If CVS Health-Aetna doesn’t happen, something else will

Rumors of a $60-billion acquisition shake up healthcare services landscape—and what about Amazon?

Years ago (2006–7, to be precise) CVS Pharmacy shook up the pharma-distribution world with a drawn-out merger battle with Caremark, then one of the largest pharmacy benefit managers (PBMs) in the country. Conceptually, retail pharmacies and PBMs were in competition with each other over the healthcare dollar, and although the merger succeeded, and despite financial analysts expecting a de-merger years after, the company has succeeded to the point where it is a $177-billion healthcare behemoth, among the top three companies in both retail pharmacy and PBM sectors.

Fast forward to October 2017, and the company, now called CVS Health, is at it again with a rumored bid for Aetna, the national health insurer, for some $66 billion. As this issue goes to press, the action was still unconfirmed, but even if it’s called off or modified, the pressures are mounting for the PBM industry (and health insurers, who have been battered by the swings in the Affordable Care Act over the past year) to do something fundamental for their future prosperity. Consider that the week before the rumors started, CVS Health had announced (on Oct. 18) that its Caremark unit would provide infrastructure and services to Anthem, Inc., another national health insurer (and the one, it so happens, that had been the subject of a disqualified merger with another insurer, Humana, while Aetna had been dallying with Cigna, in another proposed merger that the Dept. of Justice also squelched). Anthem intends to launch its own PBM, called IngenioRx; whether it goes forward with CVS Caremark depends on the outcome of the Aetna bid (and the terms of the CVS Caremark-Anthem agreement, which was said to have a five-year term).

PBM-insurer alliances are not extraordinary; United Health operates the Optum PBM, and CVS Health and Aetna were already working together through an agreement that has the former managing the latter’s pharmacy benefits.

Amazon lurks

Back of all of this is the attention being paid to Amazon, which has yet (after a couple months of rampant Wall Street speculation) made a bid to enter retail pharmacy. Speculation in earlier months was that if Amazon moves into pharmacy, its most direct path is to acquire a PBM (Express Scripts, which is a pure-play PBM and one of the largest in the sector, is the speculated target). An Amazon entry into drug delivery would put mail-order pharmacy on steroids and isn’t that much of a stretch, since the company is already selling major quantities of OTC, health and beauty products, and food (which has been a growth area for chain pharmacies). According to a St. Louis Post-Dispatch report, Amazon has already obtained licensing to be a drug distributor in 12 states.

This leads to the most eye-catching quote, in a New York Times write-up: “Pharmacies, drug wholesalers and benefit managers are trembling at the prospect of competing with Amazon,” according to Erik Gordon, a business professor at the University of Michigan.

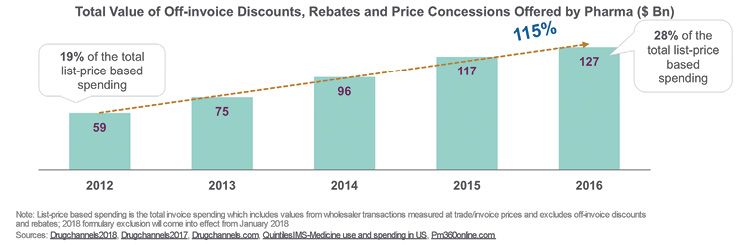

What are the consequences for the pharma industry? It has already been adjusting, in recent years, to the concentration of the leading PBMs, who can control wide swaths of the healthcare market through the tens of millions of lives their plans cover. Numerous financial observers speculate that there are savings in drug costs to be had, but it’s an open question as to how much farther PBMs can drive costs down, even while they, and health systems, profit from fees and rebates extracted from a drug’s nominal market price (see figure). A more interesting question is how much of the patient services that now accompany drug dispensing (especially for specialty products, which already represent 20% of the overall drug spend, and are nearing 50% of the drug spend in commercial insurance plans). And while drugs still represent somewhere between 10 and 20% of the healthcare dollar (depending on how that dollar is defined), healthcare services are the rest, and insurance companies tussle with health systems over who gets what part of that fraction.