Pharma Cold Chain in Search of Equilibrium

Post-pandemic conditions are improving for the temperature-controlled market, but, meanwhile, the technical demands are rising.

Like an explosion whose reverberations echo long after the smoke has cleared, the global COVID-19 pandemic continues to affect supply chains across industries and across oceans, including the pharma industry. Unlike other impacted industries, however, the pandemic has spurred significant investment in capacities and services, due to the need to deliver vaccines and treatments expeditiously around the world. These investments will benefit the pharma logistics industry for a while to come, especially in the area of fragile, deep-frozen medicines, and treatments.

One of the biggest reverberations, still playing out, is in basic transportation costs in logistics. While the headline-grabbing backlogs of ocean freighters off US ports have faded (which were then replaced by backlogs of stranded, emptied containers around the world), logistics costs in all modes are still unsettled. For ocean freight, long-term contracts were up by 50% or more in the first half of 2022, but were settling down to pre-pandemic levels by the end of the year. Air freight rates were 100% higher over pre-pandemic levels in early 2022 (at some points in 2021, rates were up sevenfold), but were softening by the end of the year.

North American trucking rates were up 7% in the contract trucking category at the end of 2022, while the spot rate had plummeted from 67% above equilibrium in mid-2021 to 31% below in late 2022, according to the Coyote Curve Index. (Coyote Logistics, a trucking broker, defines “equilibrium” as zero change of year-over-year comparisons.)

The potential for a global recession to set in during the coming year is making supply chain managers leery of locking in contract rates, since spot rates might be more attractive in coming months. Or not.

In the recent past, “The supply chain(s) used to be quite seamless and fluid,” says Marie-Christine Lombard, CEO of third-party logistics (3PL) provider Geodis, in a recent Wall Street Journal interview. “But it’s no longer smooth. It goes up and down. The world order has a huge impact on the supply chain and its stability.”

As an industry that usually requires premium services for moving its products, the pharma/ healthcare industry generally did not suffer the holdups in deliveries during and after the pandemic. But the transition was by no means smooth. “Refrigerated containers for pharma get a prioritized position on ocean freight," notes Robert Coyle, SVP of healthcare at Kuehne+Nagel, a global logistics provider. “But during the ocean freight crunch, it was difficult to maintain that priority when general freight rates approached or exceeded premium rates. We spent time talking with our carriers to make sure the message stayed on track that these pharma/ healthcare shipments would not get bumped, due to the importance of the products to our customer’s patients.”

Survey says…

Global provider UPS worked with World Business Research, a conference company to complete a poll of pharma supply chain managers in late 2021 and early 2022. In the “Vital Signs” survey it released at mid-year, cost control was the biggest challenge respondents reported. Not far behind that leading challenge was the specific instance of cold chain costs; interestingly, “cold chain management” had the same ranking as costs.

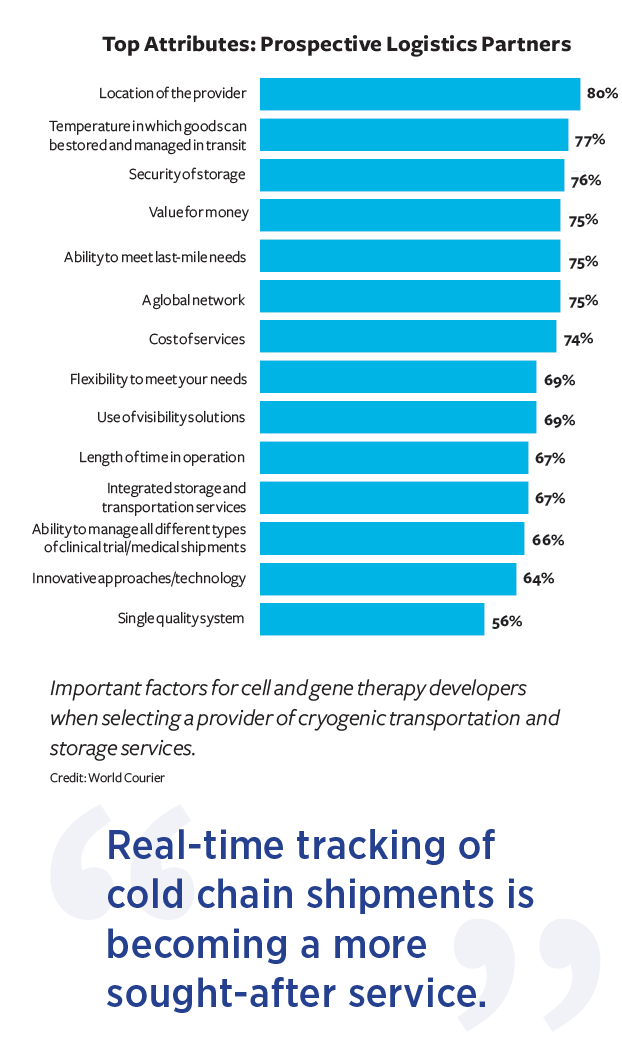

“Real-time tracking of cold chain shipments is becoming a more sought-after service,” says Dan Gagnon, VP of healthcare marketing at UPS. “We’ve responded with an initiative to aggregate all the fragmented elements of the supply chain, from warehouses to the transportation modes of ground, air, and ocean.” He touts the advent of UPS Premier services, currently being rolled out in the US and eventually globally, which will feature location and condition monitoring throughout a shipment, based on devices installed on shipments and in communication with a global network.

Uniform service quality is also a goal at K+N, where the company’s 238 GXP-compliant healthcare facilities are being brought to a uniform level of quality management, says Coyle. The scaleup of global vaccine distribution over the past two years will have a lasting impact for all pharmaceutical distribution, he adds. “Our customers are noticing that the effort we’ve put into linking our logistics services with our emergency and relief services gives them the capability to take products into markets that they couldn’t reach previously,” says Coyle. The company has doubled its healthcare-specific staff over the past three years and established uniform service-quality standards globally.

At least regarding pharma cold chains—and healthcare products generally—there is still a land grab going on for claiming a bigger share of a high-growth market. Industry surveys like the Evaluate Pharma World Preview Report peg pharma’s growth at a 6% compound annual growth rate (CAGR) through 2028 (although growth for this year is less, due to the expected recession). Temperature-controlled biologics and other specialty pharmaceuticals are expected to continue growing at twice the general industry rate.

The October 2022 issue of Pharmaceutical Commerce noted capacity expansions or acquisitions by DHL, K+N, UPS, FedEx, Tower Cold Chain, Cryoport, and BioLife Solutions, and cold-chain-specific technology introductions by Envirotainer, va-Q-tec, SkyCell, Lifoam, and Sonoco ThermoSafe—all in the prior 12 months (see https://bit.ly/3J9sN2a). Since then, UPS has acquired Bomi Group, an Italian international healthcare logistics provider. Geodis acquired trans-o-flex, a German delivery company for healthcare products. DHL Supply Chain has acquired NTA, a Mexican healthcare logistics concern. Kuehne+Nagel has contracted for airside capacity—including cold chain storage—at the OR Tambo International Airport in Johannesburg, South Africa, and has executed on its long-term contractual arrangement with Atlas Air for charter air flights. Marken, a UPS subsidiary specializing in clinical trial logistics, acquired Cedra Express, a medical courier in New Zealand.

New technology introductions in recent months include Swiss Airtainer, a new company offering an air-freight unit-load device to compete with Envirotainer, CSafe, and DoKasch. Sensitech has upgraded its lines of Temp-Tele dataloggers. With a June acquisition of an internet of things (IoT) networking company, Qopper, ParkourSC, a software platform for real-time supply-chain management, now enables “digital twinning” of supply chains, the better to analyze and optimize performance.

The US’s big three wholesaler-distributors—McKesson, AmerisourceBergen, and Cardinal Health—each have specialty pharmaceutical logistics business units. AmerisourceBergen integrated World Courier, a clinical logistics company, with its ICS business unit a few years ago. More recently, in November, Cardinal Health announced a collaboration with Medically Home around Cardinal's supply chain network and last-mile fulfillment tool, Velocare, to enable hospital-level acute care in the home by fast product and service delivery.

Cells and genes

Many, if not all of these companies are also targeting the emerging business of cell and gene therapies (CGTs; also known in Europe as “advanced technology medical products, or ATMPs). CGTs have attracted billions in venture-capital and Big Pharma investment in the past few years (although down somewhat in 2022); over 1,000 companies globally are developing candidate therapies, according to data published by the Alliance for Regenerative Medicine (ARM), a trade association that includes tissue engineering with CGTs.

There is real excitement in the field; the 20 or so products that have been commercialized around the world hold the promise of actually curing serious diseases, especially genetic birth defects that can be fatal if untreated. From a logistics perspective, however, the excitement needs to be tempered by the reality that the treatments are often formulated for individual patients with rare or ultra-rare diseases—there will be no mass market therapy in the near future. For some therapies, a few dozen vials of genetically altered cells might be all that is necessary for a year’s inventory.

Taken as a whole, what adds to the logistics business for CGTs is the volume of clinical trials currently being conducted. As of mid-2022, ARM counts 2,093 clinical trials going on worldwide, including 200 Phase III trials. “Because some of these therapies are for individual patients, the commercial (after approval) supply chain will be very similar to the clinical supply chain," notes K+N’s Coyle, who previously worked at GSK. “With traditional meds, logistics and supply chain processes for clinical trials are different from the processes once the products are approved. Now with some of the new products, the clinical and commercial processes are starting to align, and we need to look at designing the supply chain for the entire product lifecycle.

World Courier conducted a survey in mid-2022 and found a laundry list of attributes that CGT developers look for in their logistics providers (see chart at left). Note that the ability to serve commercial patients, as well as to manage clinical trial logistics, are on the list.

An added complexity of the CGT field is that many of its transportation and storage needs require cryogenic conditions (roughly, -170°C, a point at which living cells—which many CGT therapies are—become dormant and, therefore, preserve their efficacy). The Nashville company Cryoport, for one, has latched onto this requirement by offering a growing list of services ranging from dewars containing liquid nitrogen to ultracold refrigerators, to cell collection, preservation, and delivery services. “Future advances in medicine will be more and more at a cellular, rather than chemical or biochemical basis,” says Jerrell Shelton, CEO of Cryoport. Currently, the company is introducing the Cryosphere, a dewar that maintains performance regardless of its orientation (conventional dewars lose cooling if laid flat or upside down), and is developing a proprietary condition monitoring system to track and report shipping data.

The majority of CGTs on the market or in advanced development are autologous ones, requiring the use of the patient’s own cells. This necessitates a complex process of extracting those cells, delivering them to the manufacturer, and then returning them to the same patient, all within tight time constraints. The alternative, allogeneic therapy, uses cells that are treated to make them compatible with any patient and, thus, they are sometimes called “off-the-shelf” CGTs that can be stored until needed. That creates a distribution system more like conventional biotech products.

Something of a milestone was reached in December when the first allogeneic CGT received market authorization in Europe: Atara Biotherapeutics’ Ebvallo (tabelecleucel), a treatment for a rare hematologic malignancy for patients with organ transplants. “The approval of Ebvallo in Europe is a medical breakthrough for patients with significant unmet need,” stated Pascal Touchon, president and CEO of Atara, upon the announcement. “As the first allogeneic, or donor-derived, T-cell immunotherapy to receive approval from any regulatory agency in the world, this marks a historic moment for Atara, our European partner, Pierre Fabre, and for the broader cell therapy field.”

Being living cells, though, means that allogeneic CGTs will still need precise temperature control. “Freezing cells below -150°C using cryogenic storage techniques is one option to address the shelf-life for fresh cells, allowing them to be kept almost indefinitely,” writes Adrea Zobel, senior director of personalized supply chain at World Courier. “However, emerging markets and remote locations, in particular, may not have the specialist facilities to maintain cryogenic storage and transport. Cryopreservation, in some cases, is critical to enable long-term storage and long-distance transit.” She goes on to say that significant infrastructure upgrading is now occurring, with advanced packaging solutions, coolant charging stations, and real-time location tracking and temperature monitoring.

Complementing this perspective is a 2022 study from Insight Partners, "Cryopreservation Equipment Market Forecast," which values the current equipment market at $6.4 billion, growing by an 11.9% CAGR to $12.5 billion by 2028.