New Trends in Sales Force Organization

The latest IT offerings for sales force automation—including new AI tools—promise a more effective pharma sales process.

Like many other aspects of healthcare, pharmaceutical sales and marketing practices have been changed by the COVID-19 pandemic. The most noticeable initial effect, of course, was the rapid diminishment of face-to-face sales encounters. Pharma sales positions were cut back (ZS Associates notes that they have now rebounded to around 81,000 positions in the US), while video calling went up, but overall healthcare utilization plummeted as fewer patient visits with doctors’ offices occurred and fewer elective procedures were performed. According to IQVIA’s “The Use of Medicines in the US 2023,” prescribing levels (excluding COVID vaccinations) only recovered in Q4 2022 to the level they had in the first few months of 2020.

Overall, the pandemic accelerated many changes that were already occurring prior to 2020. The pharma industry had been adjusting to a rising number of “no-see” physicians (who were also increasingly becoming health system employees rather than independent practitioners). Health system consolidation was centralizing prescribing and formulary decision-making. And the industry itself has moved more deeply into specialty pharmaceuticals, which have a more complex prescribing profile and need a wide range of diagnostic or ancillary services to complete a therapy decision.

Meanwhile, the service providers to the pharma industry for sales and marketing support have continued to evolve. Video conferencing services have become routine. IT developers of sales force automation tools are expanding their range of capabilities. The latest hot trend—the emergence of “generative AI” as best exemplified by a system called ChatGPT—is attracting attention and investment from a range of technology organizations. (ChatGPT, whose current platform version is GPT-4, is owned by a nonprofit company called OpenAI Inc., which has a commercial arm that has attracted over $10 billion from Microsoft.)

Evolving commercial models

Numerof & Associates, a St. Louis healthcare consulting firm, finds that 85% of survey respondents agree that “digital content and virtual meetings will remain significant components of the customer engagement model, even if access restrictions [some of which were imposed during the pandemic] are relaxed.” The survey, “The Future of the Commercial Model: Post-Pandemic Insights,” was performed in late 2022 and follows on a similar survey in 2020. In that year, many respondents expected the industry—and its commercial models—to revert back to pre-pandemic forms, but now, there is a consensus that traditional ways of doing business are history.

Another market-research firm, Gartner, issued a report on life sciences customer relationship management (CRM) in late 2022, noting that the drive toward more digital capability, and the changing role of sales reps, has been gestating for a long time, but is now a more urgent need. "Gartner introduced the idea of a 'concierge' sales representative, which is a digitally enabled sales representative, a decade ago. However, it never reached mainstream adoption, as many life science brands preferred not to change their business models for fear of revenue disruption," the report said. "The pandemic has changed that calculus. Digital 'concierge representatives' won’t be asked to drop off samples or engage in two-minute elevator speeches, but rather, will invest significant time nurturing long-term relationships with their customers. Face-to-face engagement will change from the inside-out, ‘I have a presentation for you,’ to the outside-in, ‘What do you need from my organization, and how can I facilitate that?’”

Five recurring themes emerge from market studies like these and industry commentary:

- The need for managing both face-to-face and digital interactions, preferably with a unified system that can accommodate call reports or feedback from any channel. The older concept of “multichannel” marketing has given way to today’s “omnichannel” approach.

- The emergence of so-called hybrid reps (adept at multiple channels) and/or the development of inside-sales or call centers that complement field sales. This trend also takes advantage of the employee trend toward work-from-home arrangements.

- The availability of more, and more in-depth, data on both patients and prescribers, the former to analyze market potential and performance, and the latter to recognize key influencers among healthcare professionals (HCPs) and to feed that into the reps’ sales plans.

- The steady growth of artificial intelligence/machine learning (AI/ML) capabilities, starting with an earlier era of CRM-generated “recommendations” for sale reps’ actions, to the current “next best action” for reps or for marketing managers, to the future potential of generative AI like ChatGPT and similar IT tools.

- The growing importance of consolidated health systems and pharmacy benefit managers, whose decisions on physician access, therapy choices and drug formularies dictate market access for manufacturers. This business condition, in turn, drives the need for key-account management teams in sales forces.

“Back in the day, ‘multichannel’ simply meant putting out your content in whatever channel you could—via print, on a website, in an e-mail, and so forth,” says Parker Richardson, VP, omnichannel strategy and operations, Astellas Pharma. “The shift to omnichannel is twofold: understanding, via deep analytics, the journey that a prescriber is on and helping to orchestrate that journey; and then recognizing the content that would benefit the prescriber and delivering it.” Rather than tailoring content to multiple channels, he says, the process should begin with understanding what the prescriber needs to know, and then delivering it via the channel that prescriber prefers.

New platforms

The generally acknowledged market leader in life sciences CRM is Veeva, which states that it reaches 80% of the global market for life sciences sales reps (and even more in the US). Veeva pioneered cloud-based CRM in the mid-2000s, and has also grown a substantial business in managing IT needs for clinical research. Late last year—and in more detail at its recent Commercial Summit in Boston—it announced that it was leaving the platform it was built on, Salesforce.com, and building its own, called Vault CRM.

Salesforce.com happens to be broadly used in CRM in many industries and types of business, and competitors to Veeva, including IQVIA (and Salesforce itself, in certain applications), use that platform. Veeva says that this will be a seamless transition for users, but as Paul Shawah, EVP, commercial strategy, puts it, “Customers can choose a ‘lift and shift’ approach to transition from the old platform to the new one, or a ‘refresh’ approach to revamp their sales structure while transitioning.” The transition will begin in early 2024, and continue until 2030, when Veeva’s partnership with Salesforce.com will expire. At the same time, Veeva is moving closer to Microsoft, by enabling Microsoft’s Outlook (for email) and Microsoft 365 (the former Microsoft Office) to be seamlessly integrated with Veeva CRM.

Veeva announced some significant new offerings at that Boston meeting. One is a service center extension, tailored to supporting inside sales teams while linking seamlessly to Veeva CRM. Another is an expansion of its Compass data service, with anonymized patient data available now, and predictive prescriber and national-markets data available next year. (This product competes directly with a variety of services offered by IQVIA, which are currently available to pharma clients using Veeva CRM via third-party agreements; the new service is supposed to eliminate these agreements. On the other hand, Veeva and IQVIA have been engaged in legal actions against each other since 2017.) A third offering, CRM Bot, will be described later.

Orchestration

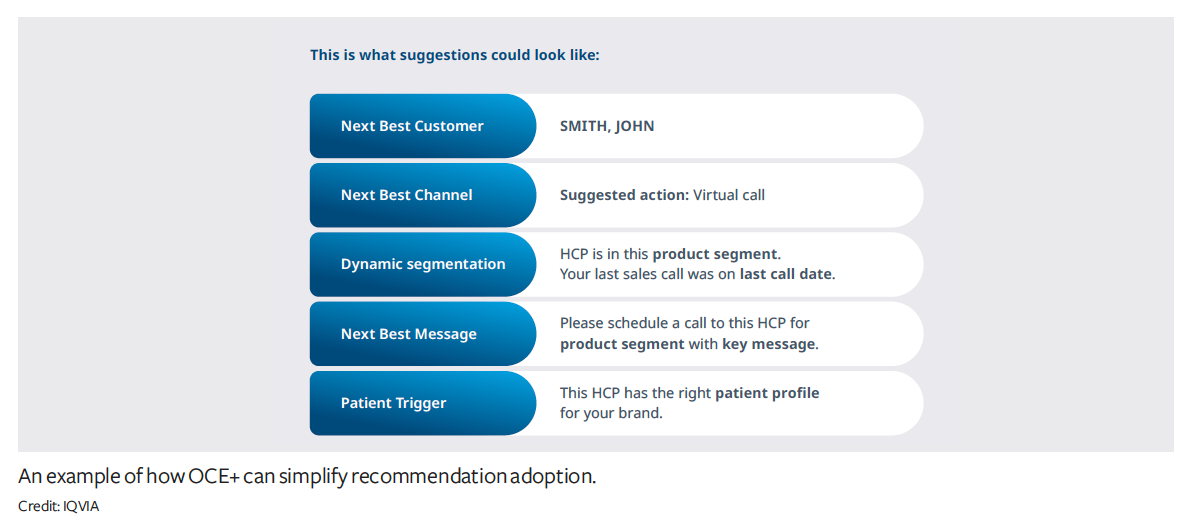

Over at IQVIA, the focus in recent years has been its Orchestrated Customer Experience (OCE), which enables the company’s rich data prescribers and markets to be integrated with the Salesforce platform. OCE has been upgraded recently to “OCE+”, the difference being the incorporation of a product from the company called the “Next Best recommendation engine.” “Next Best” refers to the process of identifying a preferable action to take (send a doctor an e-mail, engage with the medical science liaison, etc.) for reps or marketers to take, based on the data on hand and a set of business rules or algorithms (see chart above).

“IQVIA is uniquely positioned to bring together data, analytics, technology, and AI/ML capabilities all under one roof,” says Sanjay Chikarmane, chief product officer, IQVIA. “With OCE+, our customers can make smarter and more informed decisions through embedded intelligence that surfaces the actionable insights they need, when they need them, to better personalize the HCP experience and improve business results.”

The next-best action approach has been kicked around for several years by various IT firms and business consultants. Earlier versions had the problem of recommending self-evident actions or simply ineffective ones. But as AI tools have improved, acceptance is growing. Saby Mitra, principal, digital customer experience, at ZS Associates, has followed the evolution of the next-best concept for nearly a decade.

“Back in 2015, industry was not warming up to the idea of winning with better analytics [like next-best action]," he says. "In the 2015-2018 period, we saw basic business rules being implemented, i.e., ‘if you’re falling behind plan, do this.’ Now, these recommendations are becoming more predictive: ‘this doctor will have x patients for a therapy, and there is a high likelihood that the HCP will appreciate this relevant content on your next call.’”

Like IQVIA, ZS has a stable of data services, now combined with AI/ML tools, under the brandname Zaidyn. The company is also a high-level partner with Veeva, providing implementation services and consulting for life sciences sales and marketing teams. Mitra says that the earlier (2015-2018) instances of next-best actions generated sales bumps of 4-5%; now, with the latest range of AI/ML tools, that has nearly doubled.

One of these ZS data services, Affinity Monitor, has records on 800,000 HCPs. Within Zaidyn, use of Affinity Monitor enables marketers to analyze HCPs’ preferred channels; follow-up actions can range from looking for clinical trial candidates to assembling reimbursement information for patients. Mitra says that an evolving area of interest is accounting for the social determinants of health, itself a growing area of interest for deeper insight into patient behavior. Most recently, ZS announced a partnership with Informatica, a developer of master data-management tools, to combine Zaidyn with Informatica’s Intelligent Data Management Cloud (IDMC), creating (in the industry lingo) a “data fabric” across a range of data sources.

Veeva plans to jump more deeply into the AI game with a product called CRM Bot, which, when introduced in an expected 2025 timeframe, will employ ChatGTP resources to provide to reps not just next best actions for reps on prior call reports or channel preferences, but even to predict HCP needs by drawing patient data from Veeva Compass (a compilation of healthcare data) and Link (a compilation of HCP activity).

ChatGTP is a type of “generative AI” that, in this case, builds content or analysis based on “large language model” training. Google, Microsoft, and a host of other IT firms are racing to build comparable systems. Whereas everyday computer users have been experimenting with ChatGTP tools to create documents, songs or graphic images, even writing computer code, its use in pharma will require training on the data stored in pharma’s own repositories. Veeva notes that each pharma customer will be using its own data for training, not industry-wide databases.

The near-term objectives for tools like CRM Bot will be internal documents, such as reps obtaining an AI-generated summary of their customer lists and call plan goals. Marketing managers might use it to speed development of a marketing plan. However, there is a significant obstacle to creating documents or texts that might be sent outside the organization—even something as straightforward as an e-mail response to a physician query. All such communications depend on a prior legal and/or regulatory review. The experience of everyday computer users to date has shown that ChatGPT and related AI systems can make mistakes or create false narratives—and the consequences of that in a healthcare context could be disastrous.

“I think the jury is still out on these AI tools,” says Mitra. “The technology has clearly created excitement, but so far it hasn’t been used in a regulated industry like pharma.” He also sees it as being complementary to, and not a replacement for, AI tools like neural networks or ML. He adds that ZS has a workgroup devoted to developing this technology; eventually it and its pharma clients will find a way forward. Meanwhile, there is an intensifying debate within IT circles over creating guidelines for safe development of AI technology.

Still, there is a sense in industry that exciting new capabilities are just around the corner. “I’d like to see an application that goes beyond next-best action,” says Richardson. “For example, could reps ask for a system to tell them how to run their territory for the next three months?” He sees the value of well-qualified reps as more important than ever; but given the investment that the pharma industry makes in its field teams, there is potentially more value to be obtained.

The traditional lament of commercial operations in pharma has been overcoming the difficulties of siloed functions, both geographically (for global firms) and operationally in the duplicate efforts and lack of collaboration. IT providers have come a long way in weaving the disparate data of commercial operations into a unified “cloud” or “fabric"; the hope is the same can happen in a workforce context.