nVentic Report: Manufacturer Inventories Fail to Prevent Medicine Shortages

Document reveals that 20 of 28 of participating Big Pharma manufacturers saw their DIO increase by an average of 5%, suggesting that large amounts of inventory do not necessarily offer protection from running low on medication.

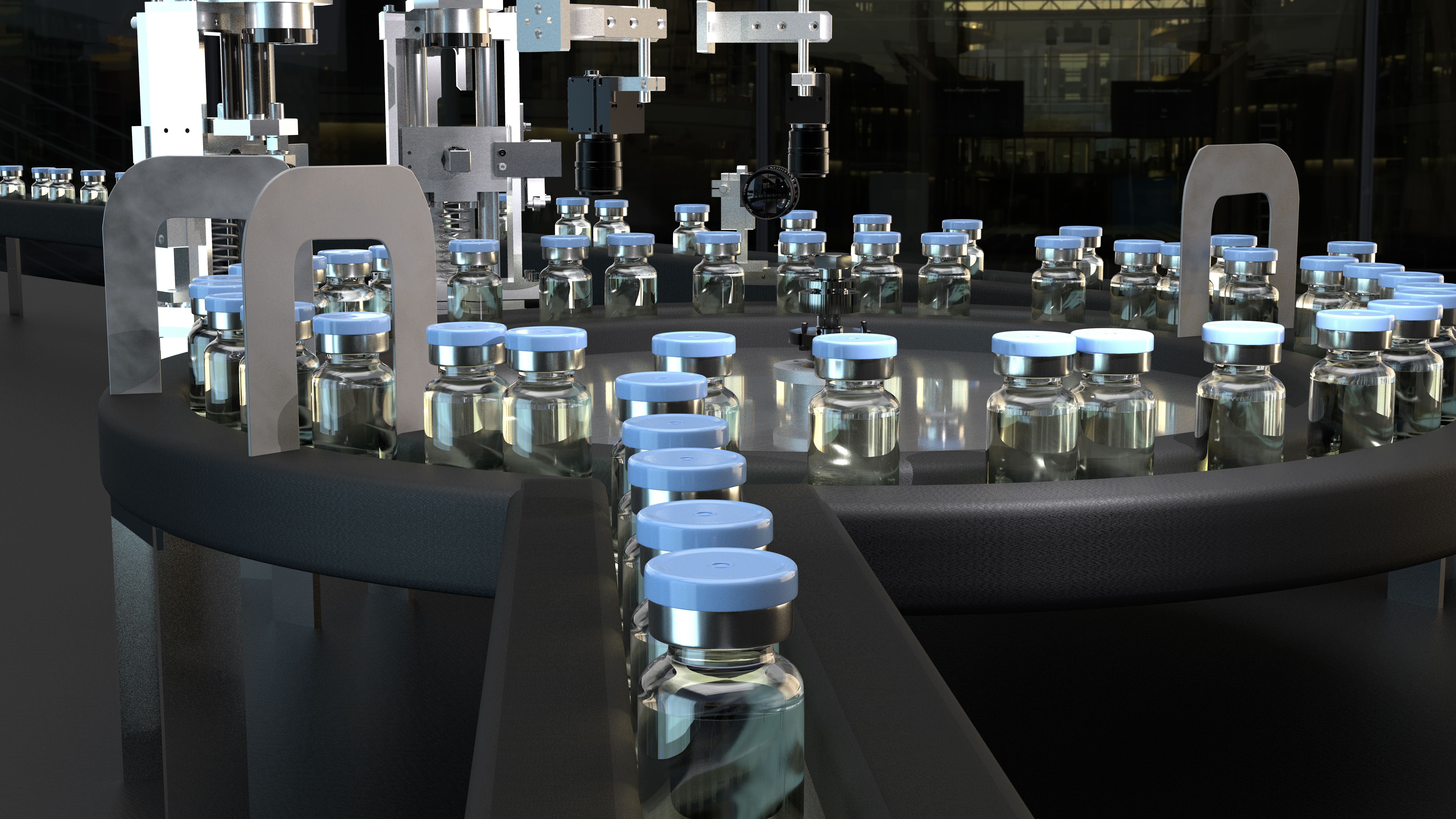

nVentic, an inventory optimization specialist, launched its 2023 Big Pharma Inventory Benchmarking Report. The report analyses the published corporate reports of 28 pharmaceutical manufacturers, including Merck, AstraZeneca, and Pfizer, and provides an annual look at the inventories held by Big Pharma manufacturers.

The aforementioned report benchmarks days inventory outstanding (DIO), which is a ratio that measures how much inventory a company holds as a proportion of cost of sales. The report also estimates how much inventory is scrapped unused each year.

When it comes to inventory shortages, the end of 2022 saw widely-reported shortages of many medicines, including antibiotics due to seasonal illness. This resulted in stockpiling, further exacerbating the situation.However, the balance sheets of pharma manufacturers show limited evidence of shortages. Inventories grew by 10% year on year in aggregate for the 28 companies, to a combined total of $150 billion. Sales grew by 7% to $994 billion, and cost of sales by 4% to $311 billion.

“While some waste is inevitable in most supply chains and medicine manufacturers need to ensure very high availability, this figure still represents a large waste of capacity and resources. At an individual company level, 20 of the 28 companies saw their DIO increase in 2022, with the mean DIO increasing 5% to 202 and the median up to 197,” comments Matthew Bardell, managing director at nVentic. “Because of this, the increase in shortages cannot be attributed to a lack of inventory. Inventories seem to grow almost every year and yet this does not appear to help protect pharma manufacturers from shortages.”