Oncology Innovation: Optimism & Obstacles

Ongoing challenges—ranging from the growing complexity of today’s advanced therapy options, to inherent shortcomings in the clinical trial process, to ongoing adherence challenges and more—must be reconciled to ensure both clinical and commercial success throughout cancer care

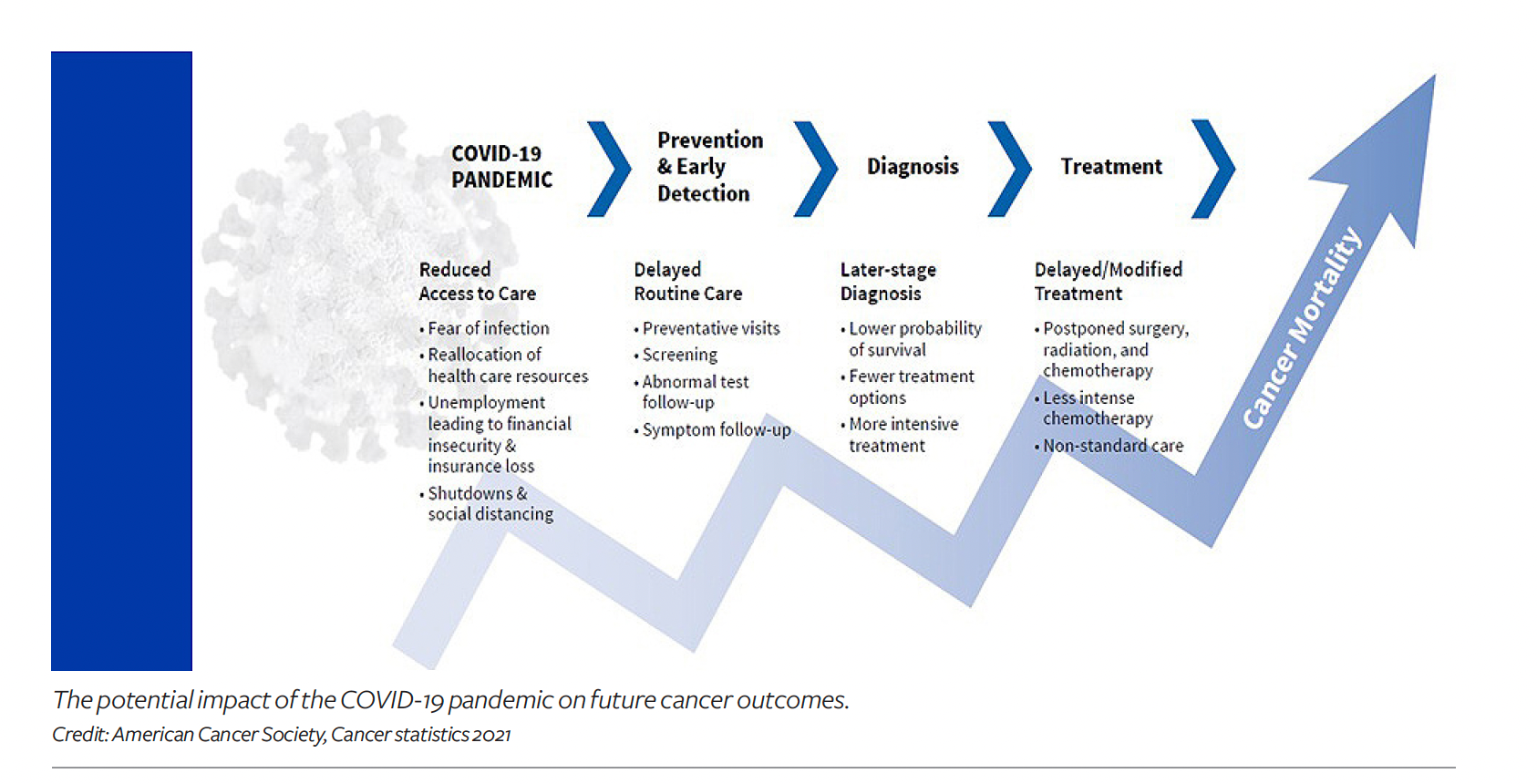

While the prospect of a cancer diagnosis understandably brings a range of emotions for everyone involved, there is considerable excitement throughout the oncology sector. Such optimism is being driven by breakthroughs in advanced therapy options and improved overall clinical outcomes in terms of progression-free survival across many different types of cancer. Ongoing efforts to both optimize trial enrollment and improve prescribing through the strategic use of genomic profiling, growth in the use of oral versus traditional infused oncology agents, and initiatives to address persistent diversity gaps and information gaps in the traditional randomized controlled trial (RCT) process also herald a bright future in this space.

At the same time, there is growing appetite among drug developers and regulators for gathering real-world data (RWD) that is collected outside of a clinical trial and analyzing or modeling it to create actionable real-world evidence (RWE). Regulators are increasingly receptive to using such findings in regulatory decision-making.

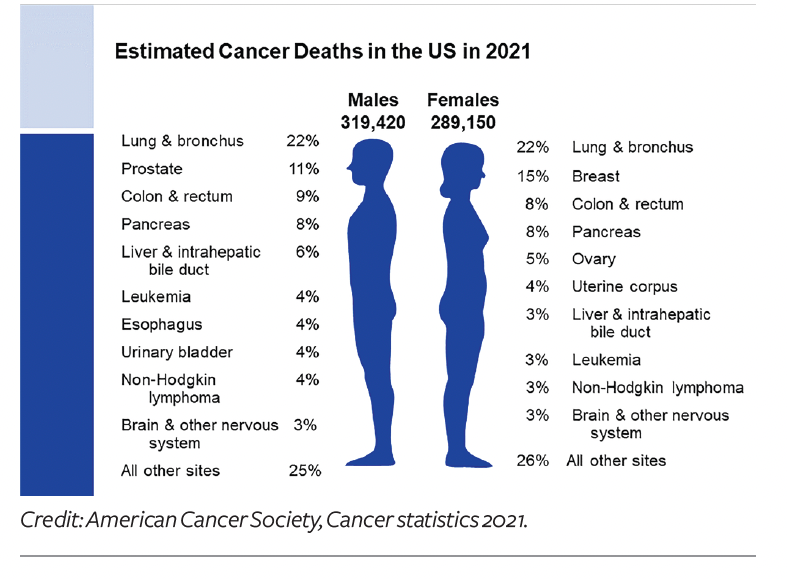

Cancer by the numbers

According to a December 2021 report from IQVIA,1 oncology is the therapeutic category that is forecast to grow the fastest, by a 9% to 12% compound annual growth rate (CAGR) through 2026. This increase is being propelled by significant development of therapeutics and expanded treatment indications, despite offsetting the growing use of biosimilars and other exclusivity losses.

Oncology therapies represented 37% of the overall drug-development pipeline in 2021, with 2,226 products currently in clinical development, according to IQVIA. The majority of therapies in the cancer pipeline (75%) involve some type of targeted therapy (that is, based on a predictive biomarker), and 42% (930 products) are aimed at treating rare cancers, says Murray Aitken, senior vice president and executive director, IQVIA Institute for Human Data.

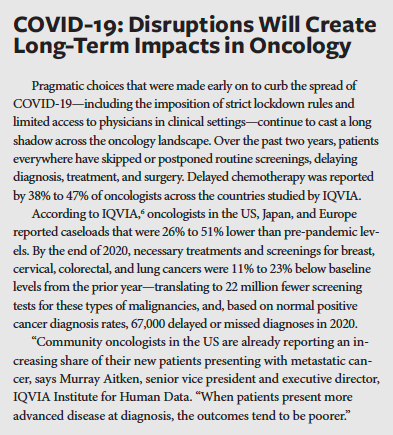

Meanwhile, clinical trial activity—a good bellwether of the health of the oncology sector—also remains robust, despite ongoing disruptions caused by the COVID-19 pandemic. According to IQVIA, oncology trials accounted for 13% of the industry’s clinical trial subjects in 2021 (a 15% increase over 2020). New cancer trials that began in 2021 required 300,000 study participants, up from 150,000 a decade ago, and the number of oncology trial starts reached historically high levels in 2020 (1,600 starts)—up by 70% from 2015.

Despite this collective activity to pursue novel oncology treatments, drug developers still face stiff headwinds. “We calculate a composite success rate of just about 5% for all cancer drugs,” says Aitken. “While that may sound discouraging, it really underscores the complexity and explosive growth in scientific innovation in oncology. The relatively low success rate is truly a reflection of the appetite for greater scientific risk companies are willing to take on.”

In its most recent R&D report,2 IQVIA says that the next-generation therapies (cell-and-gene, mRNA, immunotherapies and others) “are increasingly being pursued and are creating opportunities for enormous growth,” notes Aitken. “Collectively, these therapy classes are still relatively small, but a huge amount of investment is happening now, so it’s a really exciting time.”

While the overall approval rate is low, over the past five years, 62 novel oncology therapies have launched in the US—approved for 130 different indications across 24 different tumor types (bringing the total to 169 over the past decade). Rare cancers represent the majority of recently approved treatment options, with 16 of the launches in 2020 receiving an orphan designation. “When we look at the pipeline to predict what will emerge over next five years, the future will be even more exciting—and also more crowded and competitive,” says Aitken.

Meanwhile, global spending on oncology drugs reached $164 billion in 2020 (increasing at a CAGR of 14.3%). IQVIA projects that global spending on cancer therapies will reach $269 billion by 2025, even as growth rates are expected to slow to about 10% a year.

Biomarker-directed therapies and genomic testing

From a clinical standpoint, biomarker-directed therapies are heralded for their ability to improve prescribing efficacy, help to predict a patient’s response to therapy, drive improved clinical outcomes, help patients to avoid treatments that are unlikely to have a positive clinical impact, and help payers to avoid paying for such suboptimal treatment options. Predictive biomarker testing is now required or recommended for 79 approved oncology drugs in the US—double the number in 2014, according to IQVIA.

While the list of identified biomarkers grows every year, “the industry still needs to fine-tune its understanding of which biomarkers are actually oncogenetic drivers and correlate those to clinical outcomes, and this remains challenging,” explains Jennifer Harris, vice president, clinical development and head of the oncology scientific strategy and innovation team for Syneos Health. “We work with a lot of smaller companies that are entering the oncology arena, and it’s the rare trial that doesn’t have a robust, exploratory biomarker aspect to the trial program, often as early as Phase I. That’s grown a lot over the past five to 10 years.”

Harris also points out that biomarker-directed therapies tend to command premium prices because the biomarker requirements mean there will be fewer potential patients and thus a smaller overall market. Nonetheless, “the higher likelihood of clinical benefit associated with biomarker-directed oncology agents also increases the probability of clinical trial success, which, in turn, increases adoption rates of payers and prescribers,” adds Bruce Feinberg, DO, chief medical officer for Cardinal Health Specialty Solutions. As the saying goes—there’s nothing more expensive than a drug that doesn’t work.

“Payers are rapidly embracing genomic profiling as a cost-effective strategy. I think the more pressing barriers today are logistical and educational,” continues Feinberg. For instance, one of the important questions in the oncology sector today is what is the best strategy for carrying out genomic testing—should such testing be carried out on an ad hoc basis, only after an initial diagnosis has been made? Or should we, as a society, begin to move toward routine, large-scale, panel screening to identify many genetic mutations in all patients?

“Broad molecular testing will—and should—become more widespread,” says Marcus Neubauer, MD, chief medical officer, The US Oncology Network, which is supported by McKesson. “Cancer is a devastating disease and treatment is very expensive, so knowing the cancer molecular profile can improve outcomes and direct therapy, which reduces costs by avoiding ineffective therapy.” But he adds that “the explosion of new information around biomarkers is difficult for oncologists to keep up with, and inconsistent reimbursement for testing remains an issue.”

All stakeholders are struggling with how to best execute on this objective. “If we begin carrying out widespread, panel-type testing for many biomarkers, what is the patient supposed to do with the information—live their whole life in fear?” says Harris. “We have to better understand which biomarkers are really oncogenetic drivers, and I don’t think we’re there yet. Payers are understandably more reluctant to pay for testing if the information yields no actionable options.”

Tissue-agnostic therapies—the holy grail in oncology

One particularly promising opportunity in oncology is the ongoing evolution of so-called tissue-agnostic therapies—whereby a single therapy is able to gain regulatory approval across multiple oncology indications, “because the drug targets the presence of a particular specific biomarker—irrespective of which organ system carries the malignancy,” says Neubauer.

Perhaps the best example of a tissue-agnostic oncology therapy is Keytruda (pembrolizumab), an immune checkpoint inhibitor from Merck. Essentially, Keytruda’s success has been based in part on the fact that testing for the protein PD-L1 can identify patients regardless of where the cancer originated, Neubauer explains.

Since its initial approval by FDA in 2014, Keytruda is now approved for use in 18 different oncology indications in cancers that express PD-L1, making it a blockbuster drug—something that doesn’t happen often in oncology. In fact, according to Merck, 2021 sales data for Keytruda topped $17.2 billion, up 20% from the year before.

A second tissue-agnostic oncology therapy—Vitrakvi (laretrectinib) from Bayer and Loxo Oncology—hasn’t enjoyed the same commercial success. First approved by FDA in November 2018 to treat patients whose tumors are caused by chromosomal mismatch neurotrophic receptor tyrosine kinase (NTRK) gene fusions, Vitrakvi is now approved for use in a growing number of cancers, including lung, thyroid, gastrointestinal cancers, and others. However, despite its clinical success, Bayer has said it continues to struggle to identify patients who have the rare genetic mutation that would make them eligible for it.3 And Bayer doesn’t report Vitrakvi sales separately.4

Aitken of IQVIA says: “We are tracking about 100 drugs that have the potential to be tissue agnostic in clinical development right now. If they succeed, this will provide further impetus for appropriate testing—and science-based cancer care—taking more of the guesswork out of cancer care.”

Oral oncology options: The pros and cons

In recent years, ongoing advances in the field of oral oncology—whereby therapy options are now approved in pill form—have continued to drastically alter the landscape. The convenience of at-home administration of oral oncology medications cannot be overstated, as an alternative to regular trips to a clinical setting for intravenous infusions of traditional oncology drugs. Oral oncology agents are now available in breast cancer, leukemia, colorectal and renal cancers, multiple myeloma, lymphoma, prostate cancer, and more. More than 60% of the new active substances in cancer are available as oral formulations, according to IQVIA.

However, oral oncology regimens create specific challenges for patients and providers. “These range from affordability issues, to challenges for providers (to navigate the complexity of competing oral therapy options), to adherence (once patients must manage their drug regimens at home versus in a traditional acute care in a clinical setting), to challenging dosing regimens and safety issues that may not be recognized quickly enough by patients at home,” explains Mark Alwardt, vice president of medically integrated dispensing for McKesson.

A variety of focused support programs and wraparound services have begun to emerge to help patients manage the challenges of oral oncology therapies and improve the odds of success. At a basic level, this includes basic telemedicine options and apps that can potentially help patients to manage complex dosing regimens, remain on therapy, and manage safety issues and adverse events.

“We are using artificial intelligence (AI) and machine learning (ML) technologies to more accurately help predict or enhance the opportunities for medication-support programs to promote adherence for administration of oral oncology medications at home,” says Janmejay Singh, associate director, decision science, Axtria. “For instance, we have designed drug-adherence estimation analyses based on algorithms that can tell us what drivers will and will not keep cancer patients on their medications at home, and score these drivers based on drug adherence or non-adherence.” Such insights can inform nursing and specialty pharmacy initiatives, helping them to target the right patients at the right time to help them remain on therapy.

Meanwhile, to support patients and oncology practices, several pharmacy benefit managers (PBMs) have recently launched initiatives that are focused on addressing the challenges in oral oncology, notes Alwardt. For instance:

- IntegratedRx, a progressive oncology network co-developed by Prime Therapeutics in collaboration with McKesson, is providing holistic patient care to reduce time to therapy, improve adherence, and streamline any therapy adjustments.

- Optum recently launched Specialty Fusion, a real-time medical and pharmacy tool that gives providers therapy guidelines and recommendations, benefit coverage information (medical and pharmacy), cost information, and manufacturer-assistance programs.

- Highmark recently launched Free Market Health (FMH), a new specialty pharmacy model to streamline drug authorizations and referrals for providers; it offers a process for pharmacies to submit bids to fill prescriptions versus having exclusive contracts, and for participating pharmacies to earn additional value-based reimbursement.

Alwardt notes that “Oncology providers are also making investments to build integrated dispensaries and pharmacies that support the broader use of oral oncology drugs, based on a concept called medically integrated dispensing (MID), that focuses on quality systems and accreditation, patient-reminder notifications, and integrated patient education and medical care management.”

Clinical trial design: Addressing key shortcomings

There are currently 400,000 active trials underway across the globe, with nearly 2,400 of them addressing various cancers. However, a persistent lack of diversity in clinical trials is a big problem throughout the pharma/life sciences sphere, and it is a particularly big issue in oncology. “It’s becoming readily apparent that RCTs are inefficient, costly, and not representative, as 90% of the population of patients with cancer do not participate,” says Cardinal Health’s Feinberg.

“As a result, the findings emanating from such trials are limited and often lack critical data related to health outcomes and social determinants of health (SDOH) of diverse patient subpopulations, says Jenny Sherak, SVP and president, specialty physician services, AmerisourceBergen. “These trials provide access to innovative therapies that aren’t available yet for widespread use and offer hope for patients who have exhausted all available treatment options. However, clinical trial enrollees are often not reflective of the diverse patient populations that are in most need of the therapeutics being studied, and the benefits of clinical research tend to disproportionately favor white, male patients.”

To address the inequities, “you really need to get to the root cause of why so many clinical trials aren’t truly diverse today,” notes John Doyle, DrPH, group vice president and principal scientist for Exponent, Inc., and adjunct assistant professor at Columbia University’s Mailman School of Public Health. “It’s not as simple as setting targets to enroll specific population sub-groups in specific proportions. That’s a good start, but you also have to understand and overcome the intrinsic barriers.”

Contributing factors, such as a lack of local trial availability, restrictive eligibility criteria, transportation issues, medical mistrust, and stigma associated with clinical research, can deter or inhibit trial participation. Particularly challenging is the lingering misunderstanding as to the intent and structure of clinical research among some potential participants, notes Robert L. Coleman, MD, chief scientific officer for US Oncology Research (McKesson).

To address this common misconception, Harris of Syneos Health says: “It’s important for stakeholders to develop improved messaging to convey that when patients are enrolled in an oncology clinical trial, they get the standard of care plus the investigational agent, so they are not losing any time.”

Similarly, efforts to partner with the entire community—not just to reach out to individual patients—can help to build trust and increase the likelihood that potential participants will become aware of the trial opportunities and be more willing to enroll, adds Feinberg.

Coleman believes that when more opportunities are accessible for frequently disenfranchised populations, “you see an immediate positive effect. And importantly, increased diversity enables better extrapolation of the trial findings as to how the agent or intervention will perform after receiving approval,” he says.

Currently, around 85% of patients with cancer are treated in a community setting, rather than in a large academic hospital-based setting, yet only 3% of those patients are enrolled in clinical trials, according to Sherak of AmerisourceBergen. “Through our ION Solutions network, which works with roughly 60% of community oncology practices across the US, we are helping community practices to identify qualified patients and connect them with clinical opportunities they might not otherwise have access to,” she adds.

Another way to expand trial diversity would be to expand the eligibility criteria, which, by design, often excludes participants with comorbidities. “This is a major concern given racially marginalized groups often have a greater likelihood of experiencing one or more underlying conditions due to historical health and economic challenges, says Sherak. “If an investigational therapy, once approved, will be used among a broader patient population, it’s advantageous to expand eligibility criteria to include those with coexisting health conditions during the trial process.”

Decentralized clinical trials on the rise

As an alternative to the traditional RCT model, decentralized clinical trials (DCTs) are carried out by in multiple, localized sites, often aided by telemedicine and a network of local participating physicians. Patients in rural areas, in particular, can benefit from DCTs, as they do not require close proximity or frequent travel to large academic research institutions, notes Sherak.

“The purpose of decentralized clinical trials is to develop a more representative data set that reflects patients in the real world by reducing barriers and broadening the pool of eligible candidates,” adds Feinberg.

While the DCT may increase the initial management burden for drug companies because there are more nodes in their research network to activate, it also creates a faster, more nimble network that can generate more valuable, real-world data, explains Doyle of Exponent. “When there are dozens of sites in a decentralized clinical research program, trial sponsors can continually learn and gather real-time insights and share that with the other nodes, and they can use advanced AI and ML techniques to recognize signals earlier to improve efficiency and effectiveness of the clinical trial program,” he says.

Real-world data and real-world evidence in oncology

Doyle also points out that RWE provides an important option for closing the information gap between what’s been studied in the trial environment and what is happening in real-world prescribing situations, particularly with regard to the health-economic impact of competing treatment options. “Oncology is leading the charge with regard to RWD/RWE studies because of the overarching budget impact in terms of both the size of the population and the high cost of therapy,” he says.

“Retrospective studies have been carried out for a long time, but there are numerous opportunities to collect and study valuable RWD from multiple sources and create actionable, data-driven RWE from it,” adds Nicholas Robert, MD, chief medical officer for Ontada, McKesson’s oncology RWD and evidence business. “But it is challenging because inconsistent data quality remains a big concern that can undermine the evidentiary value of the findings.”

When extracting data from an EHR system, there needs to be a serious, detailed process to verify that the collected data is correct if it is to have any value. Even more challenging are the requirements to collect and use unstructured data from progress notes, pathology data, medical imaging, and more. “Consistent guidelines and common templates must be used to extract relevant data from unstructured sources in order to ensure uniformity and reproducibility of the results,” says Robert.

“In recent years, regulators have come to appreciate the ability of RWE to complement—not replace—clinical trial data,” adds Doyle. “But we still need to do more work collectively to close that gap and to improve generalizability of the available data by better representing diverse populations in their communities by incorporating SDOH.”

Harris believes that within the oncology setting, it’s not fair to randomize patients to receive the standard of care plus placebo, or the standard of care plus the investigational drug to prove that the drug being evaluated works. “As an alternative, we can create RWE studies to develop synthetic control arms to study existing data on patients who have already been on the standard of care alone (as a virtual alternative to an actual trial arm that would study the standard of care plus placebo), to augment the clinical trials that focus on giving trial participants the standard of care plus the investigational therapy,” she explains, noting that the FDA has been increasingly receptive to this approach.

Such external control arms provide another mechanism for addressing the diversity shortcomings of today’s clinical trials by allowing outcomes to be assessed in specific patient sub-populations that were not enrolled in the original trial, adds Feinberg of Cardinal Health.

Robert notes that RWE studies have yielded first-line approvals from FDA, approvals for additional indications for an existing therapy, approved label changes related to dosing regimen, and independent confirmation of clinical trials. In fact, over the past decade, RWE has been used in the new approval or expanded use of existing drugs 31 times, including 11 drugs in 2021, according to IQVIA,5 signaling growing receptivity at FDA. Synthetic control arms have also been used to approve six drugs over the past six years (not all in oncology), based on data from registries, EHR systems, or literature reviews.

There are also exciting inroads being made in the way AI and ML can be used to derive RWE insights from RWD in oncology, particularly to address patient adherence challenges, notes Singh of Axtria. In a recent example, Axtria conducted a deep analysis using these technologies to help determine the probability of whether chronic lymphocytic leukemia (CLL) patients would continue or stop taking their specific targeted therapy over a longer-term based on the impact of the comorbidities they had. “We used a number of advanced data-analytics and machine-learning techniques that helped us identify the most important factors that could be attributed to a patient’s discontinuation of their therapy,” explains Singh. “These types of analyses could help enhance communications from drugmakers to physicians, to help them take effective steps to manage a patient’s disease burden.”

Another use of AI and ML-based analytics has been to design studies that can identify patient pools that are most eligible for a promising new cancer therapy when the product is launched on the market. “Such an application of advanced data-analytics techniques involves identifying ‘look-alike’ patients based on key patient behaviors and patient-history, medical-journey patterns that then assigns an ‘importance’ score to these factors,” says Singh. “Such insights can help to pinpoint the best opportunities for drugmakers to educate and communicate with healthcare providers, and create precise field force-detailing plans about the therapy, based on the probability of patient adoption.”

IQVIA forecasts that more than $300 billion will be spent on cancer medicines in 2026. “When we look back periodically and reflect on what was in the pipeline, what’s come out of the pipeline, and the uptake of the new drugs and improvements, we can see what a remarkable journey we’re on, and the scientific advances will keep that progress moving forward for at least the next decade,” says Aitken.

References

1. The Global Use of Medicines 2022—Outlook to 2026, Published December 2021, IQVIA Institute for Human Data Science; https://www.iqvia.com/insights/the-iqvia-institute/reports/the-global-use-of-medicines-2022

2. Global Trends in R&D 2022—Overview Through 2021, Published in February 2022, IQVIA Institute for Human Health Data; https://www.iqvia.com/insights/the-iqvia-institute/reports/global-trends-in-r-and-d-2022

5. IQVIA Global Trends Report, p. 13.

6. Global Oncology Trends 2021—Outlook to 2025, IQVIA Institute for Human Data Science, Published in June 2021; https://www.iqvia.com/insights/the-iqvia-institute/reports/global-oncology-trends-2021