Publication

Article

Pharmaceutical Commerce

2020 Patient Support / Hub Services Report

Author(s):

Dramatic growth tracks the flood of new specialty pharmaceuticals entering the market

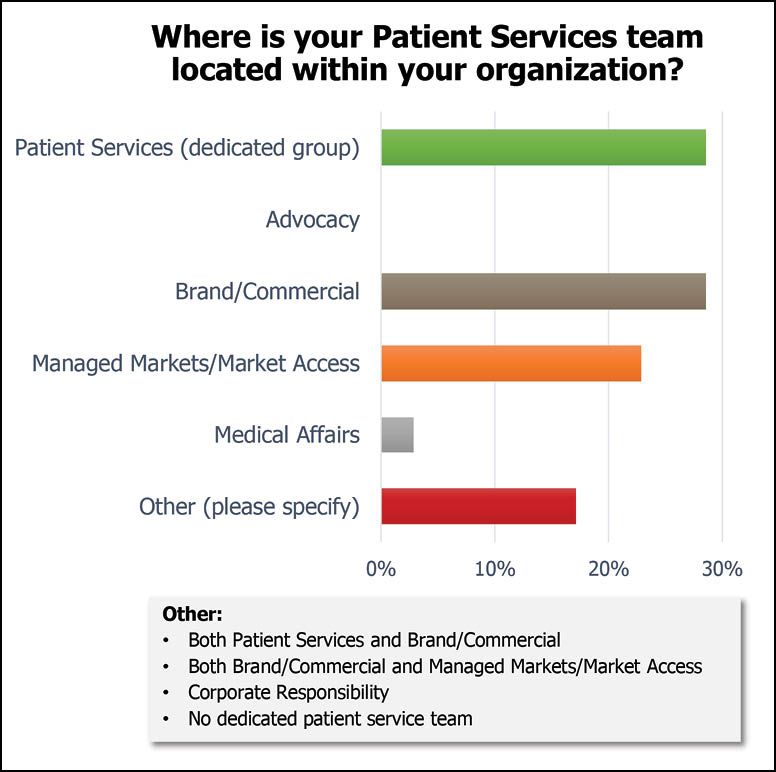

Fig. 1. Helio Health’s 2019 Hub survey finds a diverse split as to where patient support services are located within pharma companies. Credit: Helio Health

Patient support services—supported directly or indirectly by pharma companies—have gone from a ‘nice to have’ feature to a ‘must have’ one in recent years. The reasons are not hard to find: the growth of specialty pharmaceuticals (now representing nearly half of the drug-spending dollar in the US); the complexity of treatment, requiring administration by infusion (for example), and genetic and diagnostic testing; and the high cost of those specialty products, making successful treatment a high-stakes commitment by patients and payers.

Pharmaceutical Commerce has been tracking the evolution of this field for nearly a decade. In this year’s review, several trends have become apparent: more extensive digitization of the services, including mobile interaction; a stronger push toward in-field services (at patients’ homes, or at doctors’ offices); and a stronger drive toward providing so-called “end to end” services, ranging from patient acquisition, through drug dispensing, and on to followup care. That drive is compelling a wave of acquisitions, as various organizations build out a more complete suite of services. However, at the same time, new organizations are springing up, swelling the slate of service providers and service options.

All that being said, it remains remarkable how disparate the field is, with software developers, data aggregators, nursing and clinical education providers, and call-center case managers all playing a role. Pharmaceutical Commerce prefers the term “hub provider” for those organizations that bring all these and more services together; even so, numerous organizations shy away from the term. Meanwhile, specialty pharmacies continue to raise their profile with pharma manufacturers as a viable alternative to patient support.

One reason for the lack of clarity is how pharma itself looks on the topic. According to a broad survey by Helio Health, a consulting firm for commercial compliance, pharma companies differ in where patient support is located in the organization, including whether or not it is carried out internally. As Fig. 1 shows, “patient engagement” ranges from a dedicated corporate function to a subsidiary of brand/commercial teams, managed markets, or medical affairs.

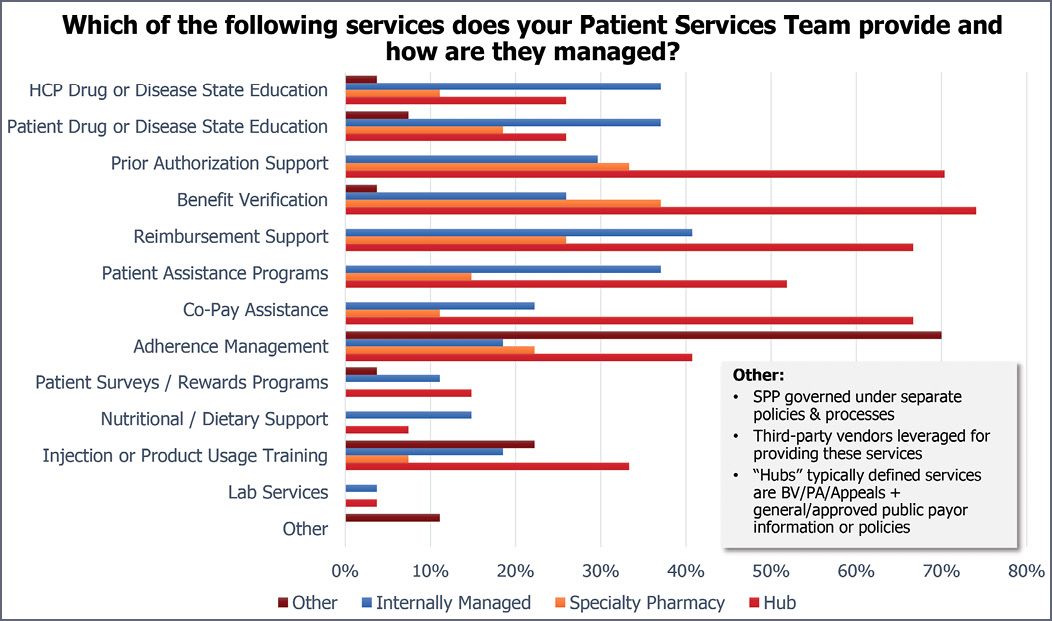

That same Helio Health survey also provides revealing data on trends in patient support. Fig. 2 shows that outsourced hub providers are most heavily utilized for managing prior authorization (PA), benefit verification (BV) and reimbursement support/patient assistance programs and copay assistance—all areas with significant regulatory risks when not properly handled. the Helio Health data show an increasing involvement of specialty pharmacies (SPs) in these areas, as well as adherence programs.

As numerous sources interviewed for this report state, PA and BV support are “table stakes” for the patient support field. Automation in this area, as will be shown later, is a big driver.

End-to-end, for real

A recurring theme among service providers is the goal of “end to end” solutions. The meaning changes slightly from one vendor to another; in some cases, it includes patient support in clinical trials; in other cases it includes providing field sales support. This comprehensive approach has driven significant M&A activity in the past year:

- TrialCard, long known has a leading provider of copay support programs, acquired a closed-door pharmacy, PC Scripts in late 2018; it is now licensed inall 50 states to support free-drug programs and PAPs. In 2019, it acquired Rx Solutions, which offered both copay programs and support for clinical trial patients; Mango Health, a mobile-app developer in support programs, and Policy Reporter, a database developer of insurance and hospital formulary-practice data, used by pharma for market access research.

- Eversana, already a conglomeration of distribution, channel management and patient services, added Cornerstone Research Group, a Canadian specialist in health economics and outcomes research (HEOR) in October, Alamo Pharma Services and BexR Logistix Telesales, for field sales, in May, and Seeker Health, an analytics firm for identifying potential patients for trials, in late 2018. It also opened a new consulting practice early this year, Eversana Consulting, and a marketing services agency, Eversana Engage.

- Diligent Health Solutions, roughly a year old now, acquired WRB Communications, a patient-support call center, from Diplomat Pharmacy late last year; the acquisition returns a business that one of the principals of Diligent had sold to Diplomat in 2017. Diplomat itself, once the leading unaffiliated specialty pharmacy, was absorbed into Optum, one of the leading pharmacy benefit managers, earlier this year. (It’s also worth noting here that Optum also acquired another leading specialty pharmacy, Avella, in 2018.)

“End-to-end solutions provide benefits to the pharma sponsor as well as to the patient,” says Joe Abdalla, chief commercial officer at TrialCard. “It’s one point of contact for the pharma company, and the patient has a better experience from enrollment, financial support, dispensing and longterm engagement. The better experience from this can result in better outcomes.”

Bhaskar Sambasivan, President of Patient Services and Chief Strategy Officer at Eversana, notes that an integrated solution is a powerful benefit for small to mid-size companies, who might not have the investments needed to get products out of the lab. Eversana’s ability to provide complete commercialization support – innovative programs that combine patient access, distribution, 3PL, agency services, field solutions – end-to-end – is a game-changer, he believes.

Fig. 2. The Helio Health survey shows that hub service providers are the dominant resource for financial factors—copay, PAs and BVs, and reimbursement support, while they and other third-party vendors dominate in adherence support. Specialty pharmacies’ role in all these areas has increased since the 2018 survey.

Patient support plus

Eversana scored something of a coup with a pharma client, Evoke Pharma, at the beginning of this year. Under a comprehensive, multi-year agreement, Eversana is taking on a full range of commercialization services for Evoke’s Gimoti, a nasal spray formulation of metoclopramide, for the relief of symptoms associated with acute and recurrent diabetic gastroparesis. Evoke expects FDA approval in June.

Not only is Eversana handling patient support services after the drug is approved; it is also managing launch, distribution and sales. (As distinct from many companies involved in patient support services, Eversana has substantial—and recently expanded—third-part logistics facilities.) The company will receive reimbursement of certain costs and a percentage of product profits in the mid to high teens when Gimoti net sales reach a preset milestone. Eversana is also providing a $5-million revolving credit to Evoke, subject to FDA approval.

“Eversana has been built up over time to provide exactly this sort of integrated service to a pharma manufacturer,” says Greg Skalicky, chief revenue officer at Eversana. “Most small pharma companies, if they’re not planning to commercialize themselves, look either to out-licensing, or being acquired. We’re providing an alternative option.”

Connecting early with an emerging pharma company is also an objective of PharmaCord, a relatively young (two-year-old) hub provider based in Louisville, KY. “We’re willing to make bets [on an emerging company’s eventual success],” says Nitin Sahney, CEO, who says that the company’s current mix of clients is half existing brands, and half companies involved in product launches. “We’ve been getting engaged 12-14 months before launch.” That willingness to take on risk might be part of the company’s success: Sahney says the firm is on track to nearly double its staff (to 400) by the end of this year; it is also planning to double again by 2023—and is building its own operations center in Jeffersonville, IN, to accommodate that future growth.

Wholesaler offerings

Each of the Big 3 wholesalers has a comprehensive patient services function; AmerisourceBergen’s is arguably the oldest, centered on Lash Group, complemented by third-party logistics, specialty product distribution to physician offices, and specialty drug pharmacy. Cardinal Specialty Solutions is centered on its Sonexus hub service (acquired in 2014), along with specialty distribution services. McKesson Life Sciences was restructured in 2018, bringing together the acquisitions Biologics (a specialty pharmacy), RxCrossroads (a hub service provider) and existing businesses in patient support.

“My first job in McKesson in 2003—my first general manager job—was running our specialty pharmaceutical business … and candidly, we probably weren’t too relevant,” Brian Tyler, McKesson CEO, told attendees of the JPMorgan Healthcare Conference in January. “But over the course of the last years, we’ve very systematically built great franchises in these markets.” Tyler used the occasion to tout a new McKesson product, Access for More Patients (AMP), which combines patient support with the data and service offerings of CoverMyMeds (a $1.3-billion, 2017 acquisition). (More about AMP later.) Tyler noted that specialty is among the “key channels that we’re in and our key manufacturer service business that leverages off those channels.”

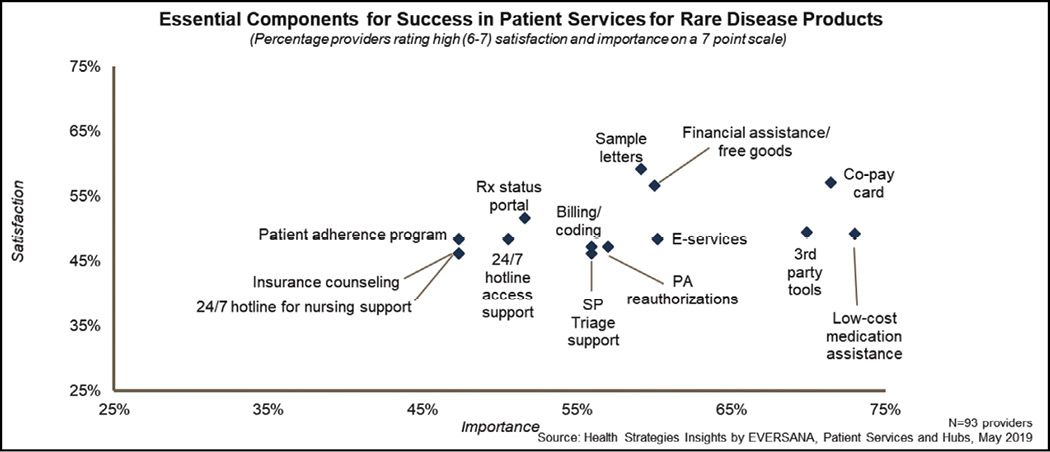

Fig. 3. Data from Eversana shows how rare-disease patients rank the services provided by a hub: financial support via copay cards or low-cost medication are highly important and engender higher satisfaction. Across the board, most of the services are at the 50% satisfaction level.

The hybrid option

There’s no question that an end-to-end solution provides simplicity in project management; nevertheless, there can be significant reasons to pick and choose among service offerings from multiple vendors. For one, a manufacturer might choose to retain some part of the patient-service offering internally, while outsourcing other parts—the so-called hybrid solution. For another, pharma management might prefer a best-of-breed solution in several distinct areas of patient service.

And while most patient support vendors offer a broad range of services, some of them put an emphasis on one or another of their capabilities. “We do everything except field services,” notes Anthony Bianchini, VP and GM, pharmaceuticals and life sciences, at Conduent. As befits its historical roots as part of Xerox business services, the company has resources and expertise to process “millions” of documents or transactions across a range of industries, he says. That capability works well for handling patient enrollment, benefits verification and prior authorization paperwork—all key components of getting patients on therapy quickly. Conduent also has the advantage of being a global organization, thus able to conduct patient outreach in multiple geographies. And while it does have staffing in nurse educators for patient interaction, Bianchini touts the company’s IT system, branded as IntelliHealth, to digitize many interactions (for example, email or text), and then direct case managers more toward exception management.

Another benefit of Conduent’s broad reach, says Bianchini, is its substantial business with healthcare providers. The company is developing a network that would quickly link patients who need diagnostic services (a common element in dispensing specialty pharmaceuticals) with the laboratories that provide such testing. “Driving service costs down, while providing a better patient experience,” he sums up.

The flip side of that capability, perhaps, is seen at Covance, which has long experience in patient support in both research and clinical settings. “We have field teams for clinical education, reimbursement support at doctors’ offices, and even field training of other field personnel,” says Adrienne Stofko, senior director in the Patient Services Group. “Some of our field personnel transition to the client pharma company” while performing this role.

To be sure, Covance also has internal staffing, IT systems that collect data and other features of a hub provider. The driving force in its offering, she says, “is to move beyond the current paradigm” of responding to a query in a certain number of minutes, “to measuring outcomes, patient quality of life—a more holistic view of the patient experience.” To that end, the Patient Services Group also taps into a health economics and outcomes research (HEOR) group, which can provide guidance to pharma clients in program design and operation.

Yet another perspective is offered by Human Care Systems, where the emphasis is on the combination of a comprehensive IT system, branded as Resilix, and what it calls “treatment experience nurses” who work with patients (usually electronically) to improve adherence. The cloud-based Resilix platform, says Thom Doyle, CEO, is designed to provide a 360° view of the patient experience by interfacing with both electronic health record (EHR) systems at health systems, and the relationship-management systems at hub providers or at the pharma clients themselves.

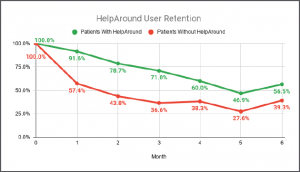

Fig. 4. Results of an adherence program for an unspecified pharmaceutical, according to the ‘mobile concierge platform’ of HelpAround. Credit: HelpAround

Mention of relationship-management software highlights a powerful driver of hub service evolution: the development of IT platforms for collecting, recording and analyzing data from channel partners, health systems, pharmacies and even patients themselves. Within the hub service, the IT platform manages workflow for case managers and care coordinators themselves.

When it comes to these enterprise systems, there are those that are built on SalesForce software and the SalesForce Health Cloud; and then everyone else with home-grown systems. Deloitte’s ConvergeHealth software-development company, as well as Accenture, Cognizant and other systems integrators, take the SalesForce platform and configure it to the requirements of each client (which are the hub services, and the pharma manufacturers themselves). The process is said to be expensive and time-consuming—but the systems work.

Cardinal Health Specialty was an early adopter of the SalesForce.com platform for patient support; in its case, it hired Deloitte ConvergeHealth the build the system, and then customized it and branded it as ConnectSource. “We’ve been stable in our implementation now for a couple years,” says Steve Jansen, VP of technology at Cardinal, “but we continue to evolve it.” A key benefit, he says, is that a new client can be onboarded with a tailored ConnectSource system in a matter of a few weeks—a vital consideration given that the company has had some success, it says, in winning switchovers from one hub service to Cardinal’s.

The company has published a case study on one such switchover, noting that the disruption in moving patients from one set of case managers to another, along with all the data collection and interfacing can lead to a 5-10% loss in revenue for the manufacturer if not handled well.

Eversana is in the process of building out its SalesForce implementation; Conduent is up and running with its version. But other hub providers interviewed for this report—TrialCard, PharmaCord, CareMetx—pride themselves on their home-grown systems. Human Care Systems Resilix platform uses a “document-based” database program, MongoDB, said to streamline extracting data from other data sources. CareMetx says that it has built numerous application programming interfaces (APIs) in its CareMetx Connect platform, to work with Salesforce and other systems; it also licenses its software out to other parties. PharmaCord’s CorSend platform has its own API tools.

“We wanted to be agnostic in the IT platform we provide,” says Trialcard’s Scott Dulitz, chief strategy officer. “Building our own platform enables us to work with many EHR systems at healthcare providers, and pharmacy management systems at pharmacies. In fact, we’ve had multiple integrations with the SalesForce systems at pharma clients.”

McKesson has combined IT, data and services in the aforementioned Access for More Patients (AMP) service, which went live late last year. The offering is based on CoverMyMeds software and data, which automate the processing of prior authorizations paperwork, together with the patient care services of RxCrossroads. According to the company, patients have been shown to gain access to prescriptions (after the PA work) 27% faster than industry norms, among other benefits.

EHR interface

CoverMyMeds has the capability to interface with common EHR systems, both to provide PA documentation and a real-time benefit check at the point of prescribing.

“AMP is a new approach to patient intake by transitioning data electronically, then bringing in case managers as needed,” says Heather Morel, VP of Access & Adherence. “It can eliminate hours of non-value-added work” by case managers and healthcare providers. AMP is also helpful, she says, in cases where outsourced hub services are bypassed entirely by working with the specialty pharmacy that dispenses the drug.

Another significant feature of AMP touted by Morel is that it can interface directly with a specialty pharmacy, so that a physician using it can write a prescription and direct it to the specific pharmacy (SP) where the drug is dispensed. (Many specialty products have a limited or exclusive distribution with SPs, and the difficulty of locating the right SP is a common obstacle to getting drug to the patient.) “Today, some manufacturers want to engage SPs directly, and the ability to use the ePA environment of CoverMyMeds to speed access to therapy benefits both the provider and the patient.”

SP/Hub interaction

Mention of direct linkage to SPs raises a contested area of patient support services: whether the assistance is provided by a hub service that coordinates the various activities, or the SPs themselves, many of whom have built up staffing and resources to support patients themselves.

The SP business is one that has undergone tremendous growth, commensurate with the growth of specialty pharmaceuticals themselves. The big integrated health providers (Cigna/Express Scripts; CVS/Aetna, United Health/Optum) dominate the SP world (as they do traditional pharmaceuticals), but the ability to provide a higher level of personalized attention at independent SPs has helped their growth. Traditionally, a hub service helps to “triage” a prescription by directing it to the appropriate SP; but if SPs themselves are connected to prescribers, that loop becomes less necessary.

A look at some of the biggest independent SPs shows how they are positioning themselves to manufacturers. The “Soleo Health Difference” at Soleo Pharmacy includes a “dedicated account team from pre-launch through program implementation and ongoing support … Preferred relationships with nationally recognized prescribers, healthcare systems and accountable care organizations (ACOs) [and] Reimbursement specialists dedicated to timely insurance verification and authorizations to expedite patient start of care and assistance with manufacturer copay programs.” The company also offers a data service, branded as SoleMetrics, that provides details on “prescriber utilization and clinical outcomes management.”

“As a manufacturer-focused, patient-centric rare pharmacy, we consistently exceed our partners’ expectations,” says PantheRx, a fast-growing SP in Pittsburgh.

“Carepoint is a nationwide specialty pharmacy helping manufacturers bring new products into the marketplace by keeping in step with every stage of the process. From research and development to clinical trials and educational programs, our clinical staff will work alongside you with one goal in mind … to offer our patients the best treatment available,” is how CarePoint Pharmacy describes its capabilities.

This SP-manufacturer relationship was brought to prominence by Diplomat Specialty Pharmacy, whose annual revenue approached $5 billion until last year, when a series of missteps caused its stock to tank; it is now absorbed into Optum. Another high-flying SP, Avella, also belongs to Optum now.

“We’re not competing with SPs,” maintains Nitin Sahney, CEO of PharmaCord. “SPs can have a difficult time maintaining their margins while providing patient services, and from the manufacturer perspective, SPs are usually not brand-specific [i.e., offering only one of what might be several brands for a particular disease state]. We are.”

Meanwhile, among wholesalers, in line with being all things to all pharma manufacturers, McKesson and AmerisourceBergen provide both hub services and SPs of their own: Biologics at McKesson; United Bioservices at ABC. Cardinal Health does not have an SP business. “We’ve carried out some hub switches from an SP to us,” says Tara Herrington at Cardinal Health Specialty. “SPs need very solid firewalls between their dispensing and their contractual relationships with manufacturers,” she notes.

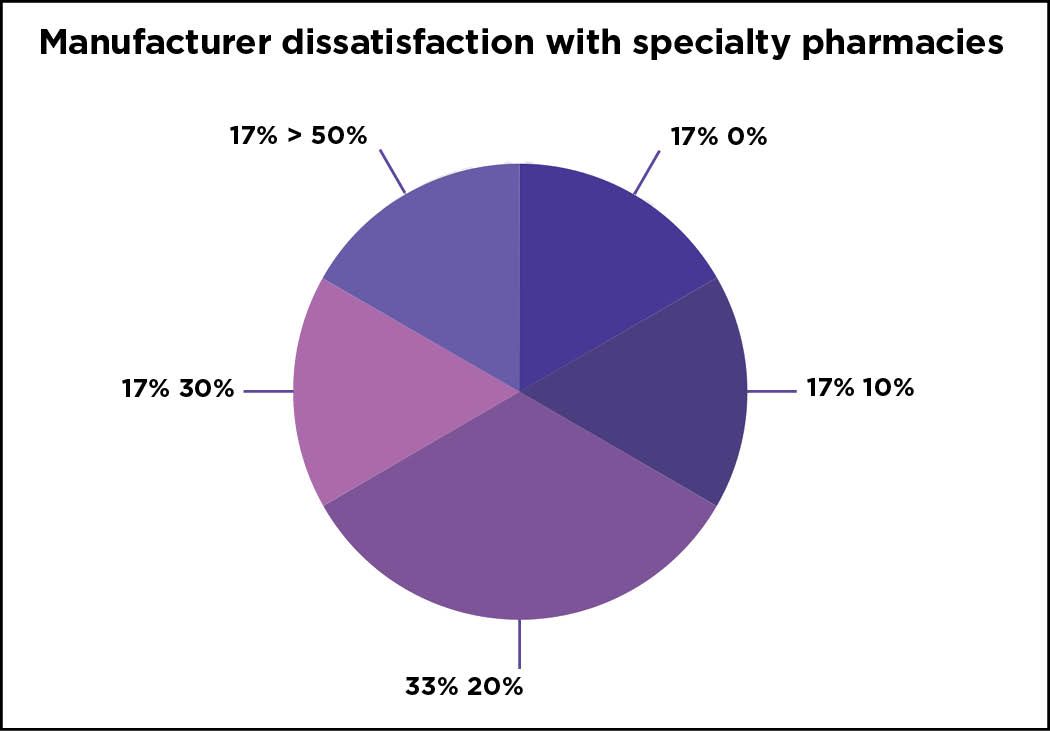

Despite the growth that many SPs are experiencing, all is not sweetness and light. A survey from CSI Specialty Group* (a subsidiary of Intalere GPO, which in turn is a unit of the Intermountain Healthcare system) found that half of SPs surveyed are constrained by insurance networks and PBM practices on the one hand, while 17% were constrained by an inability to enter limited distribution contracts on the other. At the same time, manufacturers responding to the survey said, by an 80% margin, that their patients had some sort of issue being serviced by their partner specialty pharmacies (Fig 5.)

The CSI survey also asked manufacturers about their hub-provider relationships, and here there were similar perceived shortcomings, with 83% of manufacturers reporting that “there was room for improvement in their current third-party vendor hub model,” and that “17% indicated they are not pleased and are pursuing other options.” (The implication here is that the percentage of manufacturers happy with their current hub provider across the board is zero.) Two-thirds of respondents “would like to see improvement with respect to communication between patients and providers, and half of manufacturers seek enhancements in process/workflow, technology solutions, and FTE/resource review.”

Despite this potential friction, SPs and hub providers have worked out complementary roles, and most hub providers emphasize how the “get along with” the SPs with which they interact.

(There can be some confusion for participants in specialty pharmaceutical dispensing, in that numerous hub providers have so-called “closed door” pharmacies, from which free-drug, patient assistance program, or quick-fill scrips can be fulfilled. In fact, it is a competitive advantage for the hub provider to be able to provide this service. These programs, however, do not pertain to routine prescribing.)

Fig. 5. Survey results from CSI Specialty Group show percentages of manufacturers (the first number going around the pie) that have difficulties managing a proportion of their patients (the second number going around the pie) at the SPs in their limited-distribution networks. Credit: CSI Specialty

Digitization and outcomes

There is more to the IT question than what enterprise system is chosen, or who is managing the patient interaction. The entire patient-support field is colored by gathering data from diverse sources, and presenting it in useful form to patients, providers and payers—and ultimately manufacturers.

There is a growing trend toward use of mobile technology to interface with patients, both as a means of communicating messages to them, and to gather patient-reported outcomes (PROs) from them. Use of conventional SMS texting has been commonplace for years, especially for refill reminders; now, there are efforts to communicate the status of reimbursement applications, status queries and the like.

“We’ve known we wanted to develop a virtual copay card for quite a while,” says TrialCard’s Scott Dulitz, “then the opportunity to acquire a market-leading app developer, Mango Health, came up late last year. Now, we’re working with the Mango platform to provide transparency to patients—they will be able to track enrollment applications, reimbursement actions and the like. This will be rolled out later this year.”

There are hundreds if not thousands of apps available to smartphone that have health information; the distinction here is to have an app closely tied to a hub service provider like TrialCard. Human Care Systems, developers of the Resilix CRM platform for managing the patient journey, uses text, email and click-to-chat to connect with patients even in a pre-treatment phase. The company says that a “rules-driven automatic cadences” of messages and communications both inform the patient, as well as collect responses that in turn guide adherence programs or other actions.

HelpAround, which styles itself as a “mobile concierge platform,” has had some success with improving adherence and streamlining patient communications via its app. Behind the messages and notifications sent by the system to patients, it has what it calls “hyperpersonalized” AI-based technology to tailor messages and their timing to the patient. As shown in Fig. 4, it has provided a boost for adherence for an unspecified pharmaceutical, according to the company.

Eversana’s Bhaskar Sambasivan touts the company’s recent partnership with Noom, as an example of digital patient engagement and part of Eversana’s next generation of “Patient Services 2.0” solutions that include technology and data. The goal to combining Noom’s digital therapeutic platform with Eversana’s integrated patient services model is to improve therapy adherence and patient engagement for complex therapies. Sambasivan notes that his company is working to include other behavioral data in its CRM, such as financial ratings, to help predict the level of financial assistance patients need.

There is widespread agreement that mobile communications, both from and to patients, is transforming not only patient support programs for specialty pharmacueticals, but all pharmaceutical patient interactions. In the patient-support context, though, there is thought to bringing in another element: the community of peer groups of patients taking the same drug, or suffering the same disease state. “Imagine if patients on a therapy could join a group of their peers, moderated by experts from a pharma company, to talk about their treatment,” says Valerie Sullivan, an industry consultant and former president, inVentiv Patient Access Solutions. “In general, the pharma industry is petrified of the potential liabilities of such interactions, but this kind of communication should be a more meaningful way to engage.”

Fig. 5. Mango Health / TrialCard offers a app for connecting patients with their drug therapy. credit: Mango Health

Attention to compliance

Direct interaction with patients in open forums might be a bridge too far for most pharma companies; they are continually balancing their interactions with patients with the restrictions imposed by governments. In past years, there were instances of violations in sharing protected health information of patients directly with the sales and marketing teams; this is one of the reasons for hub providers to exist in the first place—to be a clear buffer between the manufacturer and the patient.

In the past year, FDA, CMS and the US Dept. of Justice have mostly been focused on the workarounds used by some companies to provide financial support to Medicare, Medicaid and related government-insured patients; those patients are not eligible, in most cases, for copay or other financial assistance. Settlements between DoJ and manufacturers include Aegerion, Alexion, Amgen, Insys, Jazz Pharma, Lundbeck and US WorldMeds, who collectively paid hundreds of millions in fines for alleged violations of the False Claims Act and its Anti-Kickback statute. In all these cases, the government alleges, the companies paid funds into patient assistance foundations, who then reimbursed federaly insured patients’ copays. (Privately insured patients are legally allowed to receive copay assistance a manufacturer, usually through the intercession of a hub provider or copay-assistance provider.) In some of the cases, the foundation support was structured such that only one drug (of that manufacturer) was eligible for the assistance.

At least one foundation, Patient Services Inc., was also penalized for alleged violations in these patient-support efforts.

“When pharmaceutical companies use foundations to create funds that are used improperly to subsidize the copays of only their own drugs, it violates the law and undercuts a key safeguard against rising drug costs,” said Assistant Attorney General Jody Hunt of the Department of Justice’s Civil Division. “These enforcement actions make clear that the government will hold accountable drug companies that directly or indirectly pay illegal kickbacks.”

But fraud or misuse of patient support funds can come from other directions. TrialCard, which has years’ experience in managing copay programs, has been able to return roughly $10 million back to pharma companies in 2019 when it found pharmacies fraudulently claiming copay reimbursement for drugs that were never dispensed, or patients that never existed. “In the course of performing analytics on how we manage manufacturers’ copay programs, we noticed irregularities in where some of the reimbursement claims were coming from,” says Jason Zemcik, a senior director at the firm. Those irregularities were then investigated by an internal team at the company, and TrialCard was able to block reimbursement to some of the pharmacies, eventually returning the funds to the pharma client. The service has now been formalized as a TrialCard offering, RxSpotlight, and Zemcik says that the company is deepening the analytical tools it uses for this purpose.

Newsletter

Stay ahead in the life sciences industry with Pharmaceutical Commerce, the latest news, trends, and strategies in drug distribution, commercialization, and market access.