Article

2017 drug lists: new molecular entities, drug shortages, generic targets

Think of this as the industry’s vital statistics: the counts of new drugs entering the market; the ongoing problems associated with drug shortages; and the trends for generic and biosimilar products. Taken together, they give a measure of future business for pharma, and how well the industry is taking care of existing business.

From the Center for Drug Evaluation and Research (CDER) specifically, 2017 was a busy year, with 46 new approvals. To that can be added 10 biologic approvals from the Center for Biologic Evaluation and Research (CBER), for a total of 56.* That’s a major jump over 2016’s total of 28 (22 CDER and 6 CBER approvals) in 2016, and the highest in at least the past decade.

In its annual “CDER New Drugs Program: Update” report, issued in early December (and based on data through the end of November), Patrick Frey, chief of staff of the Office of New Drugs, touts the agency’s performance in meeting PDUFA goals, its volume of drug review activities, and its performance relative to the review processes of other countries. Frey noted that 78% of new drugs approved worldwide occurred in the US; and that roughly 2/3rds of drug approvals make use of the variety of expedited FDA designations: breakthrough therapy; priority approval; fast track; and accelerated approval. 100% of approved drugs in 2017 met their PDUFA goal date (the commitment by FDA to review a drug within a designated time frame).

In most recent years, the annual approvals count is pumped up by orphan drug approvals, and this year is no different: 20 new orphan drugs passed muster. Of note, the new gene therapies—Novartis’ Kymriah (tisagenlecleucel, for leukemia) Kite Pharma’s Yescarta (axicabtagene ciloleucel, for lymphoma) and Spark Theapeutics Luxturna (voretigene neparvovec-rzyl) were approved under orphan designations; Novartis and Spark also earned rare pediatric disease review vouchers, a sweetener from FDA that can be used by those companies to expedite review of any other drug, or sold to the highest bidder. FDA’s website also notes that there were 64 new orphan approvals granted during the year (only some of these are new molecular entities; meanwhile, the number of approved designations for drug therapies for orphan conditions totaled 475).

Drug shortages persist

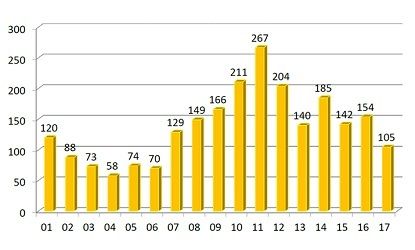

FDA and its many observers rightly focus on new drug approvals as a measure of how determined the industry is to innovate; on the flip side, industry efforts to reduce the shortages of existing drugs (the majority of which are post-patent-expiry) remains a nagging worry. The up-to-the-moment count, maintained at a webpage of the American Soc. of Health-System Pharmacists, is 140; the average through the end of September 2017 was 107. That figure is down from recent past years (good news!), but still higher than what was seen in the early 2000s (see figure). (FDA also maintains a shortage list, but its criteria are more restrictive than ASHP’s). A particular problem in late 2017 was the effects of Hurricane Maria on drug manufacturing in Puerto Rico; the slow recovery process there has constrained some drug availability.

Annual count of drug shortages. credit: ASHP

FDA commissioner Scott Gottlieb has been forthright in pushing for faster generic approvals, in part to get more manufacturers supplying drugs that consistently show up on the shortage lists. To that end, FDA began an “Off-Patent, Off-Exclusivity Drugs without an Approved Generic” listing service in the middle of 2017, with an update in December, listing nearly 400 drugs that lack ANDA approvals—the implication being that these generic version of these drugs could be approved by FDA if a manufacturer came to it with the desire to do so. Multiple sources of supply would go a long way to averting future shortages.

Meanwhile, the Office of Generic Drugs has had a busy year: for FY 2017 (October 2016 to September 2017), it approved 763 generic products, up from 651 the year before and continuing a three-year trend of expanded approvals.

On the biosimilar front, the count of US-approved products is now up to nine, with biosimilar versions of J&J's Remicade (three versions now approved, but Pfizer's Ixifi [infliximab-qptx] not currently planned for US marketing); Genentech's Herceptin and Avastin, and AbbVie's Humira approved. By comparison, the count of biosimilars available in the EU is now up to 33 (not including three other approvals that were subsequently withdrawn), according to a list maintained at Biologics Blog.

*1/17 UPDATE: We missed the approval of Spark Therapeutics’ Luxturna here; it brings the 2017 total to 57.

Newsletter

Stay ahead in the life sciences industry with Pharmaceutical Commerce, the latest news, trends, and strategies in drug distribution, commercialization, and market access.