Biosimilars represent a $56-110-billion savings potential in 2016-2020, says IMS Institute

Experience--mostly in Europe--indicates a heavy educational burden for patients and physicians

The IMS Institute for Healthcare Informatics has looked at how the biosimilars market is evolving, finding that there will be substantial savings to payers in the 2016-2020 time frame. However, those savings, which top out at a potential $112 billion over the five-year period, are likely not to show up in payers' bottom lines: still undefined is how lower-priced biosimilars can expand the market for a drug (the biosimilar as well as the originator drug, if its price comes down when biosimilars enter). In the case of filgrastim (originator drug: Amgen’s Neupogen; there are now multiple providers globally and one of them, Sandoz, achieved the first approval in the US last year under current biosimilar regulations), usage more than doubled in the 2009-2014 period in the UK.

click to enlarge

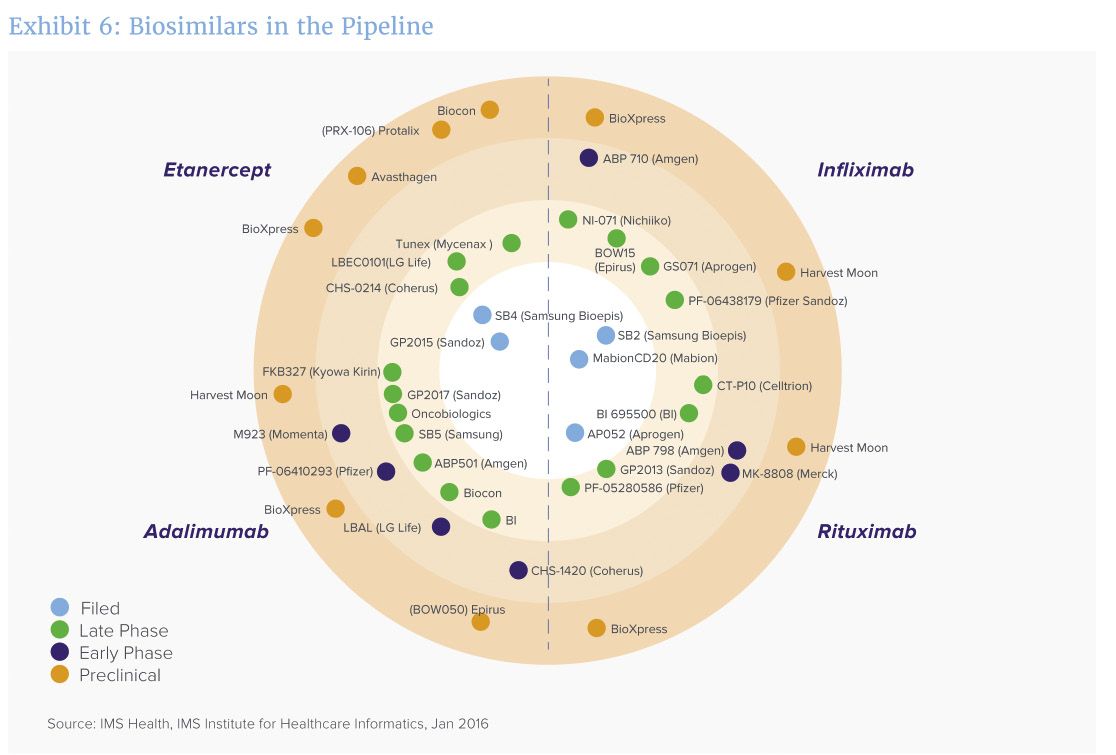

A bullseye view of how closely biosimilar manufacturers are approaching approval.[/caption]

“We are on the cusp of a surge in biosimilars entering the market in the next five years,” says Murray Aitken, IMS Health SVP and executive director of the Institute, noting about 50 biosimilars are under active development, with 41 of them targeting four key biotech blockbusters (see chart): Remicade (infliximab, from J&J); Enbrel (etanercept, from Amgen); Rituxan/Mabthera (rituximab, from Genentech/Biogen Idec) and Humira (adalimumab, from AbbVie). Some of the biosimilars are already on the market in some countries.

Traditional thinking about biosimilars held that the drug would enter the market at around a 30% discount from the originator; the originator drug might come down in price somewhat, but both could be sustained. The reality is that the discounting is all over the lot, ranging from 27 to 50% in many cases, and even higher in others. Having multiple biosimilar providers is key; but IMS Health notes that various EI countries have had differing experiences, based on how restrictive their policies are for demanding discounts and for managing the overall market for a drug.

Moreover, in some countries, the national health organization supported patient and physician education, which fostered higher levels of utilization and, ultimately, a more competitive market with multiple providers. How the US’ Centers for Medicare and Medicaid Services (CMS) intends to incentivize biosimilar competitors—by providing for a “blended” reimbursement rate that combines the pricing of all entries in one biosimilar market—could prove to be a big disincentive, since one manufacturer with a heavy discount could drag down the prices of all other entries (a situation not unlike some small-molecule generics, where progressive discounting drove all but a few—or one—manufacturer to leave the space).

Recent surveys of US physicians finds some awareness of biosimilars, but a need for considerably more education and information. If payers (or their representatives, such as pharmacy benefit managers) sinmply negotiate a relatively low rate for biosimilars, and do little to encourage their use, the biosmilar market might struggle in the future. And, although there is the beginning of a biosimilar market in the US, says Aitken, it is “still dependent on policies not yet fully rendered.”

The report is available here.