FDA set an all-time record of new drug approvals in 2018

List includes 25 orphan drugs; there were also seven additional biosimilars

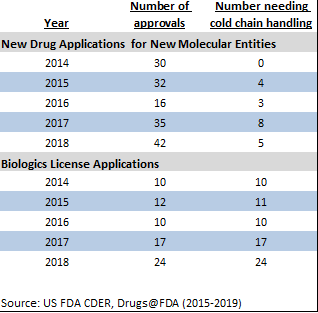

We’ll have to wait until after the government shutdown that started on Dec. 22 for an official statement, but in the meantime FDA had posted considerable information on the volume of drug approvals granted during calendar year 2018. The primary report, from the Center for Drug Evaluation and Research (CDER), indicates that there were 59 new molecular entities and biologics approved; to this can be added two other biologics approved by the Center for Biologics Evaluation and Research (CBER), giving a grand total of 61. That figure represents an all-time record for FDA; it came close to setting a comparable record in 2017 (46 approvals, plus 11 CBER biologics). The previous all-time high for CDER approvals was 1996, with 53.

FDA CDER approvals, 2018, with cold chain details

There were also seven biosimilars approved, giving a cumulative count of 16 in the US (including a second biosimilar to AbbVie’s Humira; however, except for an ongoing effort by Boehringer Ingelheim, no adalimumab biosimilar is expected on the US market until 2023). On the other hand, although cellular and genetic therapies are all the buzz in pharma research, none were approved except for a cord-blood, stem-cell product approved for the MD Anderson Cord Blood Bank; three had been approved in 2017.

Twenty-five of the 59 CDER approvals were for orphan drugs, which have access to a streamlined review and approval process. That figure easily topped 2017’s, 18.

Pharmaceutical Commerce, through its annual Biopharma Cold Chain Sourcebook, pays close attention to the storage and transport details on drug labels. In 2018, five of 42 new molecular entities, 24 of 24 CDER biologic approvals, and 12 of 16 CBER approvals (which include reagents and diagnostics, as well as therapies) required either 2-8°C refrigeration, or in a few cases frozen or cryogenic storage. Thus, precisely half—41—of the new approvals in 2018 were cold chain products. Add in the seven biosimilars, and the proportion is even higher: 54%.

Down the supply chain

More new drugs, of course, is a boon to the pharma industry, which invests tens of billions of dollars to get these products out the door. For wholesalers, the picture is more nuanced, as historically, branded drugs were handled by wholesalers at a relatively low markup, and with the price wholesalers pay, relative to the lower prices set with payers, resulting in a chargeback to the manufacturer to reconcile the difference. The growing number of specialty products (most of the biologics, and some of the others) means more business for specialty distributors and specialty pharmacies, with manufacturers opting for limited or exclusive distribution arrangements with those entities.