Sales growth of pharmaceuticals is slowing globally, says IQVIA annual study

US list-price sales reached $510 billion in 2019

The IQVIA Institute of Human Data Science’s annual study, Global Medicine Spending and Usage Trends, is out and while its data are a reliable measure of past years, and a well-grounded forecast of the next five years, the study does not reflect any details of the current coronavirus pandemic. In other words, pretend that the crisis had not occurred (and wouldn’t that be great!).

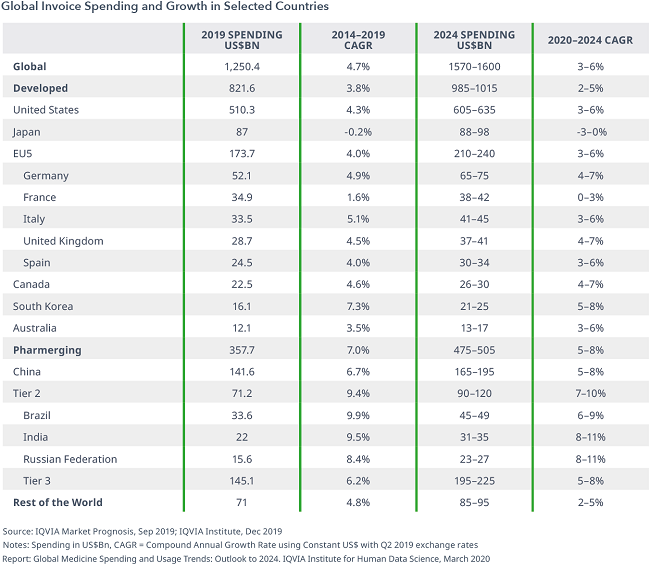

On a global level, IQVIA finds that spending for pharmaceuticals clocked in at an invoice value of $1.25 trillion in 2019, and could grow at a 3-6% CAGR through 2024, reaching $1.57-1.6 trillion. However, over time IQVIA has looked more and more closely at net prices of medicine (invoice less rebates and discounts), and calculates that the net spending was actually $955 billion in 2019, and growth will only be on the 2-5% CAGR level, reaching $1.115-1.145 trillion in 2024. The $295-billion difference between invoice and net price for 2019 is mostly taken up by the aggressive rebating environment in the US; however, Murray Aitken, executive director of the Institute, notes that rebating is becoming a more common element in most developed-world markets. “Even in single-payer markets where prices are set by governments, there is additional discounting going on when drugs are sold to individual health systems or hospitals,” he says.

Partly because of the discounting (and its growth in recent years), IQVIA projects that in the US market manufacturer net prices “are expected to grow between 1% and -2% in the United States over the next five years, significantly below historic levels, while in other developed markets, net price declines of -2 to -5% are expected as a result of continued payer and government actions.” Besides the discounting, there is an annual process of new drugs gaining approval, offset by old drugs losing patent exclusivity. The former is projected at $165 billion through 2024, while the latter is projected at $139 billion—with biosimilars having a small but growing effect.

Specialty products will continue their steady rise in the mix of pharmaceuticals dispensed; they represent 36% of global spending in 2019, and will rise to 40% by 2024. Among developed countries, those percentages are 44% and 52%, respectively. However, their CAGR is slowing; it was 11% in 2014-2019, and will be 7.5-10.5% in 2019-2024.

The top ten countries in overall spending in 2024 will be:

1. United States

2. China

3. Japan

4. Germany

5. Brazil

6. Italy

7. France

8. United Kingdom

9. India

10. Spain,

with India entering the top ten for the first time, jumping ahead of Canada and Spain, and Brazil jumping a couple spots, passing France and Italy (see chart below).

This study is self-funded by IQVIA and is freely available at its website.