Global pharma spending will hit $1.5 trillion in 2023, says IQVIA

Annual analysis predicts 3-6% CAGR through 2023, a lower rate than 2014-2018

The global market for pharmaceuticals reached $1.2 trillion in 2018, up $100 billion from 2017, according to the Global Use of Medicines report from the IQVIA Institute for Human Data Science. Going forward, the global market will grow by 4-5% CAGR, reaching $1.5 trillion (based on invoice pricing). That rate is lower than the 6.3% CAGR of the 2014-2018 period.

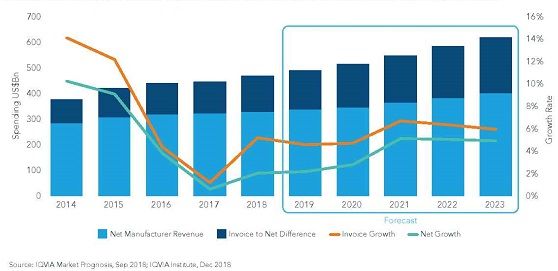

For the US specifically, the 2018 spending was $485 billion, up 5.2% over the previous year, and the 2023 spending will be $625-655 billion, representing a 4-7% CAGR over the five-year period. For several years now, IQVIA has been careful to distinguish “invoice” revenue (more or less equivalent to list pricing) from “net” revenue—the revenue that actually accrues to the pharma industry after rebates and deductions are factored in. US net revenue is expected to have risen 1.3% during 2018, and at a 0-3% rate over the next five years (see figure).

IQVIA Institute projections of invoice and net revenue, and their growth rates

Looking around the world, IQVIA sees spending in China (now the world’s second largest market) at $137 billion in 2018, and projects growth at 3-6% CAGR through 2023. The double-digit growth seen a decade ago is gone.

The few percentage-point gains to be seen in the US market going forward represent new product launches offsetting the loss of exclusivity of numerous drugs. Notable in this tradeoff is the growth of biosimilars, which will affect the market by a combination of biosimilar introductions and manufacturers of originator products lowering their prices. IQVIA estimates that the US market for all biologics would have been $189 billion in 2018 without the introduction of any biosimilars, but was instead $182 billion, with $24 billion worth of the market exposed to biosimilar competition. By 2023, those figures will increase to $379 billion (assuming no biosimilars), $319 billion (with biosimilars) and $62 billion of the market exposed to biosimilar competition.

Business trends

There is newly energized debate in the US over pricing and reimbursement policies, both for commercial and publicly funded insurance plans, but IQVIA expects only “executive rulemaking authority” (read: HHS) to affect policies for federally funded programs in the near term. IQVIA totes up over 20 distinct possible changes in pricing policies overall, ranging from near-certainties (step therapy for Medicare Part B) to low probabilities (cross-border trade); overall, it’s possible that the current volume of rebates ($150 billion) could drop to $75-100 billion, which “could induce manufacturers into price competition where it has not existed and potentially reduce their margins. This is arguably a goal of the proposals.”

The full report is available at www.IQVIAInstitute.org.