2023 challenges of the Drug Supply Chain Security Act implementation on wholesale drug distributors

Exploring new guidances and future challenges for pharma trading partners in meeting looming DSCSA mandates in the US

As we approach the 10-year anniversary of enactment of the Drug Supply Chain Security Act (DSCSA) and move toward the complex and less statutorily defined interoperable electronic tracking phase, we reflect on the effects this legislation has had on wholesale drug distributors (WDD) in the pharmaceutical supply chain. The four main areas for change include verification, authorized trading partners, product tracing and serialization.

Since 2015, wholesalers have been required to only do business with authorized trading partners, meaning they are required to report licensure and other information with the FDA and must be licensed in the states in which they do business. All product shipments must have T3 data (transaction Information [TI]; transaction history [TH]; transaction statement [TS]) to be accepted. Product tracing requirements began in 2017 with lot-level tracing. Since 2018, serialization was required except for grandfathered (previously packaged) products.1 Serialization means marking packages with a product identifier (GTIN), a serial number, lot number and an expiration date. The serialization must be done to the smallest packaging level of the product, i.e., box or bottle.

2023 challenges

The 2023 requirements still loom ahead, and the reality is that a great deal of additional work and tremendous business operation costs will be required for industry-wide hardware and software and maintenance. Because of evolving best practices, perhaps the most important challenge for WDDs will be proactively determining which investments to make. Other than a half dozen very large wholesalers, the WDD industry is characterized by a patchwork quilt of smaller distributors that are highly fragmented and for whom the DSCSA transition process can seem daunting. By 2023, interoperable exchange of product tracing data will be required.2 FDA has interpreted this as requiring fully electronic interoperable systems, but what exactly these systems will consist of is not yet entirely clear. Although the larger wholesalers may already be piloting or have these systems in place, smaller secondary and tertiary wholesalers are at a great disadvantage.

New guidance

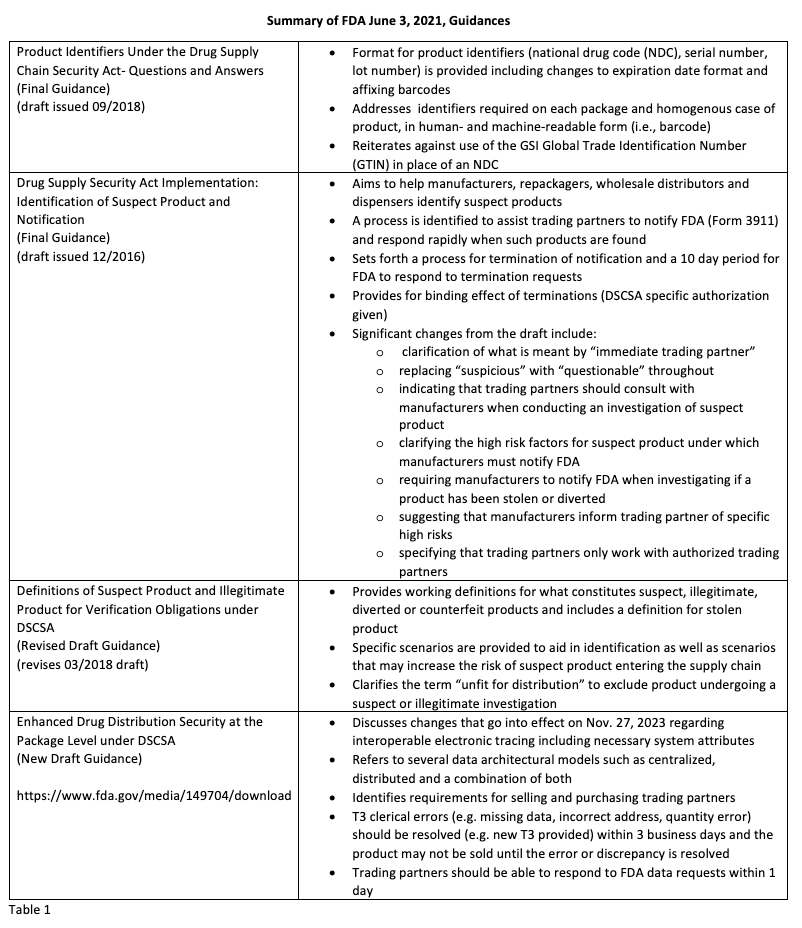

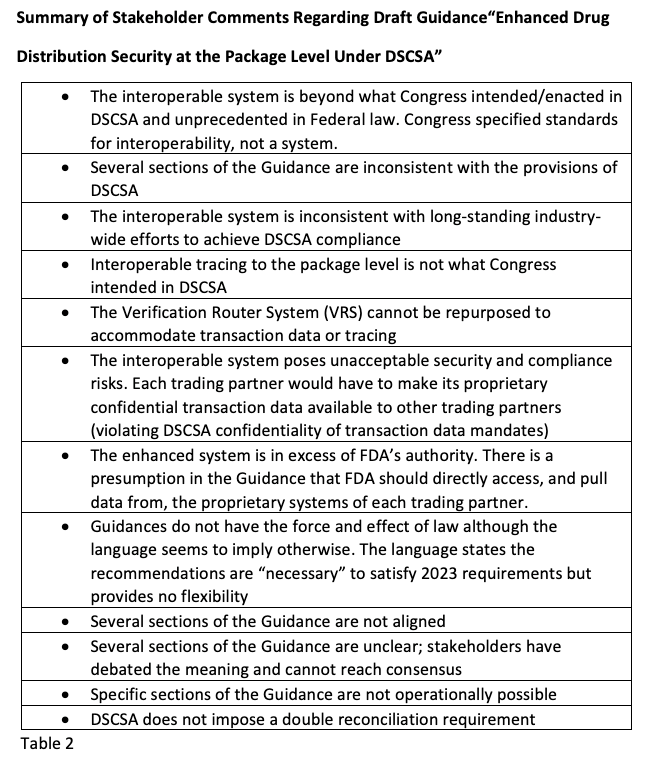

FDA issued two new draft guidances and finalized two others to assist trading partners in meeting the requirements of the DSCSA3 to further enhance the security of prescription drugs in the US supply chain (see Table 1 above; click to enlarge). In some cases, the revisions were based upon comments and questions received from stakeholders. In other cases, recent incidents of falsified T3 data and suspect product have prompted the revisions. One of the guidances detailed below, “Enhanced Drug Distribution Security at the Package Level under DSCSA,” has now resulted in WDD requests to FDA to withdraw it on the basis of overreaching. In a 37-page comment, dated Aug. 31, 2021, the Healthcare Distribution Alliance (HDA), a trade group for the WDD, detailed serious concerns with the vision for an interoperable system. Some of the concerns articulated by HDA, as well as other WDD stakeholders, are summarized in Table 2 (left) and focus on four areas: 1) the system does not currently exist; 2) the system cannot be built by 2023; 3) the system poses unacceptable security and compliance risks; and 4) unnecessary and redundant reconciliations of transaction data are required. The comments also note that there is an immense gap between what the draft guidance seems to assume industry is implementing and what industry is actually doing.

Additionally, in 2023, aggregation will be required and because of the difficulty of this requirement, the time to plan to begin implementation is now. Hierarchical aggregation means virtual connection and data relationship between serialized transport units, that is, unique identifiers for salable units, the cartons they are packed into and then the cases and pallets into which they are subsequently packed and shipped (see Figure 1 to the right). Using that data, manufacturers and WDDs can “infer” that the correct product and quantity are enclosed in transport unit without opening for inspection.

In 2023, serial-level product tracing and salable returns verification (enforcement delayed from 2019 because of technical issues, operational challenges, Covid-19) will be required. For salable returns verification, aggregation and serialization is essentially required from manufacturers. Without aggregation and serialization, verifying salable returns requires wholesalers to manually open all the returns and verify each serial number with the manufacturer. More time is needed to test verification systems. Some are also concerned about quarantined product and potential drug shortages if systems are not in place to verify returned products in time. Additionally, wholesalers will be required to provide outbound serial tracing to their dispenser customers. Additionally, many WDDs believe they should be able to redact or withhold confidential commercial information and trade secrets, including customer lists and business volumes.

There is no one-size-fits-all approach to meeting the 2023 compliance deadline, and each company will need to determine what works best for them. Stay tuned as WDDs, literally in the middle of this 10-year DSCSA implementation process between manufacturers and dispensers, progress through to the final milestones over the next 27 months.

About the author

Martha M. Rumore, PharmD, JD, MS, LLM, FAPhA, is Senior Counsel, Frier Levitt, LLC and Adjunct Professor, Hofstra School of Law.

References

1. § 582(a)(5)(A) of the FDC Act.

2. § 582(g)(1)(A) & (b) of the FDA Act.

3. P.L. 113-54.