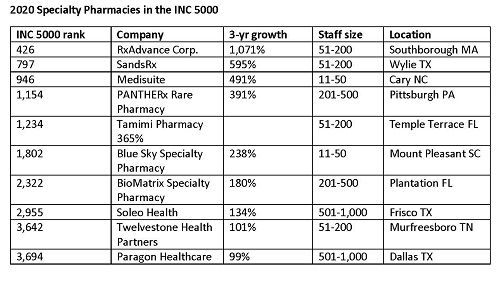

2020 Inc. 5000 lists 10 specialty pharmacies

The land rush for specialty pharma business appears to be slowing among privately held specialty pharmacies

A privately held pharmacy benefit manager, RxAdvance, has the No. 1 spot among 10 specialty pharmacies listed in this year’s Inc. 5000 (see table). With publication of the Inc. 5000, readers get a view of some of the elements of privately-held companies, whose financials are usually not apparent. RxAdvance’s news release does reveal that the company’s overall revenue is $2 billion—and given that its three-year growth rate is 1,071%, that is quite an achievement.

Overall, however, the Inc. 5000 data indicates a slowing of the growth among specialty pharmacies, which has been meteoric over the past decade. PantheRx—which is still showing dramatic, 391% growth—is now No. 1,154 on the list; it entered the Inc. 5000 in 2016 at No. 9 on the list. (Granted, revenue growth gets harder as revenues mount, but its 2016 three-year growth rate was over 13,000%.)

It is important to note that the Inc. 5000 data is not a measure of overall specialty pharmacy (let alone specialty pharmaceutical) trends; the industry is dominated by big, publicly held companies like CVS Health or Cigna-Express Scripts. The past year is also notable for the exit of Diplomat Pharmacy, which grew phenomenally during the 2010s, went public, then stumbled and was acquired by Optum earlier this year.

According to Inc. magazine, publisher, the rankings are based on percentage revenue growth when comparing 2016 and 2019. To qualify, companies must have been founded and generating revenue by March 31, 2016. They had to be U.S.-based, privately held, for profit, and independent—not subsidiaries or divisions of other companies—as of December 31, 2019. The full listing is available here.