Pondering the shrinking number of retail pharmacies

PCMA study disputes its members’ harm to brick-and-mortar businesses

A just-released study sponsored by the Pharmaceutical Care Management Assn., the trade association of PBMs, seeks to downplay PBM influence on the fate of retail pharmacy, particularly independent pharmacies. And while the study topic is another in the long-running disputes between PCMA and the lead organization of independent pharmacies, the National Community Pharmacists Assn. (NCPA), it highlights implications for pharma manufacturers, too.

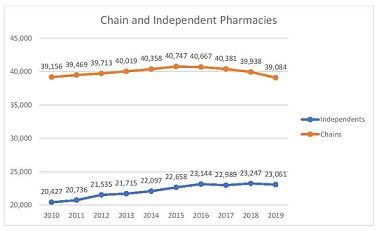

The summary conclusion of the PCMA report is that between 2010 and 2019, the number of independent pharmacies increased by more than 2,600 stores, or 12.9%, nationally. And the underlying assumption of the PBM critics—that harsh reimbursement policies by PBMs restrict the viability of independent pharmacies—is thereby disproven. Now, the qualifications: the most recent data (2016-2019) show a net loss of 83 among independent pharmacies, and among chains, the loss is even worse: 1,583 stores, or 4.0%. (see graph)

Chain and independent pharmacy trend, based on NCPDP data. Credit: PCMA

The report’s authors (two Penn State academics) also looked at state-level trends, finding that independent pharmacy store counts vary by state over 2010-2019 (no surprise there, as populations have shifted over the decade), and that “The relative growth in the number of independent stores at the state level is positively correlated to chain pharmacies. When chain pharmacies grow within a state, independent pharmacies also increase”—a point they feel important to make to disprove the idea that independents are “uniquely suffering relative to chain pharmacies.”

All that being said, a simple-minded look at the graph shows that the pharmacy business was growing steadily until 2015-2016, and has been flat to declining since. This trend aligns with any number of factors: lower net profit growth for pharma products in the past few years; flat to declining scrip volume (which declined by several million between 2017 and 2018); a significant rise in scrips filled at clinics and hospitals, versus smaller growth at chains and independents (latter data from IQVIA); and the consolidation of PBMs with insurers. One could reasonably conclude that the pharma industry is looking beyond retail pharmacy for its future growth.

The report, Independent Pharmacies in the U.S. are More on the Rise than on the Decline, is available at the PCMA website.