monitoring. “There are usually four points of digital contact with a tractor-trailer on the road: the driver, the truck, the trailer and the cargo. We connect all four for continuous monitoring in real time, and use business-intelligence rules to prevent thefts rather than account for thefts that have already occurred.” Shippers (including pharma logistics managers themselves) can take advantage of the proliferation of digital devices, telematics and sensors now in use (plus the smartphone the driver usually has)—and to connect the trucker’s activities with other parts of the supply chain to create a tailored network. “It’s better and cheaper than existing monitoring services—and that’s a winning combination,” says Conlon.

Anti-counterfeiting action

It is known that some manufacturers employ anti-counterfeiting or product-authentication technologies on their packages, but confirming that is difficult simply because these techniques are mostly covert. Also, many manufacturers are figuring that their serialization investments will protect against all but a few counterfeiting efforts, further reducing the already-low figures for the US supply chain.

Nevertheless, some traceability vendors are extending their offerings to include product authentication. Notable efforts include Systech’s proprietary UniSecure technology, StellaGuard from Covectra, and Alpvision—each of these employs optical verification of the as-is label. TruTag has been promoting a taggant based on nanoporous silica, which can be used either on packaging or as an on-dose excipient; the material is now being used to mark dietary supplements. Another taggant-based technology, from Applied DNA Sciences, involves synthesized DNA strands; in the past year, Applied DNA has announced collaborations with Videojet (provider of barcode marking equipment) and with Colorcon, a leading provider of pill coatings.