J.D. Power pharmacy satisfaction survey: independents on top in brick-and-mortar

Good Neighbor and Health Mart franchises trade top positions

The annual J. D. Power Pharmacy Study, a measure of consumer sentiment by the Costa Mesa, CA research firm, finds independent pharmacy franchises at the top of the heap among brick-and-mortar pharmacies, as it has in past years. Consumer satisfaction with other channels—mail order, mass merchandiser and supermarket—have rankings even higher in some cases, although the specific criteria measuring each channel are slightly different.

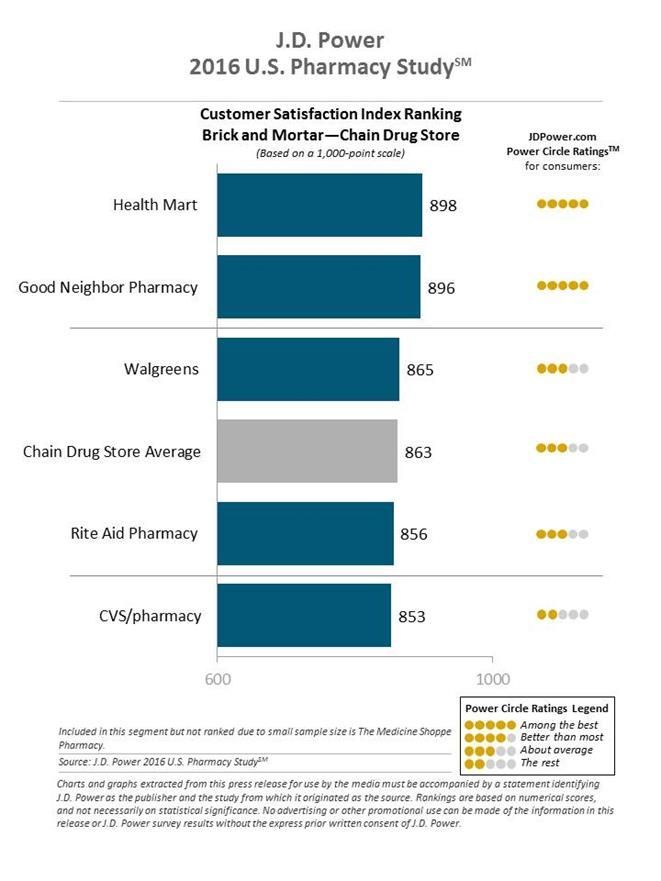

Among chains, Health Mart scored 898, on a 1,000-point scale, just nosing out Good Neighbor Pharmacy, at 896. (The former is a franchise organization run by McKesson; the latter is a franchise run by AmerisourceBergen. Both franchises have independent owners, but get business support—and drug supply—from the two wholesalers. Inexplicably, Medicine Shoppe, the franchise organization owned by Cardinal Health, was not ranked.) Walgreens scored 865, Rite Aid (which is in the process of being acquired by Walgreens) at 856, and CVS Pharmacy came in at 853.

Among mail order providers, Kaiser Permanente Pharmacy was No. 1, at 906. The two giants in the field, Express Scripts and CVS Health (Caremark), came in below the average for all mail order (869), with the former at 866 and the latter at 853. J. D. Power notes that the Veterans Administration’s mail-order pharmacy, CMOP, had a high satisfaction rating, but didn’t release a score.

Top scorer in mass merchandiser was Sam’s Club (883); for supermarkets, it was Publix (912).

J.D Power says that chain pharmacies providing wellness services do better than those that lack that feature; and that “more” customers are getting comfortable with mail order. It’s not clear that the averages across each channel are a valid comparison of that channel relative to the others, but for what it’s worth, they are:

Supermarket: 874

Mail order: 869

Chains: 863

Mass merch.: 851

J. D. Power includes pharmacies with a sufficiently high participation in a national survey of nearly 15,000 pharmacy customers, based on new or refilled prescriptions in the three months leading up to June 2016.

Newron, Myung In Pharm Form Partnership Centered Around Treating Schizophrenia in South Korea

January 14th 2025The license agreement will feature an upcoming Phase III trial and—depending on results—the development, manufacturing, and commercialization of evenamide as a potential treatment option.