PhRMA, Pacific Research studies document lower revenue growth for US pharma

Come the New Year, and the battle between the pharma industry and pharmacy benefit managers is re-engaged, pretty much where it left off last year. PhRMA, the trade association of manufacturers, has sponsored a study pointing out the inequities of the current system, where PBMs drive higher prices for drugs by demanding larger rebates from the manufacturers, while PBMs contend that they are saving clients money through those very same rebates. Meanwhile, another study, from a free-market policy group, Pacific Research Foundation, seconds some of the PhRMA-sponsored results.

All this is happening in the aftermath of the Trump administration’s backing down from changing rebate incentives last summer (as part of an overall campaign to lower drug costs) and, at the end of the year, proposing to allow drug importation (which could scramble the economics of both manufacturers and PBMs).

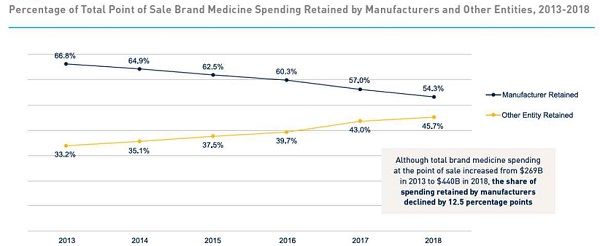

The PhRMA study, “Revisiting the Pharma Supply Chain: 2013-2018” performed by the Berkeley Research Group, finds that “supply chain and other entities, including PBMs, hospitals, pharmacies, and payers, now retain nearly half of all spending on brand medicines at the point of sale, while the biopharmaceutical companies … retain 54%.” Further, the manufacturers’ share of total brand spending has dropped by 12.5 percentage points since 2013, and 340B margins (the difference between what manufacturers receive in sales into 340B organizations, and the reimbursement that those organizations receive from payers and government) has jumped from $3.5 billion in 2013 to $30.5 billion in 2018.

Berkeley Research Group's analysis of drug rebate trends

(Purists would argue that PBMs, since they’re not handling a major part of the physical movement of drugs, are part of the ‘value’ rather than ‘supply’ chain; one can suppose that only the true pharma supply chain managers care about the distinction.)

The Pacific Research institute study, “Improving Market Efficiencies Will Promote Greater Drug Affordability,” notes some of the same trend—drug discounts have been growing faster than the growth of overall pharmaceutical sales (more than doubling from 13.1% to 28.2% in the 2009-2018 period). Further, while US drug prices are significantly higher than average drug prices in the OECD (which has many single-payer systems), that margin is actually less than the higher margin of overall US healthcare expenditures compared to the OECD. (In other words, all of US healthcare expenditures are out of line compared to OECD expenditures, and pharma expenditures less so.)

The Pacific Research study notes that generic drugs are more affordable in the US than in other countries, but also that the introduction of biosimilars in the US has been retarded by “current supply chain inefficiencies” including the perverse incentives of higher-priced originator biologics for the profit margins of providers and PBMs. Overall, Pacific Research says that some of the problems of drug pricing today could be cured by a switch to net pricing and away from drug rebates.

In general, the counterargument of PBMs has been that the rebates they negotiate with manufacturers represent savings to the healthcare system; and also that a large part of the rebates get passed on to payers, who use them to moderate the overall cost of insurance premiums. The net effect of this is that sicker patients (who spend more on drugs) are subsidizing healthier patients (who pay lower insurance premiums). The stalemate between both houses of the US Congress over drug pricing policies is unlikely to change during the current election year.